Yesterday I sent a note to the C.E.O. of the National Association of Realtors to counter the idea that home values will be going down 8% to 12% this year. I’ve been asking for two months – show us your math.

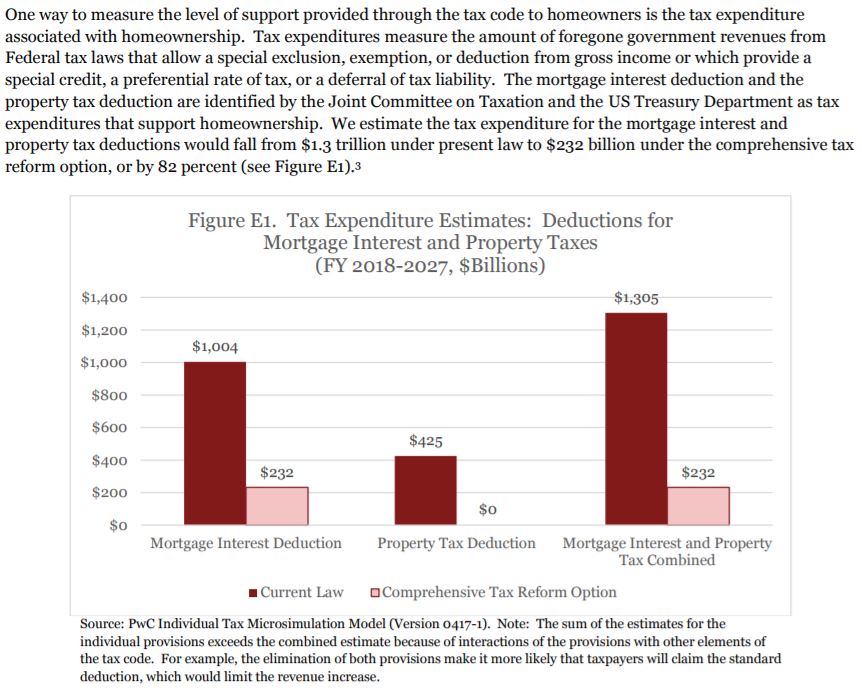

Here it is – see link below. They commissioned a study by Price Waterhouse, who used their microsimulation model to determine that demand will drop so severely that home values would tank by 8% to 12%. The study is dated May, 2017, so it’s not based on the final tax reform legislation – they used samples of what they thought it could be.

Here they note that the mortgage-interest deduction would drop by almost $800 billion when the law that was passed had NO IMPACT on the ability of existing homeowners to deduct the same mortgage-interest as they’ve been deducting all along.

They also drop the Property Tax Deduction to zero – which is wrong too.

So Lawrence and the N.A.R. are publicizing the negativity based on an old report from six to twelve months ago that used faulty assumptions.

Great.

The data point I included in my email was the bidding war in Carmel Valley this week on a tract-house listed for $1.2 million that garnered 16 offers. Apparently, the tax reform didn’t impact those buyers the way the microsimulation model expected.

Here’s the email from Lawrence:

Hello Mr. Klinge,

Our CEO shared your note with me, as it mentions my name.

Thanks for sending us the market info on the ground from San Diego. We always appreciate member feedback. We have also heard similar condition of multiple bidding and the lack of inventory in CA coastal cities and in many parts of the country. I will use your comments in my presentations about variations in the country: with upper-end market needing to cut prices in CT and IL and still multiple bidding in San Diego.

We regularly conduct a survey of Realtors® for that exact reason of gauging what is happening on the ground. The latest monthly Realtor® feedback, which we call the Realtor® Confidence Index, is attached. Getting a feel for the market from these 3,000 Realtors® greatly helps me and my staff. I am asking my staff to contact you subsequently to be part of this survey. There is an open-ended question at the end where we delve into issue not mentioned in the questionnaire and comments like yours will be helpful for us to understand what is happening on the ground and to identify “turning points” in the market.

https://www.nar.realtor/research-and-statistics/research-reports/realtors-confidence-index

I’m very glad to hear that the tax deductions limit on mortgage interest and property tax appear not to be impacting your market. The strong job market in San Diego is no doubt helping boost home buying confidence. That is not what we are hearing in other markets, however. Here’s a couple news interview of academics. I am attaching a link of Dr. Robert Shiller’s interview with CNBC at a recent NAR event, when he gave talk about the market condition. He, unlike most other economists, does not believe that consumers are always rational. In fact, people are more irrational then rational, in his view. Always interesting to hear his perspective and it’s here:

Most economists would be like Mark Zandi, believing consumers are mostly rational in their behavior, and has called for negative home price impact from limit real estate tax preferences. Here’s Dr. Zandi’s interview with CBS

https://www.cbsnews.com/news/gop-tax-bill-wont-help-housing-prices/

Our projection is based on Price Waterhouse Cooper research report, which we commissioned. Here below:

http://narfocus.com/billdatabase/clientfiles/172/21/2888.pdf

After taking into account of current market momentum, the job market, local housing starts, interest rate forecast, we have CA home prices rising by only 1% in 2018. It would be presumptuous to imply this NAR forecast will be the reality for 2018. Indeed, CA may experience for the remainder of the year what you are seeing currently. Given that many members have asked for our views for outlook in 2018, and the below forecast is our attempt at that.

https://www.nar.realtor/research-and-statistics/tax-reform-impact-and-home-price-outlook

One big issue we have been working on is to boost inventory and housing supply. As such we have been working with University of California Berkeley … to boost housing supply and homeownership in a sustainable way. Here’s the paper and my presentation at the University is attached.

https://escholarship.org/uc/item/40p726v2

Based on Realtor® feedbacks, we know how critical it is to have more inventory. Therefore, my presentations have focused on this issue. I am attaching 2 powerpoint presentations that talks to the great undersupply in CA.

- Housing Conference at University of California at Berkeley

- Homeownership Conference at HUD, with Dr. Ben Carson presiding.

For day-to-day update on the ever changing market conditions, follow us on social media, along with other 100,000 + fellow realtors®. I am sure you will not agree on all things shown, but it is my hope, some of the info can be used in your business.

https://twitter.com/NAR_Research

Finally, if not already, please consider becoming a major RPAC donor. Many very successful Realtors® like to give their time back to the organization by volunteering and by investing in RPAC to help protect private property rights.

Best regards,

Lawrence

Lawrence Yun, Ph.D.

Chief Economist

National Association of REALTORS

Washington, DC 20001

It looks like the NAR is most interested in maximizing the number of overall sales and is less concerned with rises or drops in sales price. From this perspective a drop in prices might be a good thing as more buyers could enter the market resulting in more sales overall – which I suppose could be a benefit to the members of the NAR when taken as a whole.

From an individual realtor perspective you have to ask yourself whether higher sales price or higher volume is more advantageous to your bottom line, and this would depend on the market you are in, the # of clients you have, the type of clients you are after, etc.

Obviously the NAR doesn’t give hoot about existing homeowners, and why would they? They don’t represent homeowners, they represent realtors. So a drop in prices, in and of itself, isn’t a bad thing to the NAR.

It looks like the NAR is most interested in maximizing the number of overall sales

Saying that home values are going to drop 8% to 12% is only going to stall the market. Buyers will want to wait it out, and sellers aren’t going to believe it for months or years – none of them are motivated enough to dump on price right away.

Let’s also be clear. After the big run-up we’ve had, the thought of have to lower their price by 8% to 12% will be unfathomable to sellers, and would be considered ‘dumping’ on price. Egos don’t like the sound of that.

I think your example of the 1.2 CV house is probably instructive. At that price, you are still pretty close to full MID and your property tax is “mostly” covered under the $10k. So people can wave it a way on the margin. But as you creep up in price in the same neighborhood people will start to crunch the numbers a little harder. I suspect this will add significant pressure to the 1.0-1.2 inventory in such areas, but that pressure will not translate to the higher priced (1.4-1.7) product.

Good point, and for all I know there were buyers who were previously looking to spend $1.5-ish, and when they saw the $1.2 listing…….the tax reform caused them compromise?

Or just anything decent-looking in CV that’s under $1.5 draws a crowd. A big crowd. SP will likely be LP + $75,000. And 15 buyers looking harder at the next listing.

Yes to everything you said. There will be more pressure to hit that range house hard with your best shot than there will be to capitulate and stretch up to the next rung. Multi-year year run up in prices, interest rates moving up, tax benefit shaved. Gives the penny-pincher in the family more ammo to use to beat back the aspirational spender.

I may not be typical but at $1.2m I expect to be told ”see? There’s the ocean.” At $1.5m I don’t expect being told is necessary.

Just did a BPO rental on a Camarillo house for a good friend. Wow. So expensive. He is only asking +4% after two years. I said no. 5%.

One of my mountain community renters did a smart thing in November. He raised his own rent rather than risk my raising it.

Interest rates may not be the cap if rental rates keep exploding.