The world was rocked by tariff talk on April 2nd.

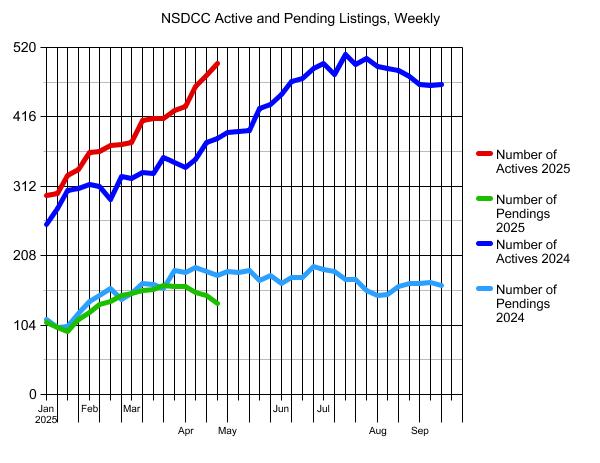

The number of actives and pendings were already fighting to stay in line with last year, but look at the changes that began in April.

Has the selling season ended prematurely, and it will feel like the off-season for the rest of the year? Looks like it.

I’ve already had people wonder out loud if they should wait until next year. It won’t be better next year.

The market sluggishness will stay like this until there is a meaningful change in rates and/or prices, which could take years. Home sellers will be faced with a choice. Take less now, or take less later.

That red line is about to go vertical.

It’s about time. Turning houses into speculative assets has destroyed the well being of the majority, especially the youth.

Crash is long overdue, let’s hope this time there won’t be bailouts and banks would be forced to mark to market their assets as it should be.

The resolution will be quick.

I WISH!

Kamala banned foreclosures for the most part. Banks will have very little to do with the outcome.

It will be up to the mom-and-pop sellers and they will not give it away. Promise.

It will take years and they might still win out if they wait long enough.

It took 16 years for Japan’s 1989 peak housing pricing bubble to unwind.

The home price declines were also highly correlated to stock market declines.

Government can ban foreclosures only by compensating the lenders. Loans have to be serviced. If they are not, banks will have to show losses and mark the assets to market as it has always been the rule. They will either have to sell at any price the market will bear and clean their balance sheets or go bankrupt. To pretend, lenders must have access to free money aka bailouts. Its possible they will get it again to “save” the world as we know it unless Trump has a grudge against them.

Last time it was easy to walk away because the ‘homeowners’ had no equity.

Do you think homeowners today are going to walk away from gobs of equity?

It’s spurious equity Jim.

When prices start coming down, that equity will evaporate instantly. Banks were saved last time by removing the mark to market rule to allow them to pretend their assets weren’t impaired while the system was flooded with money. There is no reason my house I bought for one million 3 years ago is worth 2 million today. A crisis is coming and it will be terrific.

A crisis is coming and it will be terrific.

I hope you’re right because last time it happened, this blog was on fire!

I’d love to see that again!

Foreclosure videos!

Biological discoloration!

Ice-cream trucks!

“no reason”?

Here’s 3. . .

Inflation – including cost to build, USD Index, wage increases, etc

Specific to SD- supply/demand (as other less desirable markets increased nationwide, it’s natural that the most desirable will outpace those gains)

Flight to hard assets (even though stock market is up from 3 years ago there’s been a repositioning of assets to commodities) and increased institutional interests

People who bought in late 2023 and 2024 have the same equity when they purchased if lucky. Over leveraged people will feel the pain. However about 1/3 of recent buyers are spoiled little shits of rich boomers. Let’s see what happens when the tide goes out and see who is swimming with no suits.

People that bought in 2023/24 will just leverage whatever credit they have, refi and pull out cash, use that cash to buy another house, and stop making payments on their previous house and rent it out.

If the bank goes after the “homeowner” for not making payments. They’ll make a payment here and there to keep the bank from forclosing. They’ll take the rent and use it to pay off the mortgage on the new house they just bought.

Banks are enabling this behavior by not foreclosing right away.

What I described is technically called a “buy and bail” with rent made on the bail property because the banks won’t foreclose.

There was a lot of this type thing going on in 2009. With the number of young people being forced to rent because they can’t buy and prices being even higher I bet it’s even worse today. Unfortunately it will take 2-3 years of price drops before the fraudsters are smoked out.