Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

What were we doing in September of 2008?

Here is one blog post:

https://www.bubbleinfo.com/2008/09/18/more-fallout-from-fraud/

Jan did get foreclosed on her $1,250,000 in loans, and the lender sold the house for $780,000 in February, 2010.

It just sold again last month for $1,149,000.

For newcomers who weren’t with us in 2008:

A scam artist teamed with a local real estate broker and did seminars at places like the Carlsbad Theater on State St.

They pitched 100% financing of million-dollar homes to novice investors. They also promised to rent out the homes, and manage them until the appreciation was sufficient to re-sell for a tidy profit.

No money down, and reap the windfall within a few years!

They did buy about a dozen homes for full price in 2007 and 2008, mostly in Bressi Ranch.

The deals included a kickback of 5% to 10% from the seller to the scammers. This was known to the buyers, and the monies were held for ‘management expenses’ and to cover the payments while vacant.

Except nobody bothered to check what the market rents were.

The payments on $1.0 to $1.3 million in mortgages far exceeded what they could get for rents, and within a few months the unsuspecting new homeowners realized they had been scammed when they couldn’t find tenants willing to pay the freight.

I exposed it here on the blog, hoping to warn more people of the scam. Of course, no good deed goes unpunished – I got hate mail from Bressi owners who vowed to kick my butt if they ever see me around.

It also became known to me that realtors were using my blog posts against me, so all of the old posts have been marked private. As long-timers have probably noticed, the content here has been toned down too.

The scam artist did do a few months in jail, and he called me one day and asked if I would take down posts with his name so he could lead a normal life. I obliged. Super J is still a local real estate broker – I saw her at a listing of hers last year.

I did have a conversation with her back in 2008, and she denied having any involvement with the scam – she said she was duped too.

P.S. All the homes were foreclosed or were sold short at an avg loss of $500k to the lenders. Countrywide was the loan originator.

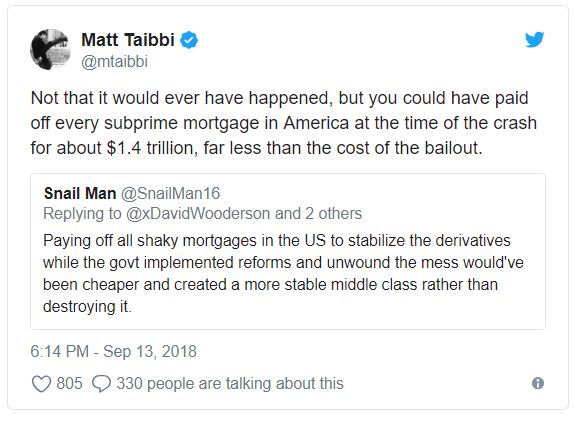

I still contend that ripping the bandaid off would have been better than a dozen years of festering.

“Monthly nut” to “rent” ratios aren’t as bad. Yet.

Better to have avoided the crisis in the first place. Calculated Risk offers this quote:

We conclude this financial crisis was avoidable. …

Despite the expressed view of many on Wall Street and in Washington that the crisis could not have been foreseen or avoided, there were warning signs. … Yet there was pervasive permissiveness; little meaningful action was taken to quell the threats in a timely manner.

The prime example is the Federal Reserve’s pivotal failure to stem the flow of toxic mortgages, which it could have done by setting prudent mortgage-lending standards. The Federal Reserve was the one entity empowered to do so and it did not.

This phenomenon is charitably referred to as “regulatory capture” i.e. regulators who fall under the spell of those whom they are supposed to regulate. I offer an alternative view: the upper echelons of business and government are not adversaries, but two sides of the same elite coin, all members of the ruling class who have more in common with each other than the common citizen, and will always protect their own interests at the expense of the general populace.

Thanks Ross, and I totally agree.

My alternative would have been to put me, or somebody like me, in front of the microphone to explain how neg-am mortgages work, and to have patience – they take care of themselves over time.

But instead of reading the fine print, everyone freaked out when they heard your balance can go up – including the mortgage brokers who didn’t have a clue what they were jamming their customers into.