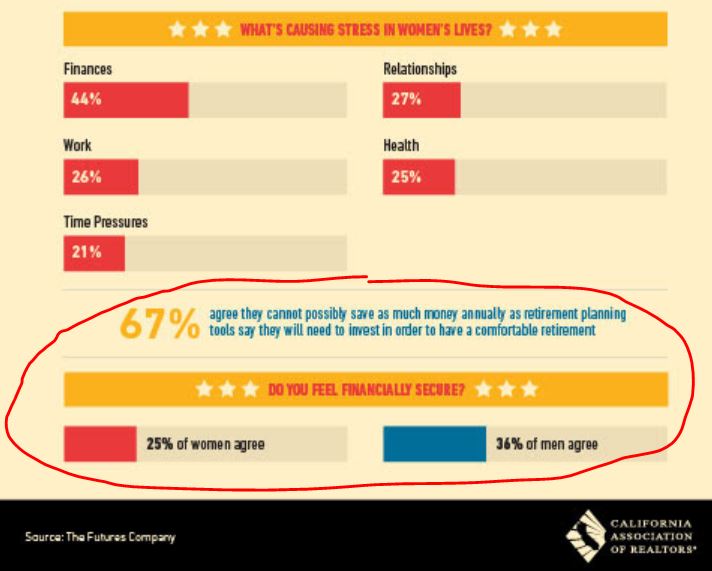

The CAR has been publishing goodies for realtors to use on their blogs – you may have seen them? The part in the red circle is what I’d like to address.

My biggest concern coming down the pike is boomer liquidations.

The above graphic isn’t boomers only, but they sound like people who are at risk of having to sell their house to survive (unless they are all renting?). For those boomers whose eyesight may be a little fuzzy when looking at the image – I’m one of you!

Here’s what they say above:

-

67% of women agree they cannot possibly save as much money annually as retirement planning tools say they will need to invest in order to have a comfortable retirement.

-

25% of women feel financially secure.

-

36% of men feel financially secure.

Obviously this polling company must have found a bunch of losers to come to these conclusions. But even if it was half this bad, it could be a problem.

We are currently enjoying a real sweet spot in real estate. Not enough people want to sell (yet), and the market has been very orderly.

But if people aren’t financially secure, at what point do they sell their house to survive?

Baby boomers are susceptible to losing their health/job/spouse, and all it would take is for a handful of those around you to cash-out and run. Once you have a downward trend in pricing, then the lower-motivated sellers will wait, because they aren’t going to give it away. Then who is going to sell?

The issue will probably work itself out over the next 10-20 years, and most homeowners probably won’t feel a thing. But there could be neighborhoods where a quick exit by a handful of sellers could cause some pricing chaos.

Markets will work well and solve this problem, provided the government doesn’t try to apply “fairness.”

Don’t do it!

If you’re long-time Prop 13’d, your monthly cost may be far less than renting somewhere less desireable.

I’d hit a reverse mortgage rather than liquidating.

The rent is too damn high! And getting higher!

I don’t foresee anything changing on the near future.

1. Reverse Mortgage options are available

2. Banks aren’t foreclosing + allowing people to live free for years.

3. Movers and Shakers in business are making big $$$. These are the people that will bail out the banks buying the “overpriced” properties.

4. Short Sales are completely lawless + figuring out creative ways (cash kickbacks) to get homeowners out of the house they’re no longer paying for.

5. Interest rates are low and will remain low. This allows people that love credit to pay more and more for homes.

The pressure that’s building up is slow and not enough to counter the items I listed above.

What I do think will cause more serious pressure on baby boomers is healthcare costs. Treatments to slow the aging processes are expensive. 1 or 2 big health issues could wipe you out. As boomers age this is only going to increase.

Reverse mortgages are a great option for those who have a big equity position – tap a few hundred thousand dollars and turn off the the annoying payments every month.

But those who don’t have more than 20%-30% equity can’t get their hands on enough dough to make it wirth it. And these are the folks that could be more desperate and might punch the panic button prematurely.

I really don’t understand reverse mortgages. So here are my questions:

1. Aren’t the fees astronomical?

2. Does the homeowner have to pay monthly mortgage insurance?

3. Interest on top of that for amount you take out each month?

4. What happens when you leave the home?

5. Who pays it back when the homeowner leaves the home–like if they have to go to a nursing home?

6. What happens if the homeowner dies and the house is

underwater?