Hat tip to Jorge who sent in this interview with Jeffrey Gundlach, the prominent bond trader who speculates with confidence on the Fed’s half-point cut and what it means for the markets. He speaks quite knowledgeably about everything except the future of the housing market, which he called the ‘wild card’ for the economy.

This video starts where he says that he expects another 3/4% Fed cut this year, and then housing:

He said that none of us really know what’s going to happen……but let’s use math to predict the future.

My Theory:

It’s the HIGHER HOME PRICES that are locking in the current homeowners, not mortgage rates.

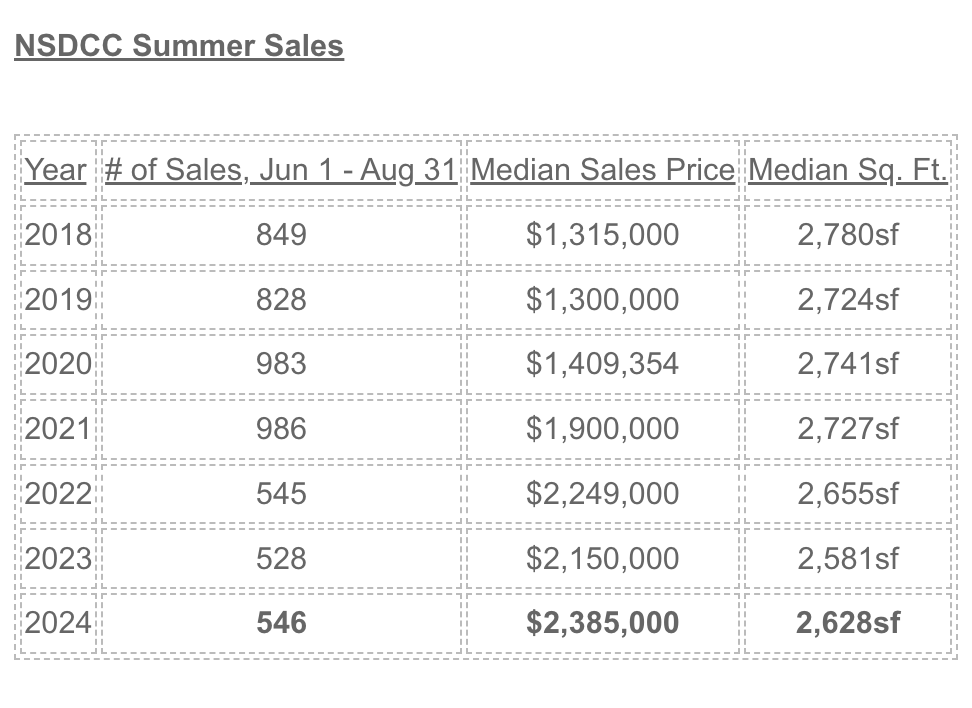

Everyone who bought a home before 2022 is enjoying a bonanza of new-found equity. Let’s use the 2019 buyer for an example. They hit the jackpot to buy a regular home for $1,300,000 back then, and now it’s worth around $2,385,000 – wow, an extra million dollars of equity, just like that!

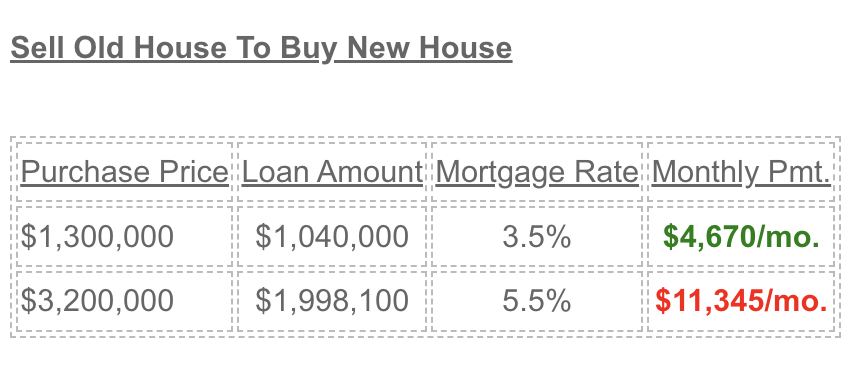

Some may have a good reason to move, and they are DREAMING about using their same equity, and same mortgage amount to buy up and live with a slightly-higher rate.

But they can’t buy a much-better house for $2,385,000 – they already own a similar-sized house! The old house that was worth $1,300,000 is now $2,385,000. So they have to spend more to make it worth moving.

My rule-of-thumb is 50% more, or $3,577,500.

But let’s say that they work with a really sharp, experienced realtor and find a home that makes it worth moving for $3,200,000 and use ALL of their equity from the old house after closing costs:

Let’s also point out that in California the property taxes would go up an additional $1,742 per month, so the $11,345 + $1,741 = $13,086 MORE PER MONTH to move to a better home in the same area. Even if rates were to drop to 3.5%, the combined P&I+T = $10,713 per month.

“You’re killing me, Jim – aren’t there any other alternatives?” Yes, there are two:

- Buy a smaller, crappier house in the same area.

- Move out of town.

That’s it, or throw down another $1,000,000 in cash to keep the loan amount down where it was.

What does it mean for the 2025 market?

Mortgage rates should be lower than they are today, and probably in the mid-5%s. There will be a new president, and all the wait-and-see buyers who were determined to see the Fed cut rates before venturing out again will be storming the streets en masse. Those first-time buyers and out-of-towners are used to these prices now and will succumb.

What about the supply? We will have a similar number of deaths, divorces, and job-transfers (The Big Three) who always sell every year. Will those who bought a home since 2022 who made a mistake and bought the wrong house be motivated to sell? Not unless they can buy something at least equal or better – the ego can’t take a step down, so they may just refi to a lower rate instead.

But those who already own a house here will appreciate it even more, because once they look around, they will realize that their existing home will have to last them forever – they’re not moving!

This will always be the first thing that pops into my head when I see Gundlach:

https://www.reuters.com/article/world/uk/sex-drugs-and-porn-barred-from-jeffrey-gundlach-trial-idUSTRE76L08V/

He did come out victorious:

https://www.mto.com/news/headlines/2024/munger-tolles-olson-successfully-defends-doubleline-capital-and-its-founder-against-500-million-securities-lawsuit/

Not Hotel Del but $350/day gets you a nice suite at a fancy Gaslamp Hotel. And the unspent down payment kicks off $200/day of that cost. Oh and there’s always renting out for even more cash flow.

Your assessment is spot on. Exactly how I see the market going.

But I’d also add that we’ve hit an upper level plateau on pricing for a while. The coasts are always different but in cities like Denver price cuts are becoming the norm. Also if a certain presidential candidate is elected and starts cutting back on spending it will slow down inflation even if interest rates are low.

Here’s another potential issue…

https://www.cbs8.com/article/news/local/san-diego-top-for-homes-bought-by-investors/509-759b8e51-fafb-41f7-aced-e89da57670d1

“Study shows nearly a quarter of single-family homes in San Diego County were purchased by investors”

On the investor article. The investors are mostly taking advantage of the estate sales and cashing out the heirs who can’t wait to get their grubby little hands on the money. There is very little impact if any on our north county coastal region. Tom has one now in Carlsbad for which he paid $1,050,000, but that’s about all:

https://www.compass.com/listing/4980-via-marta-carlsbad-ca-92008/1663145031362183225/?origin=listing_page&origin_type=copy_url&agent_id=5b51d51d9474a8364b9a8353

Furthermore, I don’t trust the source. They have been lying scumbags since the day they opened and their “studies” can’t be deemed reliable as a result.

Their disclaimer (most retirees will take title in a trust):

For this analysis, we looked at county sale records for homes purchased from January 2000 through June 2024. We define an investor as any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.

Hat tip to you and the others who sent in the article though!

I appreciate the feedback reguarding the details about how they’re calculating what an “investor” is.

It does seem odd to just assume LLC = investor.