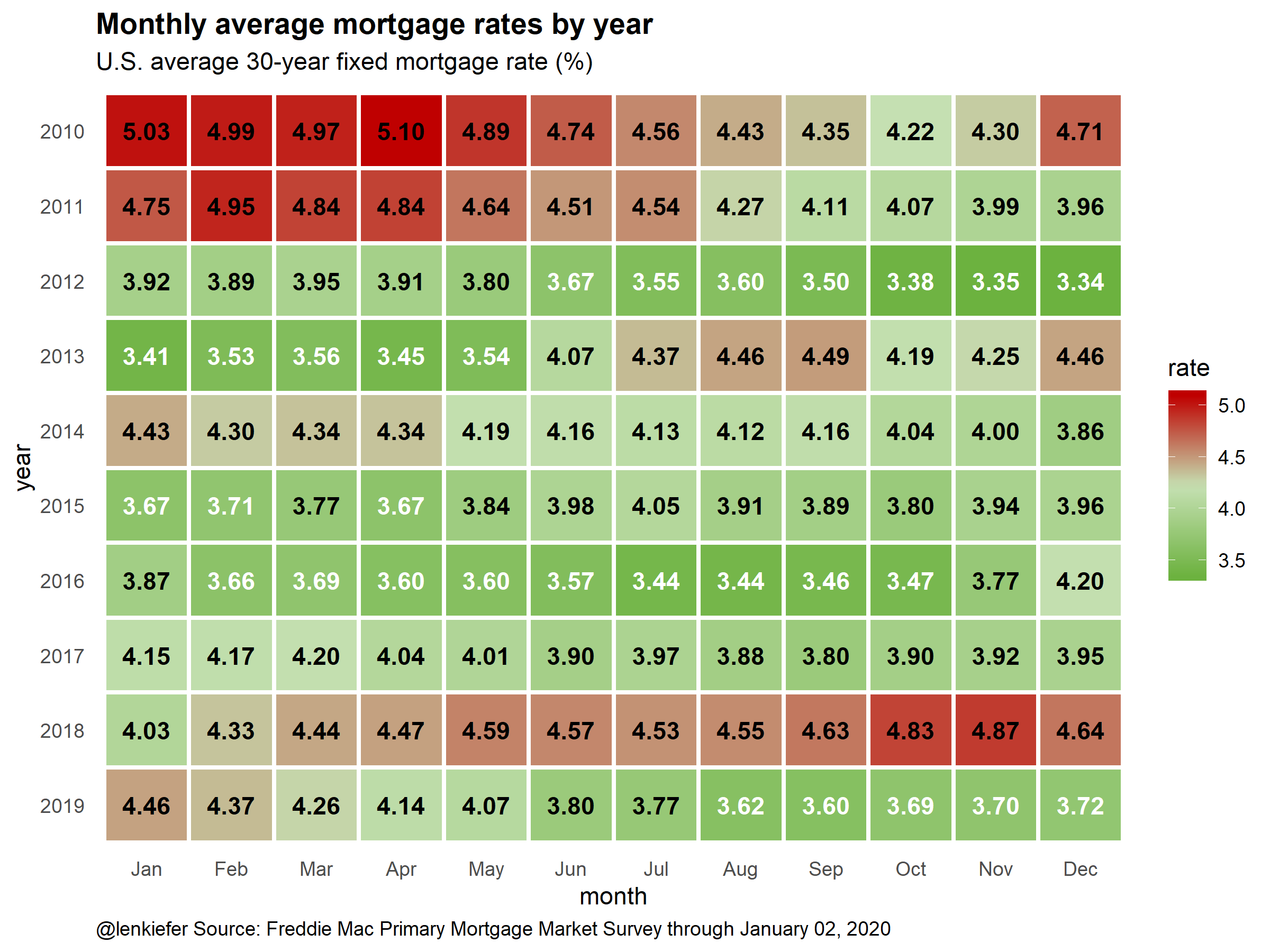

Mortgage rates were the best they’ve been in December since 2012. How were sales?

We had a nice pop in sales compared to 2018, but that’s about it:

NSDCC December Sales

| Year | |||

| 2015 | |||

| 2016 | |||

| 2017 | |||

| 2018 | |||

| 2019 |

How much momentum are we carrying into the new year from the last couple of months?

The market has felt very active, but looking at the stats, we’ve only beat last year’s count by 13%…..which isn’t saying much, given how much lower rates have been (-20% YoY):

NSDCC November + December Sales

| Year | |||

| 2015 | |||

| 2016 | |||

| 2017 | |||

| 2018 | |||

| 2019 |

Hopefully, the 2020 sellers are noticing that there haven’t been the big gains in pricing recently – but those who are willing to sell for about the same as what the last guy got should do fine!

that rate spike in Summer 2013 spooked enough people to pause buying that JtR was able to swoop in and get us our house!

We will be forever grateful to JtR!!

Timely move, just some guy!

Here’s an interesting case – back then he said, “When this home’s value hits a million, I’ll take it! Just go ahead and plant your for-sale sign in my front yard.”

The ‘million’ value has arrived, but no sale.

Virtually everyone who has bought a house will only move again if they absolutely have to move. There aren’t any elective sales left.

We haven’t discussed the truly great thing about low rates. Homeowners build equity much earlier/faster.

At 6% the first payment on $1m is $5000 interest, $1000 principle.

It isn’t until the middle of year 18 that it sees $3000/$3000.

At 3.75% the first payment on $1m is $3100 interest, $1500 principle.

By the middle of year 11 the ratio reaches $2300/$2300.

Life of loan Interest paid: $1,158,381.89 vs. $667,216.13

Wow – people can’t afford to not buy a house!

$4,000 rent of same house x 360 months = $1,440,000!

Get good help? 😉

I’m old enough to have attended a neighborhood mortgage burning party. Barely old enough mind you. In those days it was an interesting event as inflation often made new car payments higher than old mortgage payments.

Life investment plans and having decent housing have become entwined. I’m a savvy guy (IMO) but I’ve only navigated a dozen or so purchases and several fewer sales. I use Realtors® to mediate my rentals because a single accusation of impropriety would wipe out a decade of gains if unfounded. There will always be a place for the RE Professional. Sorry for the sappy thumbs up. If you want the other side, I’d be glad to share stories of me putting the pressure on the agent/realtor.