Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

This lady drove through Austin Texas earlier this year and saw what we saw a few weeks ago with a simple search on Zillow – they have hundreds of new homes for sale there.

It’s really all the evidence she has, but she goes on for an hour here on how it means housing in general has a Cat 5 storm approaching.

What is noteworthy is that she has 82,000+ views in less than 24 hours:

https://youtu.be/_emO4Dl8sUM?si=QkgMkMqXzLcKse08

The comment section there is raving about how great she is and agreeing that the housing market is doomed.

You did say you are expecting 50% price jump from here within 5 years.

I watched Big Short again the other night and alot of the sentiment around the current housing market really sounds familiar. Especially the “prices never go down” line. US incomes have gone down 3 straight years and housing costs have gone up 25-30%. The numbers don’t support a bright outlook in real estate.

You did say you are expecting 50% price jump from here within 5 years.

Yes I did, and that’s after I expected a -5% for the rest of 2023.

But I might be too pessimistic!

The numbers don’t support a bright outlook in real estate.

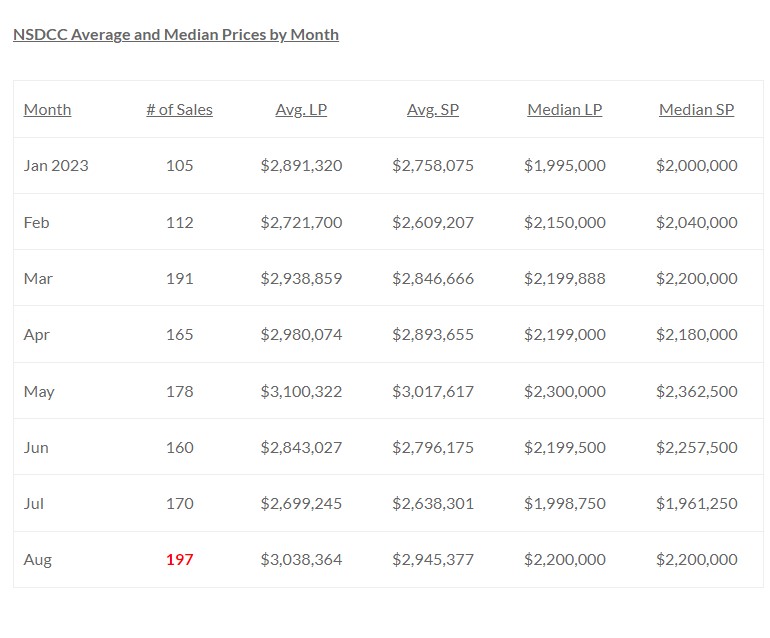

I’ll just comment on our local market. It has defied the numbers and all logic for several years now.

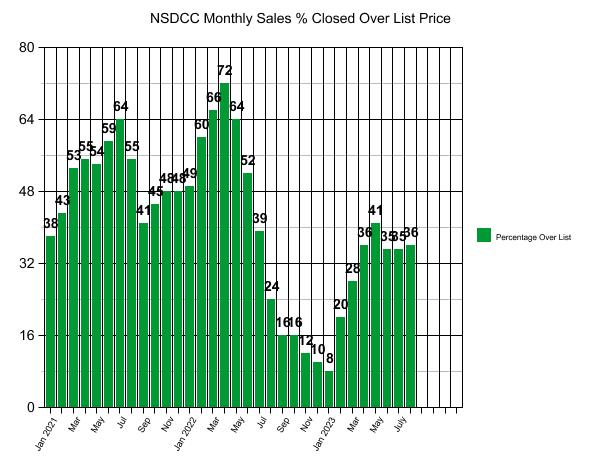

Even with the higher costs, a third of the buyers are still paying over the list price! Doomers have to consider why.

Agree with you that the lady on the interview is not credible but I see stresses building up in the industry in my work similar to 2008, especially multi family and all Airbnb purchases.

Housing prices are set on the margin, one house sells for 20% less and sets the comps for all the neighborhood.

I think Airbnb will be our subprime this time.

I don’t see housing going another 50% in 5 years, but crazier things have happened before so who knows.

The Car 5 chick in the You Tube video looks like a palm reader.

I don’t see housing going another 50% in 5 years, but crazier things have happened before so who knows.

All I need is the dollar to deval another 50% and I’m right in there. Crank up those printing presses!

The Car 5 chick in the You Tube video looks like a palm reader.

Now that’s funny – and true! 😆

They devalue the dollar by 50% in 5 years and housing will be our least concern. It’s the kind of event that brought about the French Revolution and also Hitler to power. Such devaluation is destructive to any society and interest rates will spike to 100% and more.

Could happen but an empire like the US has a lot of inertia, won’t collapse suddenly, the 2% inflation target is enough to steal from the plebs without much notice over time. Our current burst of inflation is mainly due to spineless Powell and a a Fed that is incompetent and sheepishly underwrote government spending plans. It’s within their mandate to say no. They still can stop this if they did their job and had true leadership. Powell will make Burns look good in history books.

They devalue the dollar by 50% in 5 years and housing will be our least concern. It’s the kind of event that brought about the French Revolution and also Hitler to power. Such devaluation is destructive to any society and interest rates will spike to 100% and more.

Could happen but an empire like the US has a lot of inertia, won’t collapse suddenly, the 2% inflation target is enough to steal from the plebs without much notice over time. Our current burst of inflation is mainly due to spineless Powell and a a Fed that is incompetent and sheepishly underwrote government spending plans. It’s within their mandate to say no. They still can stop this if they did their job and had true leadership. Powell will make Burns look good in history books.

Yeah blah blah. Ok 25% deval and 25% appreciation. I just hope I’m around five years from now to see how it turned out!

News Flash:

Rich people with money want to live in North County San Diego. Period. Amen. Interest rates are a minimal factor to this buyer. Flippers and Investors, on the other hand, have just had his/her/their “ball sack(s)” squeezed due to a higher cost of funds.

When do rich buyers dry up? When they lose their money in the stock market or they spend it. The W-2 chump making under $300k in San Diego with no stock options or inheritance for the down payment, welcome to Temecula, East County San Diego, Arizona, Idaho, Florida or Texas.

There should be a surge of hand-me-down monies before the 2026 estate-tax benefit retreats. Hang onto your hats!