The experts say that the majority of homeowners are locked into their homes by their low mortgage rate, and if/when today’s high rates come down, then the inventory of homes for sale will bounce back.

Boy, are they going to be disappointed.

For the last 10-12 years, San Diegans have been buying their ‘forever home’, whether they knew it or not. They are locked into their home all right, and their low rate is only one of the reasons – with two other facts being more of a burden:

- Difficulty of finding a better home at a reasonable price.

- Capital-gains taxes in the six figures.

- Ultra-low mortgage rate.

If mortgage rates magically came back to the 3% to 4% range, would it make sellers shrug off the first two? If rates came down to the 2% to 3% range? They would still need a very good reason to move, and endure the first two problems.

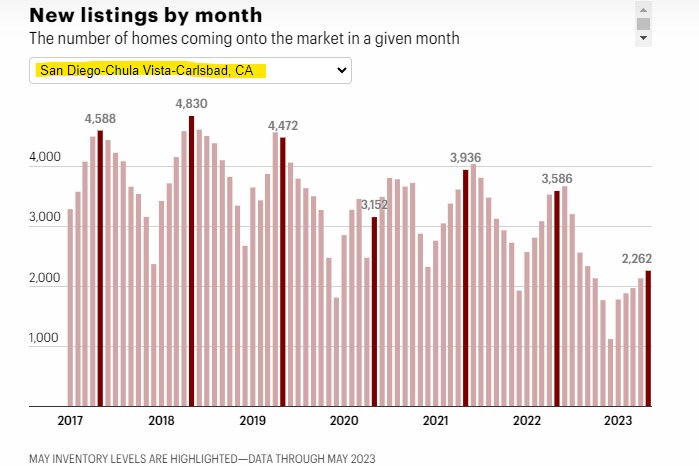

The low-inventory environment is here to stay.

$300K home equity loan for 30 years at 7.5% is a $2098/month. At 5%for 30 years is $1610/month. If you’re in a good neighborhood it’s going to make more sense to remodel rather than buying a different house that will most likely require additional remodel work also. In addition to paying more in interest on a new 30 year loan.

$300K remodel can really help make you love your existing home.

Agree – and homeowners who previously would have NEVER considered the hassle of remodeling will give it another look….before paying six-figures in taxes!

Let’s also add to my list the cost and difficulty of obtaining insurance on a new purchase in California! Might as well stay put where I can keep my existing policy that is less than half of what it would be a the next home.

Higher property taxes?