Here’s an example of how home sellers can get jammed up by lower sales in the surrounding area and the market turning. During the frenzy, any lower-priced sales nearby were shrugged off by the anxious buyers who just wanted to get any house at any price. Not now.

Our listing at 29482 Vista Valley was the best custom estate on the golf course when it was built in 1987 – and it still is today. The house across the street – and not on the golf course – sold last June for $1,985,000 so at least I had one comp, although aged.

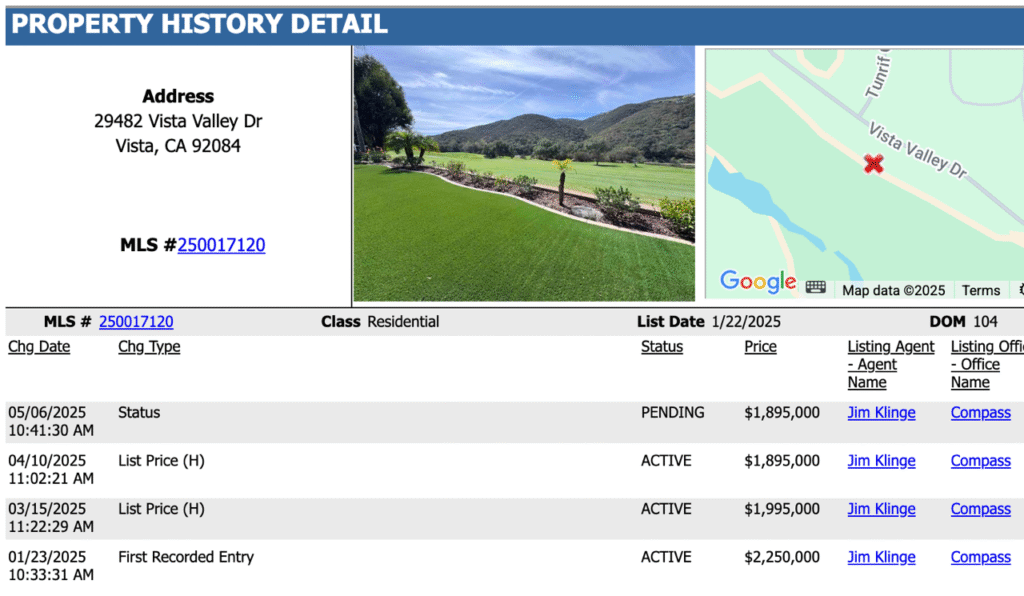

We hit the open market on January 22nd listed for $2,250,000.

The 2025 market was off to a fast start, and we had good activity – but no offers.

The Gopher Canyon corridor is a rural area like Bonsall/Fallbrook and it has some fine custom estates mixed with more-modest homes. Unfortunately, there weren’t any of the fine estates selling in 2025 and by April/May there had not been any sales above $1,900,000 nearby.

Plus, the new-home tract at the bottom of the hill is owned by the same guy who owns the golf club. They have sold 55 of their 60 new homes with club-membership options included, and over 90% of them closed under $1,500,000.

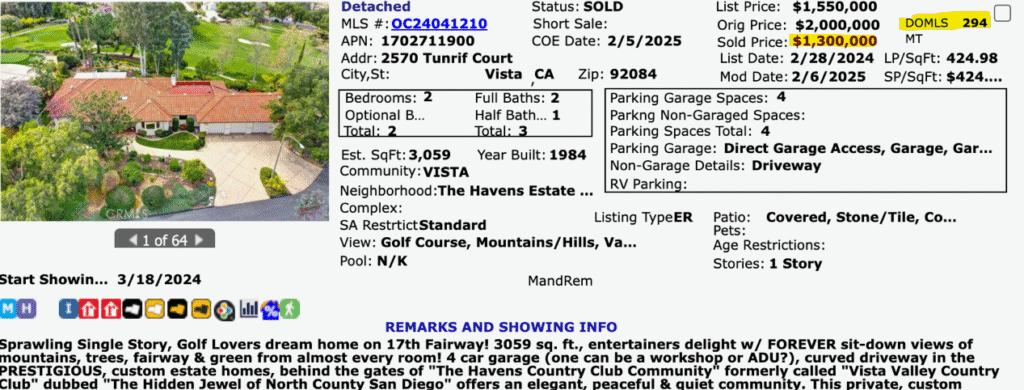

The only other sale within the golf estates was this 2br disaster. They did no improvements to sell it, no staging, and just dumped on price. Ouch:

I wasn’t getting any help from the surrounding sales!

We waited until mid-March to lower the price. Within a week after Liberation Day, it was obvious that it was impacting the market. We lowered another $100,000:

Finally we found retirees from Ohio who want to join their family here. Their agent was smart to float $1.6 and $1.7 prices by me, because her buyers were like most and wondering how much can they get away with! I told her to not bother.

She submitted a $1,800,000 cash offer, take it or leave it.

To be faced with having to accept an offer that was $450,000 under our initial list price was excruciating mentally, but it was our only offer in 100 days and there wasn’t any reason to think it will get better later. The sellers had some regret about not going on the market last summer like we had discussed, but that’s water under the bridge now.

We took the deal.

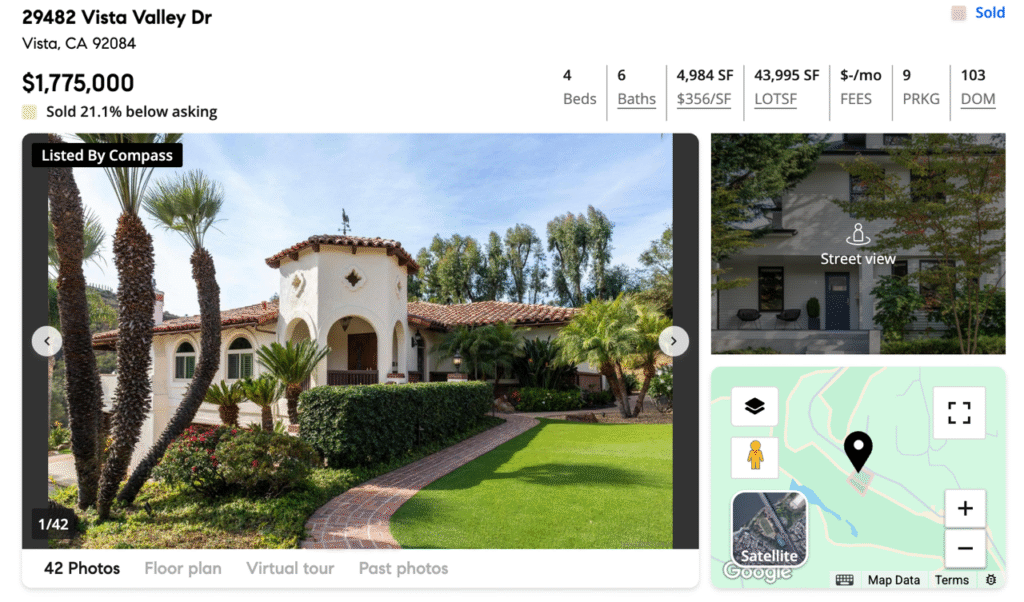

Though the house was mostly in original condition, it was immaculate. It had been a lightly-used and well-maintained vacation home for 30 years. How much could be wrong?

The home inspection did confirm – not much wrong here! But the roof had not been replaced, and Mr. Buyer had a previous roof history so he insisted.

They got roof-replacement quotes from $50,000 to $100,000, and in spite of me telling them that we weren’t going to do anything for them, they asked for another $25,000 off the price.

It was a smart move – do we ditch them and go for the two in the bush? No.

We took it, and it closed for $1,775,000, or 21% below the original price.

It was the cumulation of all the bad things that can happen:

- Being a higher-end home in a more modest area

- Being a custom-estate but buyers think it’s dated because kitchen isn’t white

- Having a good golf view but not enough to compensate for above

- Bad break with Liberation Day

It’s a good example of buyers who found a suitable home but wanted/needed the deal to be more attractive to get them to buy it. They had planned to move any time in the next year, so no rush. On our side, the outcome didn’t feel great but our sellers had already purchased a replacement home near their daughter and had no reason to fight what had become obvious after 100 days of trying.

Sounds exactly the opposite of when prices were going up. Before sellers were in take it or leave it mode because there were other buyers waiting to buy.

Now buyers are in the drivers seat and they’ll push down on price which sellers will have to take if other buyers aren’t looking to get into the deal.

I bet in 1-2 years this seller will look like a genius as houses sell for less and less and generally take longer to sell. Its been a while since we’ve seen housing market declines.

Most sellers will fight it, and a few will be rewarded and surmise that it just takes longer. No, you got lucky.

Remember the other golf-frontage listing I had? On La Costa?

After 24 open houses, 14 written offers, and 105 days on the market, the seller determined that my results were unsatisfactory, and he “wanted to go in a diffferent direction”. My high offer? $1.85 cash.

He listed with another agent, and 97 days later, it’s still unsold. List price is $1,880,000.

As 2025 began, the stars were aligning for a housing market rebound.

Inflation was easing, the economy looked strong and mortgage rates were drifting downward. By April, there were more available homes to buy than at any time since January 2020, according to the Federal Reserve of St. Louis. The conditions were ripe for buyers to re-emerge, checkbooks in hands, and sellers to negotiate.

Then on April 2, President Trump rolled out his expansive global trade tariffs, shocking the stock and bond markets and sparking fears of a recession. Mortgage rates jumped again, hitting 6.89 percent for a 30-year fixed-rate loan on May 29, their highest level since early February. The extreme volatility threw cold water on a fragile market. Buyers bailed out.

“There isn’t any urgency to buying right now — if anything it feels more risky to put a down payment into a home when you might not have a job six months from now,” said Daryl Fairweather, the chief economist of Redfin.

Real estate agents across the country report a chilled environment, with sellers unwilling to lower their prices and buyers reluctant to make a big purchase as the economy flounders and the costs for a mortgage, insurance and property taxes rise. Even in markets where prices have fallen and inventory is piling up, like Austin, Texas, homes are sitting on the market for months. In fiercely competitive areas, like the New York City suburbs, where prices are still rising and homes sell fast, properties that would have gotten a dozen offers a year ago now get two or three.

“Yes, there is more inventory, but it’s almost like too little too late,” said Selma Hepp, the chief economist for Cotality, a real estate data provider.

In Lewisburg, W.Va., Leah and Jesse Jones, who were in the market for a three-bedroom home, lost out on two bids: one to a cash buyer who waived contingencies, and the other because the seller wouldn’t lower the price enough. After six months, they’ve paused their search, hoping a downturn might bring home prices down, too.

“I feel like buying a home, owning a home, is becoming a privilege that only the truly wealthy can enjoy,” said Ms. Jones, 45, a clinical dietitian.

Yet despite a market full of reluctant buyers, sellers are not under pressure to drop their prices. Almost 60 percent of households have an interest rate below 4 percent, according to a study published in the Journal of Finance; selling would mean trading that low rate for a much higher one on a new purchase. Not since the 1980s, when borrowing rates soared into the double digits, have so many Americans been locked into their mortgages, said Lu Liu, an assistant professor of finance at the Wharton School at the University of Pennsylvania, and an author of the study, describing the conditions as “unprecedented.”

Even Austin is stuck, despite starting construction on 102,000 single-family homes between 2020 and 2024, according to Zonda, a data provider. The median sale price there has fallen by 18 percent since the peak in April 2022, according to Unlock MLS, the multiple listing service for the Austin Board of Realtors.

But buyers still see an overheated market — the median home price jumped 69 percent from April 2020 to April 2022 — and an uncertain future. Many sellers, in turn, would rather pull a listing from the market than meaningfully lower the price. “It’s a bit of a frozen market,” said Eric Bramlett, an Austin real estate agent. He said, “Sellers are not refusing to sell, but are instead stuck on their price.”

In February, John Huffman and Nan Walsh listed their three-bedroom house in East Austin for $950,000, after buying a home in Columbus, Ohio, closer to family. The house hasn’t sold, and though they’ve lowered the price to $925,000, they’re in no hurry to make a deal. “I don’t feel any pressure,” said Mr. Huffman, 68.

The couple paid $618,000 for the house in 2017 and have a mortgage with a 2.6 percent interest rate. If it doesn’t sell, they may rent it out or use it as a winter getaway.

https://www.nytimes.com/2025/06/02/realestate/recession-mortgage-rates-housing-market.html?unlocked_article_code=1.NU8.iE1Y.RY6touIWvZxN&smid=url-share

Sounds a lot like our story when we sold our custom home with you in Vista 14 years ago. In escrow and ready to close and at the last minute…”oh we need a new roof and they asked for 50k!” You creatively whittled that down in costs and the deal closed.