How can the market keep going? Generational wealth distribution!

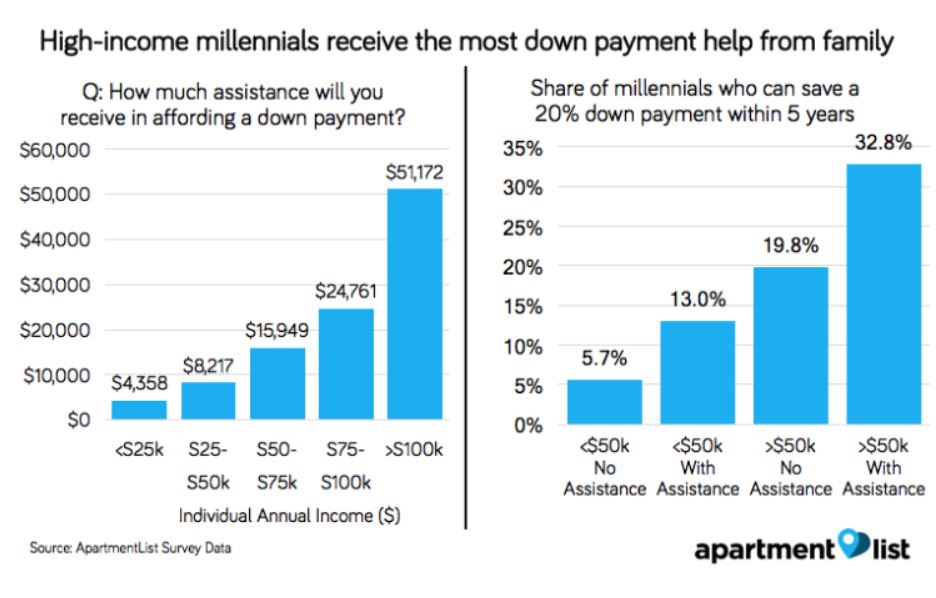

Among respondents with an annual income over $100,000 who anticipate familial help with a down payment, the average expected level of support is over $50,000, enough for a 20 percent down payment on the national median condo price.

This is more than twice the expected down payment assistance of those making between $50,000 and 75,000, and over ten times that of those making less than $25,000, who expect to receive $4,358 on average.

This finding highlights the chronic nature of wealth inequality — not only do lower-income millennials have less purchasing power themselves, but their families have less support to offer.

We find that when it is available, familial down payment assistance can put homeownership much closer in reach.

Among millennials earning more than $50,000 and expecting help with a down payment, we estimate that 32.8 percent will be able to acquire a 20 percent down payment within the next five years, compared to 19.8 of those with similar earnings but no expected down payment assistance.

Among those earning less than $50,000, the prospects are notably worse, but those who expect down payment help still see a significant step up compared to those expecting no help. While help from family can make homeownership a more attainable goal, this option is available to a minority of millennials, with the largest benefits accruing to those earning the highest incomes.

Link to Article

Lots of talk of a recession and corresponding stock market pull back coming. That might put a damper on the housing market as a whole and the ability for parents to pass cash down. My parents will stay in their home forever and with interest rates only going up… The housing ATM is closed for a while.

The rich get richer and the poor fall further behind.

The rich get richer and the poor fall further behind.

The unfortunate truth.

I’d rather have real estate be affordable because agents like me could complete more sales. I used to sell twice as many houses!

Do you think that these millennials who received down payments also have student loan debt? Probably not. If mom and dad are wealthy enough to give a down payment for a house, they probably paid for the majority of college.

Agree – we don’t let kids risk any failure, which results in very little street smarts.

Pampered to the end, unless they kids breakout on their own.

The rich get richer

Umm so you used to sell twice the number of houses for twice the work but only half the commission per house? I know too many people who worked themselves to death or dropped dead before they could spend the money hard work brought them.

Umm so you used to sell twice the number of houses for twice the work but only half the commission per house? I know too many people who worked themselves to death or dropped dead before they could spend the money hard work brought them.

My best year for number of sales was when we were doing the REOs, and we had 2-3 more people. The best year was 72 sales, and this year will be 27 sales. I don’t worry too much about the commission, I’d just like to help more people.

The dying part? It’s not for me – I’m going to beat that one! 🙂