It’s common that when the residential resale market feels slower, the participants shrug it off by saying, “It just takes longer to sell these days.” It is a too-quick opinion that masks the real problem, which is:

It’s taking longer for sellers to admit how wrong their price is.

Because the days-on-market is publicly displayed, the buyers are watching it closely as an indicator. What’s worse is that they think the longer a home is on the market, the more wrong the price is!

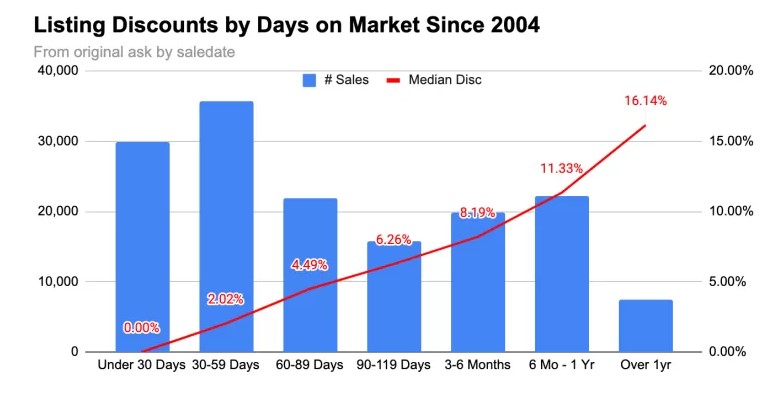

Consider the graph above, which tracks discounts back to the old days when the DOM counts weren’t as available as they are today. Today, I think those timelines are 2x as fast – or faster!

Today, if a house hasn’t sold in the first two weeks, buyers start thinking the price is wrong.

Conversely, if buyers think the price is decent, they buy the home without waiting.

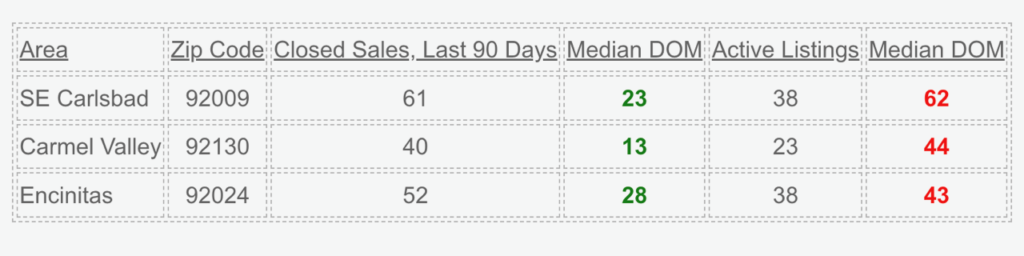

Here’s a sampling of the three mid-range zip codes in north county’s coastal region:

My main point?

Conveniently, the opinion that “It just takes longer to sell these days” has been true when prices are rising. Eventually, the market catches up and the over-priced turkey will eventually look like a deal if you wait long enough – but only when prices are rising.

When prices go flat – like they are today – then the market doesn’t come to save you. Instead, it undercuts the OPTs, leaving them high and dry. It is especially true when there is a surge of new listings that makes it even more obvious.

Yesterday, I mentioned to a past client in CV that I sold Nantucket for over list after the first weekend, and he said, “Incredible! We have houses in our area sitting on the market for months with zero action”.

In Spring, 2025, listing agents will be asking their sellers; “do you mind taking a little less than the actives?”

Welcome to Flat City, with OPTs being ignored and causing buyers to be suspicious of everyone’s price.

0 Comments