Congrats to Mike for coming on board. With him generating market data regularly, we have as much to gain as anyone at Compass – look for more data from Mike here!

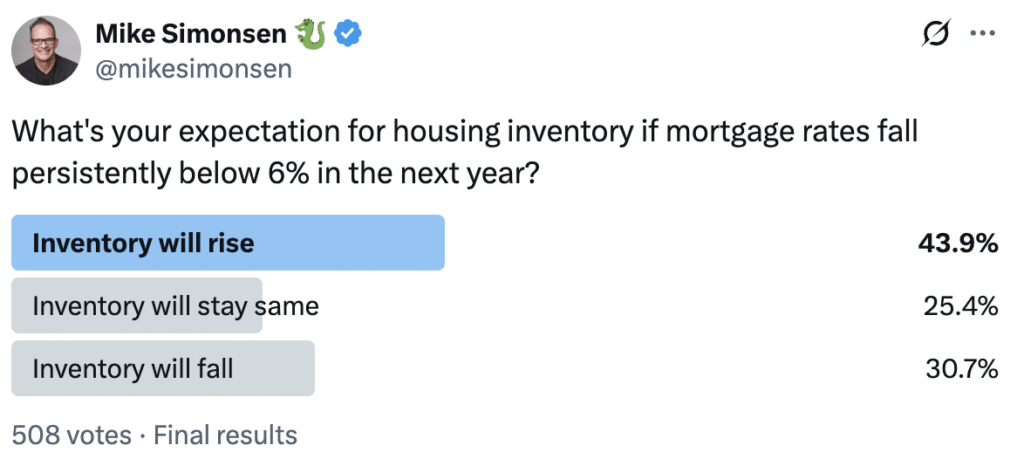

He offered a question on twitter:

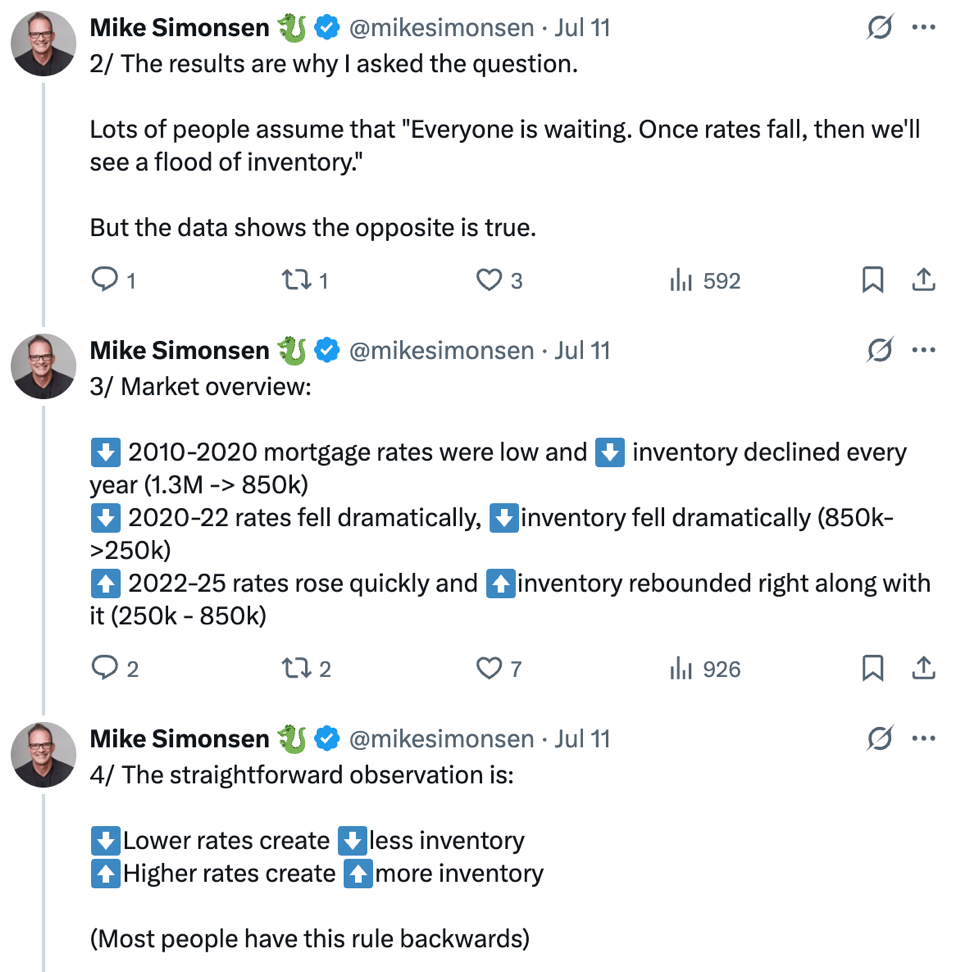

Here is his response:

He goes into more detail here.

Because there is recent history (the last 15 years) when lower rates coincided with lower inventory, he believes it will happen again. He says that lower mortgage rates motivates all buyers, which causes the demand to move faster than the supply.

In other words, when rates go down, the frenzy conditions will re-appear.

I said the same thing last week – that the current market lull will be over as soon as Trump can get rid of Powell and install a new Fed chief next May who will dump on rates.

But I’ve been thinking about it ever since.

Here’s why I don’t think it’s going to happen and why Mike could be wrong this time. We’ve never had market conditions like this before, so we should throw out all previous assumptions (hat tip Rob Dawg/Giving Cat):

- The unsold listings from this year will be coming back to market faster in 2026. Frustrated sellers who dinked around this year will come back firing!

- I think Mike is mixing ‘inventory’ and ‘active inventory’. He thinks the additional demand will gobble up the inventory, leaving fewer actives, which makes sense. But I guarantee there will be more listings overall.

- The seller’s market has been broken. Buyers didn’t know if it would ever happen, or what it would look like – but this is it. Not sure it’s a full-blown buyer’s market yet, but the sellers have lost considerable negotiating ground.

- More sellers combined with cautious buyers means more of what we have now. Low activity with everyone wondering about pricing, now and in the future.

- Realtors have jumped the shark.

- If the tax-free-home-sale bill gets passed, look out. Will any Republican would oppose it? Paying the extra tax has been the #1 reason long-time homeowners tell me why they don’t want to move. For those still spry enough to pack it up and go (probably move out-of-state), here’s your chance. It will be especially attractive to those who have lived elsewhere and can move back home.

- I don’t think mortgage rates can dump, even if Trump gets his way. If they decline slowly, it gives more fuel to the buyers to wait longer.

In summary, I think the 2026 listings will come faster than buyers will/can gobble.

Buyers are enjoying this new-found freedom of being patient and aren’t feeling pressured to pay crazy amounts over the list price. Buyers prefer this feeling!

Sellers have been thinking they would have a line of buyers who would pay their price, and they would get to pick the winner. But now, nobody is looking at their home, let alone making an offer.

Advantage: Buyer.

Buyers dig this new feeling, and they aren’t going to get suckered into paying some crazy price. Especially if the flow of listings keeps them thinking there will be others.

By next year, there will be enough unsuccessful sellers from 2024-2025 that a few will feel some panic. Not the type of panic like before when sellers only had 10% equity and if hired the wrong realtor they walked away with just enough dough for a steak dinner.

It will be a nervousness from not knowing how low they might need to go on price. They will act tough and tell everyone that they’re not going to give it away, but inside it will feel out of control.

Most sellers are flush, and they will gladly wait until ‘the market gets better’, rather than give it away. They will join the hundreds of households on the market now, just waiting.

But the market is made by those who are transacting.

Sales will likely suffer, and the comps will scatter all over the board as some lucky sales are interspersed with the giveaways. Sellers will gravitate to the former, and buyers will believe the giveaways are more indicative of the current market. They will want a deal too!

Get Good Help!

Something else youve mentioned before but didnt include in this list.

When theres access inventory and prices arent going down many sellers will turn into landlords renting their place out.

The more rentals availabe the more attractive your price will need to be to attract renters.

If renters feel like renting is a better deal then buying they’ll stay on the fence waiting for prices to keep going down.

Relatedly, home sellers will need to make their homes more attractive to get renters to buy.

A vicious cycle there!