Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

Here’s an unintended consequence of Prop 19. If you inherit your parent’s home and sell it, the property tax basis will be increased to market value as of the date of death. It will encourage those kids to hurry up and sell to save having to pay the higher tax. From the OCR:

But if Proposition 19 passes, property transferred between parents and children would be reassessed to market value as of the date of transfer, which in the case of inheritance is the date of death. A child would have to move in and make the parent’s home his or her primary residence within one year in order to qualify for an exclusion from reassessment.

If children who inherit their parents’ home and other property want to sell it, they would have to pay much higher property taxes over that average 17-month period from the date of death to the close of escrow. Our clients would have owed an average of $8,500 in extra taxes.

In my conversations with different county assessors’ offices in California, the majority of parent-to-child exclusions from reassessment under Proposition 58 are granted for this exact scenario. Proposition 19 will create a new tax for average Californians that just lost a parent.

The proponents of Proposition 19 say their measure eliminates “unfair tax loopholes used by East Coast investors, celebrities, wealthy non-California residents, and trust fund heirs.” They seem to be under the impression that a significant number of parent-to-child transfers are for wealthy, undeserving individuals. Let’s look at some data on our clients.

Over the last year, 61 percent of our clients have received an exclusion from reassessment for properties they did not intend to immediately occupy. Of those, 8 percent were not California residents. The non-California residents did not live farther east than Utah. The average property value for these non-California residents was $665,000. They were hardly wealthy, celebrities or from the East Coast.

The higher taxes under Proposition 19 would compel two-thirds of our clients to sell the property, even if they preferred to keep it. This might be great for realtors, who expect to collect more commissions. It’s not great for a family grieving the loss of a parent.

https://www.ocregister.com/2020/11/02/prop-19-will-negatively-impact-many-ordinary-californians/

Youre taking some small lumps on the predictions lately 😉 but its all gonna be fine whomever wins and whatever passes. Change comes slow.

I think this is like the election polls and it is way off regarding heirs. It is not gonna happen to prime real estate in CA. My kids will get mine someday paid off. Id love one of them to live here and maybe both if I ever get that grandpa flat built. If they rent out the result is instead of $60K of income based upon current prices they would make around $55K plus own a prime piece of CA real estate that will only appreciate more over time. While Prop 19 isnt a positive for them they are smart enough to do the math and keep it.

I do think it could be a nice boost for tax receipts as it could spur more older folks to move more often. Me? Not going anywhere!

Pie charts are hard!

You’re taking some small lumps on the predictions lately ?. I do think it could be a nice boost for tax receipts as it could spur more older folks to move more often.

At least my lumps are from being conservative! I do recommend that everyone moves every 6-12 months!

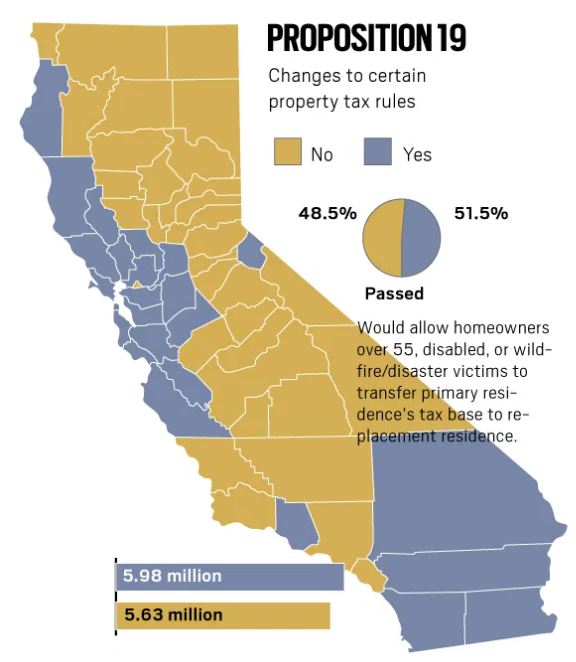

It does appear that California has a few more votes to count, so winning isn’t 100% yet. Today, the AP said the count is 82%.

Reporting on the props has been interesting. I saw in two places where they said it was 100%!

From the CAR president:

Proposition 19:

With the latest update from the Secretary of State’s office, some media outlets have already called the election in favor of Proposition 19. We remain highly confident that Proposition 19 will officially pass when all of the remaining 4.5 million votes are counted. We currently are holding at 51.4% “Yes” and 48.6% “No,” with approximately a 330,000-vote difference. The votes reported continue to remain consistent with the campaign’s voter modeling.

I would like to thank all of you for your hard work and the continued effort to pass Proposition 19. Each email, letter, phone call, social media post, and text message you shared about the initiative is appreciated and positively affected the Yes on 19 Campaign.