The year-end slide of the local non-seasonally-adjusted Case-Shiller Index looks like it will last twice as long this year. In 2023, it was a relatively-brief three months, but this year the pricing turned in mid-summer.

Expect the same result in 2025 – the prime properties will fly off the market at premium prices and the junkers, OPTs, bad locations, and poorly-presented homes will languish through the second half of the year as they get picked over by the bargain hunters.

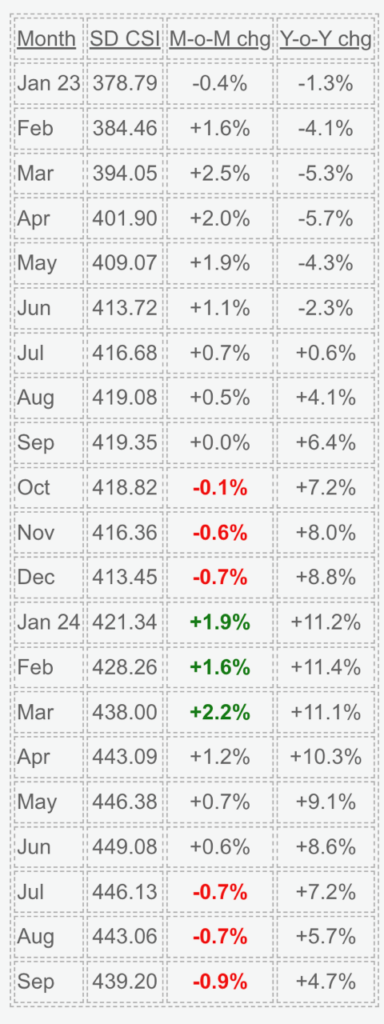

San Diego Case-Shiller Index, Non-Seasonally-Adjusted

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.3%, while the 20-City and 10-City Composite reported monthly rises of 0.2% and 0.1%, respectively.

“Home price growth stalled in the third quarter, after a steady start to 2024,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “The slight downtick could be attributed to technical factors as the seasonally adjusted figures boasted a 16th consecutive all-time high.

“We continue to see above-trend price growth in the Northeast and Midwest, growing 5.7% and 5.4%, respectively, led by New York, Cleveland, and Chicago,” Luke continued. “The Big Apple has taken the top spot for five consecutive months, pushing the region ahead of all others since August 2023. The South region reported its slowest growth in over a year, rising 2.8%, barely above current inflation levels.”

> Expect the same result in 2025 – the prime properties will fly off the market at premium prices and the junkers, OPTs, bad locations, and poorly-presented homes will languish through the second half of the year as they get picked over by the bargain hunters.

Almost as if the market acts like a Slinky toy.

We’ve talked slinky before but those who write for a living don’t look too far for an explanation – too easy to jump to doom instantly:

San Diego County’s home prices continue to decline — a sharp contrast to the start of 2024 when the region led the nation in home price gains.

The San Diego metropolitan area’s home price increased 4.7% annually in September, according to the S&P Case-Shiller Indices report released Tuesday. That’s a percentage point down from August.

San Diego dropped to No. 8 in the 20-city index with the metro areas in Orange and Los Angeles counties right behind it with a 4.6% year-over-year increase. Once again, New York led the pack in September with a 7.5% year-over-year increase, followed by Cleveland jumping up the list, with a 7.1% increase.

Since September of last year, San Diego occupied the top two spots for annual price gains, at least up until July when it dropped to No. 4.

San Diego is not alone in seeing sluggish annual home price growth in September. Seventeen out of the 20 metropolitan areas tracked in the Case-Shiller report saw a slowdown in price growth that month.

Nationally, home prices increased 3.9% annually, but that growth is down about 0.1% from August. Despite the tepid growth — the lowest annual increase since August 2023 — home prices are still rising, said Bright MLS chief economist Lisa Sturtevant.

“This year, the September data could be indicative of a slowdown in home price appreciation in the months ahead,” she said.

“A key reason for the upward pressure on home prices is a lack of supply,” she said. “However, the inventory picture is starting to change, which will likely mean slower home price appreciation during the fourth quarter of 2024 and into 2025. According to the National Association of Realtors, the inventory of existing homes has increased for 11 months in a row.”

The Case-Shiller Indices track repeat sales of identical single-family houses — and are seasonally adjusted — as they turn over through the years. The median resale single-family home price in the San Diego metro was $982,500 in September.

Mortgage rates hit a low in September, an average 6.08% for a 30-year, fixed-rate mortgage in the last week of the month. But, that reprieve for house hunters didn’t last as rates quickly shot up to 6.72% by the end of October.

The persistently high mortgage rates across the country have slowed home sales. That factor combined with a lack of new inventory — including fewer homes being put on the market — has made it a tough environment for potential buyers to close deals.

“As we continue through this slower time of the year for the housing market, things are likely to remain quiet,” said Selma Hepp, CoreLogic chief economist. “Home sales will be slow, particularly given the jump in mortgage rates in September. As a result, price gains will remain weak and potentially continue to post small monthly declines.”

The Denver metropolitan area had the smallest annual home price growth in September (0.2%) alongside Tampa and Portland — both recording 1.0% — though none of these regions saw a decline.

“The Case-Shiller Indices track repeat sales of identical single-family houses…”

Same houses not identical houses. Their 1896 houses are likely to have added indoor plumbing, electricity, and more improvements incorporated.