During the Yahoo Finance Invest Conference, Meredith Whitney, who accurately predicted the 2008 financial crisis and became known as “the Oracle of Wall Street,” said that housing prices will fall in 2024 due to a “silver tsunami” of baby boomers who are expected to downsize in the coming years.

More than 30 million units of housing are expected to be brought onto the market as 51% of people over 50, who own more than 70% of U.S. homes, downsize to smaller homes.

It’s been a challenging time for hopeful homebuyers amid soaring prices and mortgage rates, but a little bit of good news might be around the corner.

Highlighting estimates from AARP, Whitney said that over 51% of individuals aged 50 and above, who own more than 70% of U.S. homes, are projected to move into smaller residences. This downsizing trend could result in over 30 million units of housing being brought onto the market.

Every year another expert rages on about the silver tsunami, mostly based on antiquated beliefs that seniors will all downsize – but it’s different now, especially around San Diego.

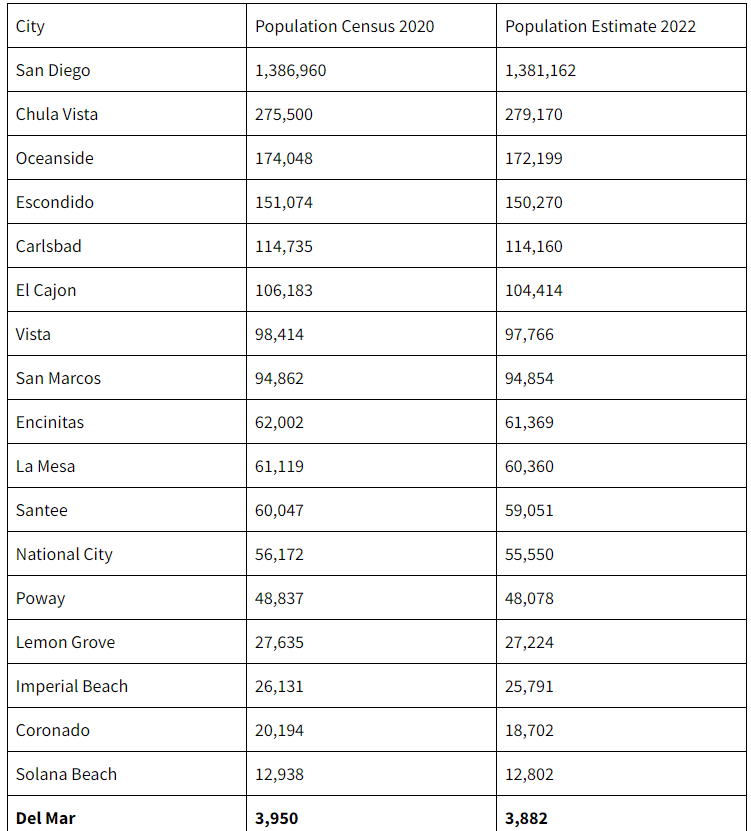

If seniors are downsizing, they need to leave town to make it worth moving. Here’s how the local populations have changed in a recent 2-year period – it’s hardly been an exodus, and it also suggests that there are new incoming residents who are filling the gap:

Comment> “Meredith Whitney, who accurately predicted the 2008 financial crisis and became known as “the Oracle of Wall Street,” said that housing prices will fall in 2024 due to a “silver tsunami” of baby boomers who are expected to downsize in the coming years.”

Ummm, she didn’t “predict” 2008. When she did predict, in 2013, she was wrong. She’s wrong now as well. There’s more truth to the phrase “hoard of silver” than any divestment barring economic upheaval. And as I keep stressing, technology will keep people alive, more active longer than any actuarial table can predict.

To assist with her prognosis ability, here is her recent experience to enrich her awareness of the housing market:

NEW YORK, April 28, 2021 /PRNewswire/ — Kindbody, a high-growth health and technology company, today announced Meredith Whitney as its Chief Financial Officer and newest addition to its female-led executive team. Whitney joins Kindbody as a seasoned leader with a long and illustrious career in finance, having shattered the glass ceiling during her time on Wall Street.

Whitney has been one of the most visible female analysts on Wall Street, earning recognition from Fortune Magazine as one of the “50 Most Powerful Women” (2008 – 2013) and from Time Magazine as one of the “100 Most Influential People in the World” (2009). She is revered for predicting Citibank’s need to raise capital in October 2007, a forecast which ultimately proved to be correct and was widely recognized as an opening event for the global financial crisis.

Kindbody, a fertility and family-building provider and benefit solution, welcomes Whitney at an exciting time in its growth trajectory. Having raised $64 million in funding to date and in market for its Series C, the Company expects to own and operate 42 Kindbody locations by the end of 2023, with a robust telehealth platform, mobile pop-ups, and 300+ partner clinics nationwide.

Whitney’s decision to join Kindbody is motivated by her belief in the Company’s mission and vision. “It is not every day you get a chance to join a company like Kindbody,” said Whitney. “This is a deeply personal issue for me and many of my female colleagues. I imagine many of us would have stayed on Wall Street if Kindbody’s services had been readily available. Kindbody is positioned to elevate women across industries and meaningfully impact retention and diversity in the workplace.”

Whitney most recently served as CFO of Zume, a SoftBank-backed technology company, where she built the accounting and financial reporting platform, spearheaded M&A, and was instrumental in the Company’s fundraising. Prior to Zume, she served as SVP at Arch Insurance Group, the world’s largest mortgage insurer. Whitney’s experience as a dynamic, data-driven, and highly quantitative CFO will enable Kindbody to accelerate its already rapid growth.

“Meredith is a rare leader who has the right skill set and experience to propel Kindbody’s exciting path forward,” said Gina Bartasi, Founder and CEO of Kindbody. “The fact that Meredith achieved such success on Wall Street as a woman is all the more impressive. Empowered women empower women, and we are making a conscious effort to advance that thinking as we deliver best-in-class women’s health and fertility care.”

Kindbody combines full-service care with accessible pricing and welcoming spaces for women, couples, and the LGBTQ+ community, offering fertility services (including IVF, egg freezing, and third-party reproduction), as well as gynecology, nutrition, mental health, and pre and postpartum care. In addition to its own brick-and-mortar locations and comprehensive virtual suite of services, Kindbody utilizes a robust network of partner clinics, to ensure no gaps in coverage for the patients and employers it serves.

In addition to its executive team, Kindbody has a female-led board of directors, including Ellen Hukkelhoven, Managing Director at Perceptive Advisors, Kindbody’s largest institutional shareholder. “This is an amazing group of strong, humble, hard-working, and committed women who are capable of rapidly scaling a highly successful and valuable company,” said Hukkelhoven.

Kindbody’s current investors include Perceptive Advisors, GV (formerly Google Ventures), RRE Capital, Rock Springs Capital, Claritas Capital and TQ Ventures. That list is expected to grow as the Company raises its Series C round. Whitney’s deep relationships on Wall Street will benefit the Company as it completes its fundraise and in preparation for a potential public listing, which could come sooner rather than later given the Company’s rapid pace of growth.

Whitney joins a team of other industry veterans at Kindbody, including Founder and CEO Gina Bartasi, a seasoned entrepreneur with 20+ years of experience in healthtech and the founder of Progyny, President Annbeth Eschbach, previously the Founder and CEO of Exhale Spa, Chief Medical Officer, Dr. Lynn Westphal, previously at Stanford Fertility, Chief Commercial Officer Cindy Gentry, an industry veteran from Mercer, and Founding OB/GYN, Dr. Fahimeh Sasan, previously of Mount Sinai Health System in New York.

Is anybody keeping track of the ages of people moving in and out of areas? Maybe boomers selling homes in San Diego to downsize out of the area are being replaced by boomers selling homes and downsizing out of places like LA, San Francisco and Silicon Valley.

The Boomer Downsizing Tsunami is going to hit us about as hard as that devastating Pacific hurricane did a few months ago.

That’s not to say it’s going to be all sunshine and rainbows for the rest of the Roaring 20’s.

I totally agree. The doubters and doomers have been screaming for years all while the affluent flip them the bird and buy the house they want anyway.

> …while the affluent flip them the bird and buy the house(s) they want anyway.

Fixed that for ya.

Thanks! 😆