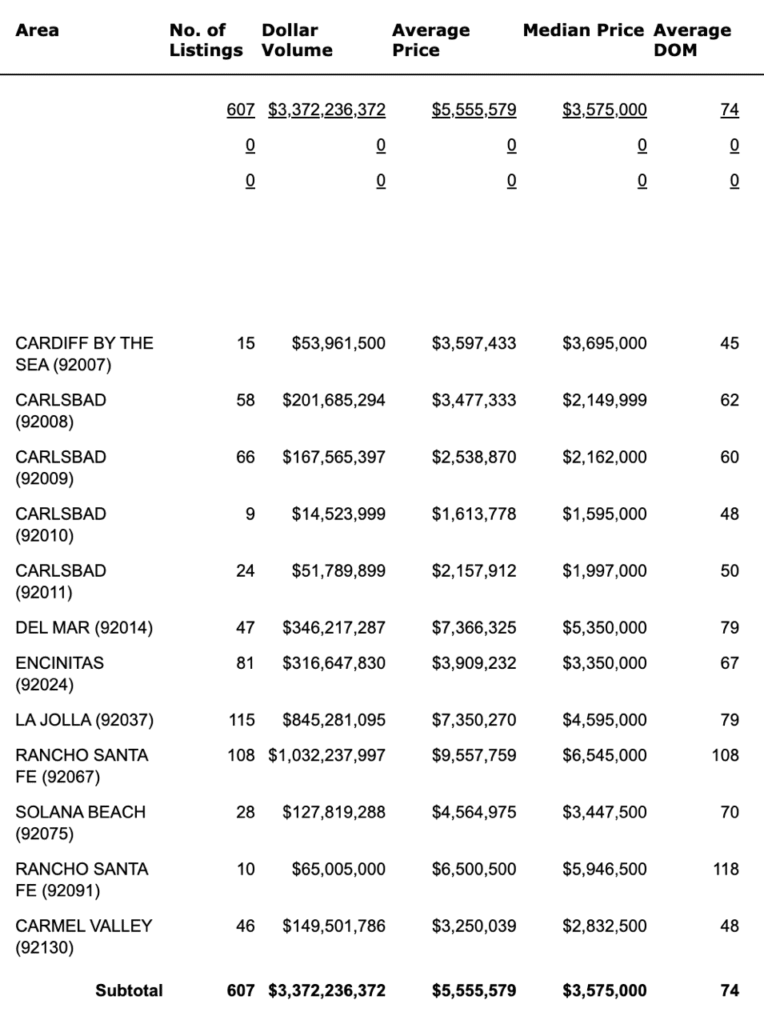

This is the breakdown of the NSDCC active listings.

Only 38% of them are in La Jolla and Rancho Santa Fe, so there are plenty of more reasonably-priced options. But the common thread of these unsolds is that they must not be trying too hard to sell. I say that because there have been 1,103 NSDCC closed sales this year, or about 155 sales per month on average. Nothing wrong with that!

Some of the highlights:

- In the 92008 (NW Carlsbad), there are ten houses for sale listed for more than $4,000,000. Only four of the ten are oceanfront, and they are all $10,000,000+.

- In Encinitas – which has exploded in recent years – the median list price is $3,350,000 and the average LP/sf is $1,284/sf.

- Carmel Valley looks the healthiest with a median list price of $2,832,500, and an average LP/sf of $876/sf – with only 48 average days-on-market. Only ten of the 46 homes for sale are priced over $3,500,000.

The 469 NSDCC homes sold in the last 90 days have a median DOM of 25 days. It’s time for seller recalibration. Summer is going to be over before you know it!

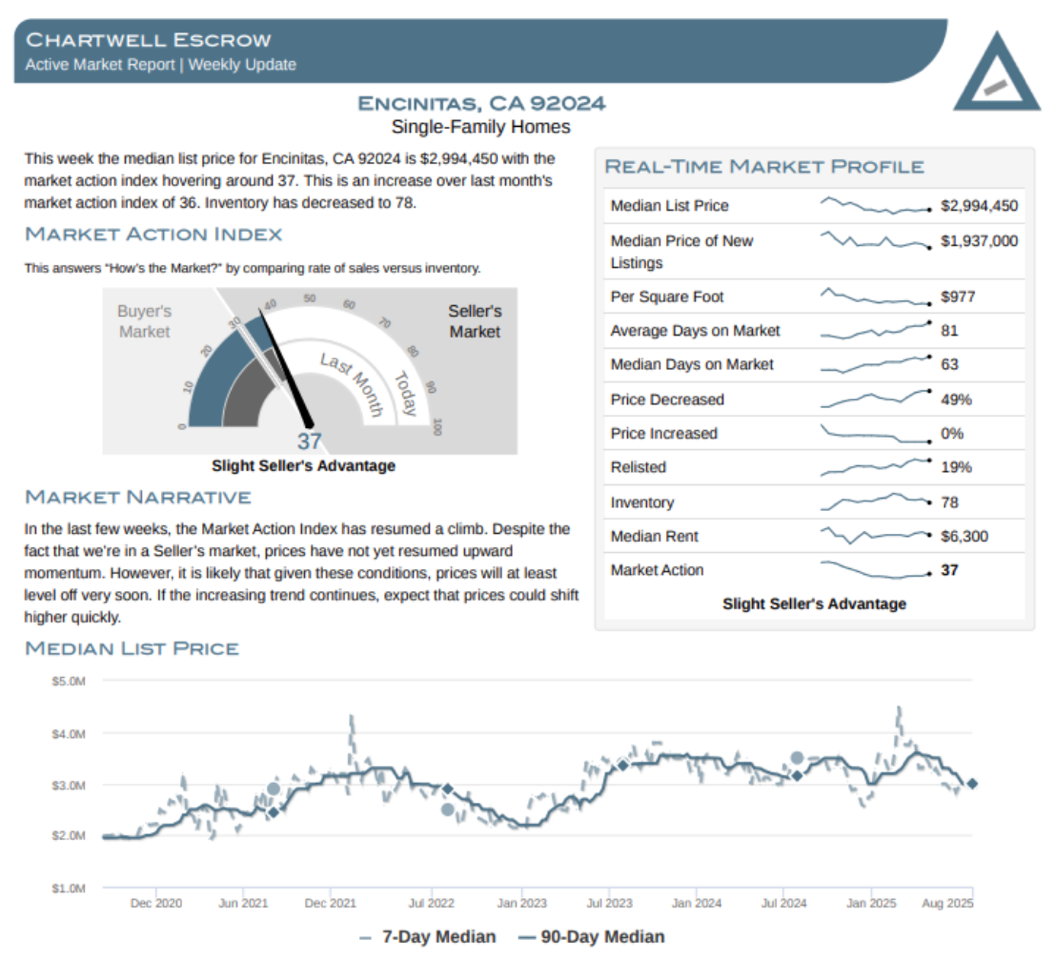

Meanwhile, this is the typical view – just waiting for a comeback:

A billion dollars of sales in RSF alone. These are numbers I don’t understand. $10m per property. At 6% that’s $3500 per day. PER DAY.

Factor in these variables:

Nobody wants to lowball and risk offending anybody. Especially the buyer-agents who don’t want to risk making the listing agent mad.

Every one of those RSF sellers could take $1,000,000 less and still come out with huge profits. But they aren’t going to give it away.

The listing agents aren’t used to these market conditions, and most have only known a raging seller’s market. They would rather wait, than risk offending the sellers with a price-reduction chat.

Waiting has become a strategy. Probably the most popular strategy!

Agree with Jim x1000%

What made the market go down in 2008 was banks taking actions on deadbeats forcing Forclosures which also forced Short Sales because comps were down.

These days banks let deadbeats live in their house for free. What this does is create a permanent plateau of high prices because theres no downward pressure.

The only “kind of” downward pressure on house prices is the number of listings going up. But even this doesnt really matter if banks let deadbeats live for free in houses instead of foreclosing.

The only “kind of” downward pressure on house prices is the number of listings going up.

Which doesn’t seem to have much, if any, impact on the current buyers or sellers. Does anyone even notice?

There were a multitude of factors that caused San Diego home values to plummet between 2007 and 2012. The big picture is that prospective buyers either could not or would not sign on the line which is dotted at those inflated prices, so prices had to come down to get deals done.

Just because we are not currently in an era of exotic lending, Wall Street Frankensteinian securitization, fraud and foreclosures does not mean there are not many other factors brewing today that will result in prospective buyers being unable or unwilling to pay the current prices. And if not, once again prices will have to come down to get deals done. As someone once said, history does not repeat itself, but it sure does rhyme.