After the recent article by Zillow on whether the San Diego market is in a bubble, the UT conducted their own investigation. Thankfully, they talked to our old friend Rich Toscano:

An excerpt:

The San Diego man who predicted the housing crash on his blog Professor Piggington’s Econo-Almanac, Rich Toscano, agrees that San Diego is not in a housing bubble, although he was not part of the Zillow survey.

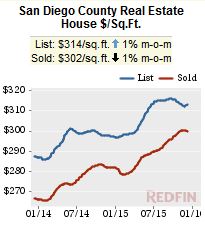

Toscano, a partner at Pacific Capital Associates, said overvaluation can best be tracked by looking at rent, income and home prices together. In mid-2005, home prices shot up 75 percent over historic median levels. Today, they are 19 percent over those historic median levels.

“Valuations (now) are like prior cyclical peaks but nothing like the bubble,” he said. “A lot of people say prices are like the bubble so that means it’s just like the bubble. So they kind of ignore we’ve had 10 years of rents and incomes going up.”

He said the mood back in 2005 was “you’re a complete idiot if you don’t buy” because housing can only ever go up. An example of the psychology changing is that people are asking all of the time if housing is in a bubble.

“What you really care about is if you are way overpaying,” Toscano said. “Sure, housing is expensive but it is nothing like it was during the bubble.”

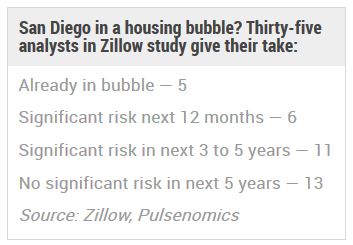

The Zillow survey, conducted by Massachusetts-based Pulsenomics, listed the St. Louis market as the least likely to face a bubble with 34 out of 36 analysts saying there was no significant risk in the next five years.

Pulsenomics interviews more than 100 economists, investment strategists and housing market analysts in quarterly surveys. Not all respondents answer every question so the number of analysts responding to the bubble question varies.

Read full article here:

http://www.sandiegouniontribune.com/news/2015/dec/10/housing-bubble-zillow-study/

“Valuations (now) are like prior cyclical peaks but nothing like the bubble,” he said.

Yep. Time to break out the 40 year San Diego Valuation Index chart to see where we are in the current “cycle”.

San Diego in general doesn’t look bad – statistically we’re well under peak:

https://www.bubbleinfo.com/wp-content/uploads/2015/12/sdpricehistory.jpg

But in the tony coastal areas, there are houses selling for prices well above their previous peaks. Do we throw the ‘bubble’ label on them?

Is it only a bubble if it pops?

Bubble? Nope. We are just nearing the top end of a normal cycle. Give it a little more time to top, and then we’ll have a little downturn. To see what a bubble looks like in the framework of cycles, see, eg:

http://piggington.com/images/housing_valuations_6_15-1-1.jpg

Moral of the story? Either buy below the median line or don’t have a short-term time horizon. I had scores of friends that got caught buying in 1989. You know who didn’t care? Those that lived their lives, went to work and t-ball games and didn’t have to sell. Most of them ended up as move-up buyers in 2001-02, happy as can be.

I responded but something went wrong, so I’ll try again.

Nope, not a bubble. Just nearing the top of the normal cycle. To see a bubble in the context of normal cycles look at this:

http://piggington.com/images/housing_valuations_6_15-1-1.jpg

I had tons of friends buy in the ’89 timeframe. They weren’t happy in ’91, but most of them just put their head down, went to work and t-ball games and by 2001-02 were move-up buyers and happy as can be. Time fixes most wounds. Those that got caught over-extended and had to sell, well, they are still rubbing dirt on that one.

I don’t think there’s a bubble, but by the time a survey of pundits says there is one, it will already have burst.

And if the ratio of renters vs buyers returns to anything closer to normal, the market will be even stronger (and there will be more bubble speculation).