How prepared is the real estate market for unpredictable black swan events?

The 2008 financial crisis gets thrown onto the list, but it was a gray swan that was predictable – and widely discussed for 2-3 years in advance. Things could have been done to avert that crisis – like stopping Angelo from talking up Countrywide’s neg-am loans while he was quietly dumping $300,000,000+ in stocks.

The Hamas uprising in Israel will be considered a black swan event, and will likely capture the attention of everyone world-wide for the foreseeable future. It will be a distraction like the Persian Gulf War when watching rockets and missles was a major event on TV, or like the OJ trial.

Both of those events happened during some of the most difficult real estate markets, and that’s probably not a coincidence – major distractions can impact the market. But at least they were both of those were helped by being in a declining interest-rate environment.

In the low-inventory/unaffordability era, will the Israeli conflict be the last straw?

I think we can expect the rest of this year to be dormant – both buyers and sellers have to be looking for any reason to take a breather, and the Hamas massacre will provide a good reason to sit out the next three months. After 9/11, the local market rested for a few weeks but the conditions had been so red hot in 2001 that it got back on track quickly. But in 2001, the NSDCC median sales price was $570,000 and ez-qual mortgages were everywhere. This year, the MSP is $2,180,000 and getting a mortgage is miracle work.

I was hoping for 300+ NSDCC sales in 4Q2023, but now I think the count will be closer to 200 sales.

There will be buyers who really need to move, and/or they find the perfect house at the perfect price – which is no small feat. There will be sellers who need to sell and can’t wait until 2024 – or don’t want to take the chance on the market getting worse.

Will there be discounts?

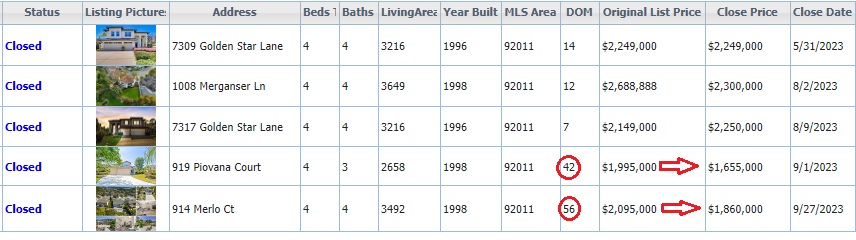

They have been in the works already. Here’s an example in the south end of Aviara:

The two on Golden Star were built by Davidson, but I’m not sure that will carry any gravitas with today’s buyers. As recently as last month, sales were closing for list price or higher, but look at the two that closed this month. I represented the buyers of Merlo Ct., and after the discount slide that started on Piovana – a house that was completely original and no effort was made to dress it up – we were able to continue at Merlo because it was the original owners who had paid $395,500 in 1998. They could afford a discount, and wanted to get on their way to the east coast.

There will probably be 5% to 10% discounts (or more) being negotiated – especially on the high-end. Any sellers still on the open market over the next 2-3 months must be motivated, and buyers are going to take advantage.

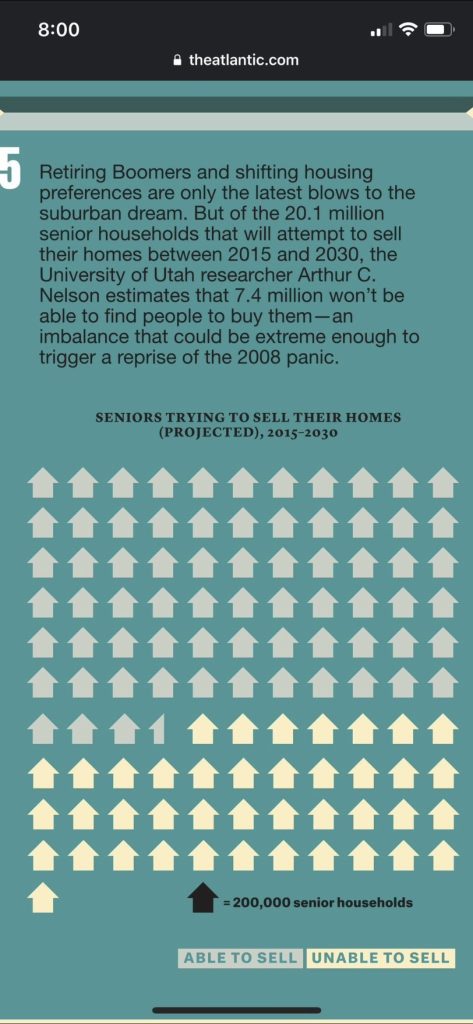

The social media won’t be helping either. This is another visual being sent around, but nobody mentions that the guy wrote it in 2013, and a lot has changed since then:

I suggested for years that boomer liquidations were inevitable, but I’ve given up hope. Seniors want to age in place, mostly due to the excessive cost of senior facilities. Between reverse mortgages and in-home care, more people can live out their life where they are most comfortable – at their long-time home.

Expect fewer homes for sale – and even fewer quality buys available. More buyers will be looking for a discount, but will have to lowball to get one. Just the fact that a home is on the market now is evidence enough that the sellers must be motivated – but they probably won’t reflect it much in their list price.

The first thing I saw on twitter today was a claim that Hamas guys are already in America, and we’re next. If they start bombing major cities in the USA, all bets are off about the real estate market.

Hamas has about 20,000 fighters. By next week it’ll be half that.

If they attacked here it’d be zero pretty quickly.