by Jim the Realtor | Nov 3, 2014 | Inventory

The inventory count isn’t dropping much (-1% this week), and maybe it’s a sign that the participants see it as a year-round market now?

The UNDER-$800,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

DOM |

Avg SF |

| November 25 |

95 |

$376/sf |

47 |

1,988sf |

| December 2 |

79 |

$371/sf |

50 |

2,047sf |

| December 9 |

72 |

$383/sf |

43 |

1,954sf |

| December 16 |

81 |

$378/sf |

42 |

1,948sf |

| December 23 |

77 |

$374/sf |

49 |

1,937sf |

| December 30 |

76 |

$373/sf |

51 |

1,950sf |

| January 6 |

74 |

$370/sf |

49 |

1,995sf |

| January 13 |

71 |

$381/sf |

44 |

1,921sf |

| January 20 |

72 |

$384/sf |

41 |

1,877sf |

| January 27 |

75 |

$399/sf |

40 |

1,891sf |

| February 3 |

78 |

$409/sf |

41 |

1,876sf |

| February 10 |

82 |

$395/sf |

38 |

1,927sf |

| February 17 |

85 |

$387/sf |

35 |

1,929sf |

| February 24 |

90 |

$383/sf |

37 |

2,008sf |

| March 3 |

82 |

$397/sf |

39 |

1,942sf |

| March 10 |

88 |

$377/sf |

37 |

2,008sf |

| March 17 |

89 |

$366/sf |

34 |

2,038sf |

| March 24 |

79 |

$369/sf |

34 |

2,031sf |

| March 31 |

78 |

$367/sf |

39 |

2,069sf |

| April 7 |

87 |

$373/sf |

32 |

2,054sf |

| April 14 |

97 |

$380/sf |

31 |

2,000sf |

| April 21 |

87 |

$377/sf |

32 |

2,062sf |

| April 28 |

107 |

$379/sf |

29 |

2,044sf |

| May 5 |

114 |

$376/sf |

27 |

2,046sf |

| May 12 |

108 |

$385/sf |

31 |

2,012sf |

| May 19 |

107 |

$385/sf |

0 |

0sf |

| May 26 |

105 |

$375/sf |

34 |

0sf |

| Jun 2 |

102 |

$376/sf |

36 |

0sf |

| Jun 9 |

102 |

$377/sf |

37 |

0sf |

| Jun 16 |

104 |

$369/sf |

35 |

0sf |

| Jun 23 |

111 |

$380/sf |

34 |

0sf |

| Jun 30 |

119 |

$376/sf |

36 |

0sf |

| Jul 7 |

122 |

$387/sf |

36 |

0sf |

| Jul 14 |

127 |

$388/sf |

34 |

0sf |

| Jul 21 |

135 |

$381/sf |

36 |

0sf |

| Jul 28 |

144 |

$382/sf |

37 |

0sf |

| Aug 4 |

148 |

$379/sf |

39 |

0sf |

| Aug 11 |

135 |

$375/sf |

42 |

0sf |

| Aug 25 |

135 |

$374/sf |

43 |

0sf |

| Sep 1 |

126 |

$377/sf |

46 |

0sf |

| Sep 8 |

130 |

$375/sf |

46 |

0sf |

| Sep 15 |

134 |

$369/sf |

45 |

0sf |

| Sep 22 |

127 |

$376/sf |

49 |

0sf |

| Sep 29 |

132 |

$378/sf |

48 |

0sf |

| Oct 6 |

130 |

$367/sf |

48 |

0sf |

| Oct 13 |

131 |

$378/sf |

44 |

0sf |

| Oct 20 |

130 |

$385/sf |

45 |

0sf |

| Oct 27 |

128 |

$375/sf |

48 |

0sf |

| Nov 3 |

128 |

$371/sf |

49 |

0sf |

(more…)

by Jim the Realtor | Nov 2, 2014 | Boomers |

From MND:

http://www.mortgagenewsdaily.com/10312014_aging_housing.asp

An excerpt:

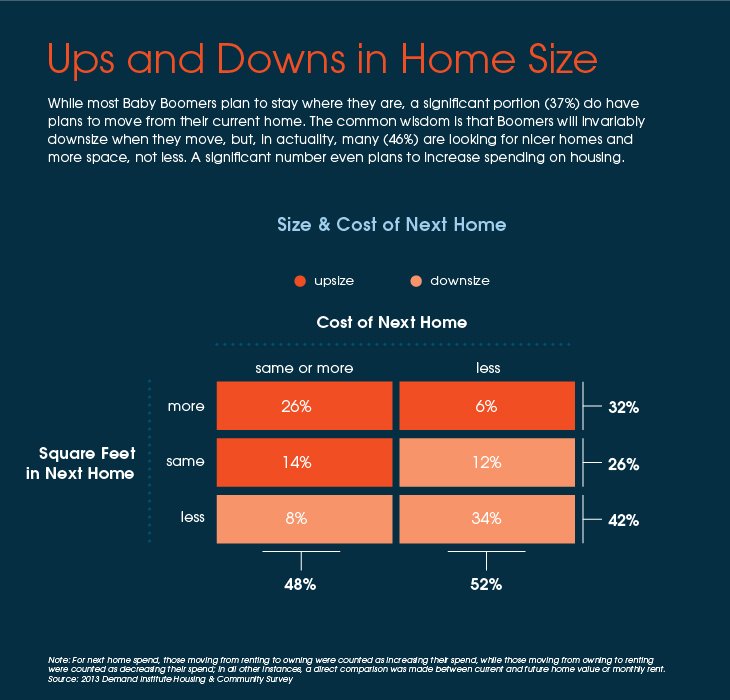

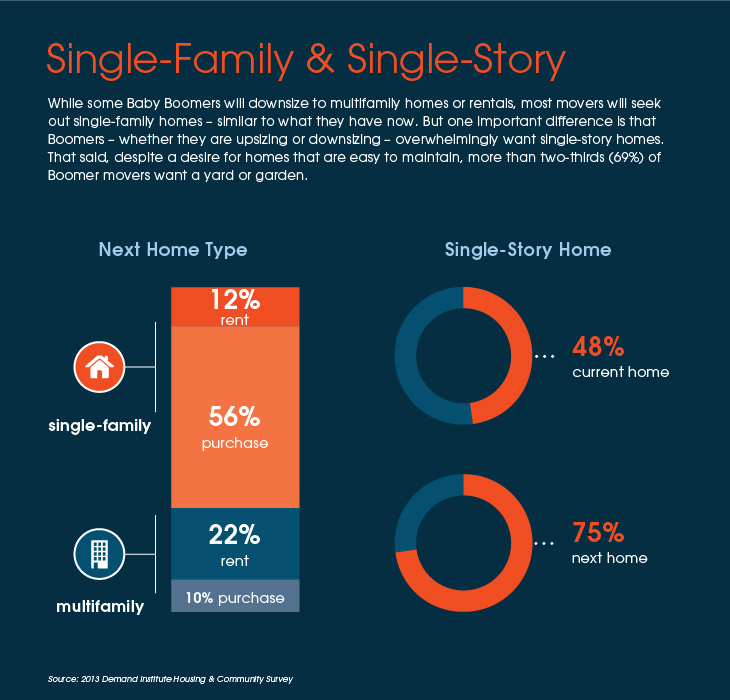

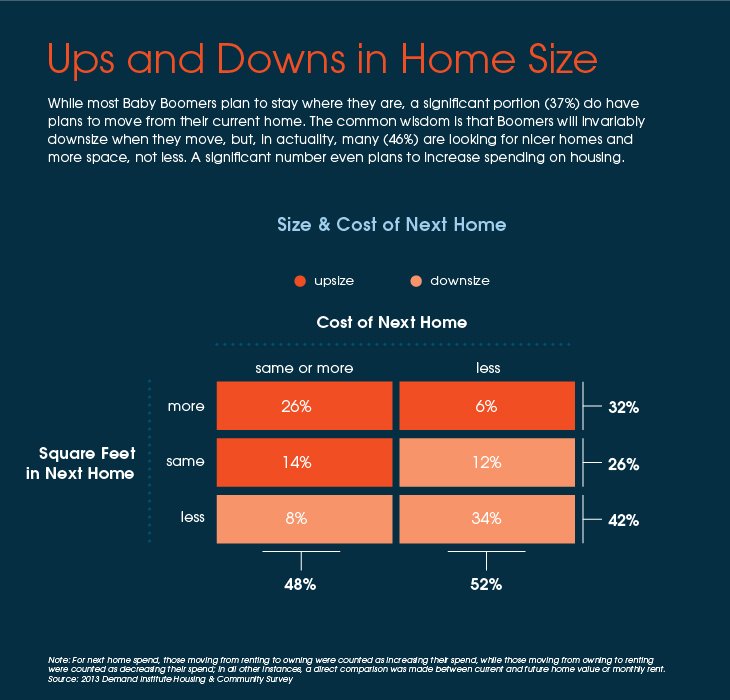

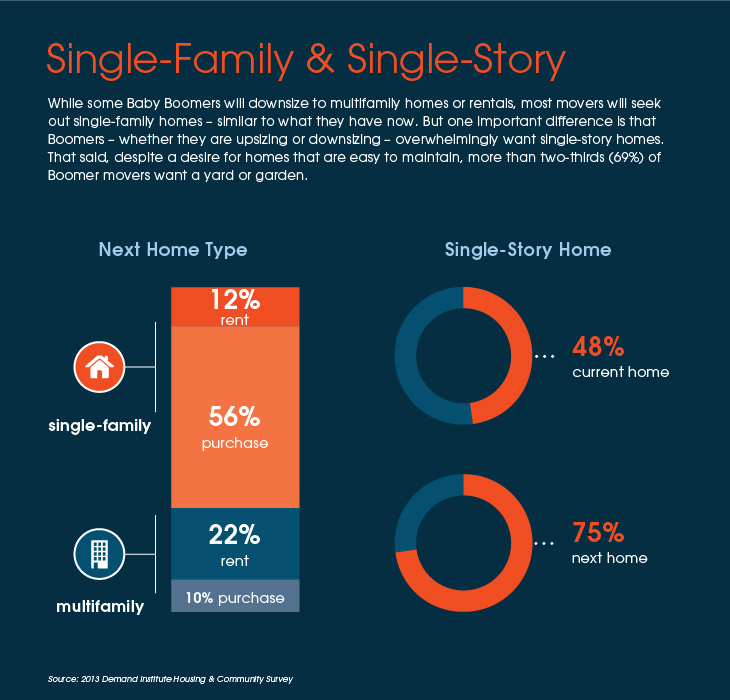

A survey of attitudes toward housing released on Thursday by The Demand Institute indicates that the Baby Boom generation still has no intention of aging gracefully. In fact, when it comes to housing it appears few intend to yield at all to their advancing years.

The Institute, a nonprofit run by the Conference Board and the Nielson ratings people, surveyed 4,000 households last year in which residents qualified as members of that huge post-war generation born between 1944 and 1963 about their future housing plans.

The survey found that as a group Baby Boomers had a median net worth of $200,000 in 2007 and were on their way to accumulate nearly $370,000 by 2013. Instead the recession sent many off the rails and at the time of the survey that median net worth was down to a median of $143,000. Although many Boomers have delayed or modified their plans due to the recession they have, the Institute says, not abandoned them entirely. Over the next five years it is expected they will spend $1.9 trillion on new home purchases and $500 billion on rent.

Read full story here:

http://www.mortgagenewsdaily.com/10312014_aging_housing.asp

by Jim the Realtor | Nov 1, 2014 | About the author |

If you are like most middle-aged guys, you are under constant attack – both real and imagined – about whether you still have it or not.

I said something about how I used to keep my car back in the day, and some wondered whether there was any chance I could duplicate the effort. So I waxed my own car for the first time in years, and this is how it turned out:

by Jim the Realtor | Nov 1, 2014 | Jim's Take on the Market, Thinking of Buying? |

This is probably the least-likely time to get a lowball offer accepted in the history of the world, due to the lack of pressure on any seller – but for the next 2-3 weeks you might have a sliver of a chance. Once we get into December, the next selling season will be within sight, so sellers will pack it in – either literally or mentally – and be reluctant to make any deal. Then they will wait until end of summer before thinking their price might be wrong…again.

I haven’t had any luck lately – so this is just theory. But these are the things I’m looking for on behalf of buyers looking to make a deal in November:

1. Vacant houses that have been on the market 2+ months. They need to be eating a mortgage payment to really be motivated, but anyone sitting on an empty house in November must be avoiding the thought of renting it.

2. Homes that have been on the market for months – and have a mortgage balance around 70% to 80% of list price. They don’t want to lower their price because they hope to get a decent chunk out of it, but the payment could be eating them alive. There is a very small minority of sellers in this category, because banks are so lenient these days. But those who are barely making their payments to keep their good credit might appreciate any offer at this point.

3. Homes listed with great agents. They know the score, and if they just had an offer they might be able to convince a motivated seller to make a deal.

4. Fixers are prime candidates. The sellers apparently don’t want to make improvements (or can’t), and you have ample evidence why they should consider a lower offer.

At least nine out of ten sellers and their listing agents will think you are crazy, but it’s worth a try. To save time, I get the agent on the phone and feel them out first, and listen for any hesitation before they scoff at me.

Sellers shouldn’t take it personal – if you are comfortable just ignore any lowball offers and keep waiting for the market to head your way. But for those who really want and need to sell, this is your chance to do so – and at least you won’t have to worry about what the market might do in 2015.

P.S. If this is a house you love, don’t risk a lowball offer. If the sellers get offended, they will sell the house to anyone but you!