I disagreed with the expert opinions yesterday. What are they missing?

My thoughts:

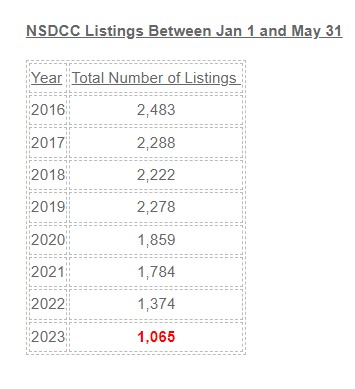

We cannot apply any previous assumptions or beliefs about real estate sales to the market conditions of today – we need to clean the slate. The discussion starts with how the number of people who are willing to sell their home has dropped significantly:

The Ultra-Low Inventory Causes More Volatility

A single one-off sale in La Costa Valley where a cash buyer paid 10% above the last model-match sale has caused a similar increase in other LCV sales. Now pricing is the same or higher than the first half of 2022 which was the peak of the pandemic frenzy.

But will it continue?

Can the current LCV homeowners count on those recent gains holding? Only if they use these recent sales for comps – and they are only good for six months. Buyers in 2024 and beyond will be reluctant to rely on comps that are 1+ years old.

Here’s where the volatility comes in to play. Without having a steady stream of LCV listings to continue the hot streak, we will be starting over each year. Sure, the sellers will use the comps from the previous year, but will the buyers? Will the sellers be satsified with getting the same price as the previous year, os insist on the usual 5% bump or more? Will they improve their home to deserve a premium price? Probably not, which means the buyers will be faced with paying more, for less. Not a good bet, because….

Mortgage Rates Are Going To Remain High

Mortgage rates don’t appear to have much chance of coming down this year. The Fed could raise further and kill any likelihood of rates getting back to 6%, let alone into the 5s, which means….

Home Pricing Will Be Flat

Generally-speaking, the overall pricing will most likely go back to the +/- 3% annually, which gives buyers a reason to pause. Without runaway prices that cause buyers to worry about getting in now before they are priced out forever, they have a reason to pause. They already have to wait patiently for another house to come up for sale, and if they don’t get the feeling that prices aren’t going up – they can, and will, wait for the next one. Might as well if prices aren’t going up much.

Seasonality Is Back

The knucklehaeds who think that housing has recovered are going to get a harsh reminder that real estate is seasonal – even in San Diego. Remember at the end of last year when I documented a few sales where the sellers were lowballed by more than 10% and they took it? It will happen again this year, which leads to…..

The Biggest Fear

Home sellers have had huge gains in equity, and if they have to give some back it won’t hurt much – and some will give more than others. A few low sales in the off-season will thwart the idea that comps from the first-half of the year are sustainable.

We’ve dodged the bullet this year – so far. Each year will be different!

Get Good Help!

When mortgage rates will reverse course is anyone’s guess, but we wanted experts to weigh in. Understanding where interest rates are headed can help homebuyers and homeowners alike better understand the options available to them.

“The Fed has recently signaled that it may forego a rate increase at its next meeting while it evaluates the effect its recent increases have had on inflation, but the market still expects the Fed to continue raising rates later this year,” says Peter Idziak, senior associate at Polunsky Beitel Green. “However, if the Fed stops raising because the data shows the economy weakening and inflation coming down further, then I would expect mortgage rates to decrease during the second half of 2023.”

Chief Economist at First American Financial Corp, Mark Fleming, says an interest rate drop may not happen for several months. “Possibly in 2024, but it will depend on the Fed’s decisions about raising rates in the second half of the year,” says Fleming. “And even if they do go down, it won’t be back to the rates of yesteryear. 6% mortgage rates used to be normal, and that’s more reasonable to expect too.”

Adam Sharif, founder and chief strategist of nxtCRE—a platform for commercial real estate investors—agrees. He adds, “If rates go down, it will be next year and not by much. Today’s interest rates are considered normal by historical measures.”

Inflation would slow down if gov wasnt spending like crazy to fight a war in another country.

Watch the stock market. Yes buyers have cash from previous real estate sales but many are flush with cash from stock sales and the equity markets are rallying currently. What will cause deflation in the real estate market? Perhaps deflation in all assets from an unknown event in the future. For now, buckle up and enjoy the ride. Economists are the only people that are paid to be wrong. And if they are wrong, they just make another prediction. Simply put, it’s supply and demand. We have about 2-3 times (or more) buyers than sellers. What will decrease buyers and what will increase sellers? Mortgage rates. Deposit rates. Equity markets. Unemployment. New construction or lack there of. Immigration and emigration to a particular area. It’s an unknown cocktail of events. Right now that cocktail tastes pretty good in North County San Diego. Fetch another round JTR and call me a taxi/Uber if I drink too much at the real estate bar. Don’t look a gift horse in the mouth.

> “We cannot apply any previous assumptions or beliefs about real estate sales to the market conditions of today – we need to clean the slate.”

Wise words. Excepting “location location location” there’s no similarities.

The biggest threat in California is intrusive governance. The State has effectively overridden local zoning and growth management. There are going to be some horrible development projects rammed through before municipalities regain some measure of control.

“Inflation would slow down if gov wasnt spending like crazy to fight a war in another country.”

We had 2% inflation for nearly two decades of fighting wars in two other countries, so you are just plain wrong.

“The Fed has recently signaled that it may forego a rate increase ”

No, it absolutely did not. This is a perpetual media and market delusion. Two other CB’s have already un-paused their own pause:

https://wolfstreet.com/2023/06/06/reserve-bank-of-australia-first-central-bank-to-pause-then-un-pause-hikes-again-warns-of-more-hikes-qt-continues/

https://wolfstreet.com/2023/06/07/the-bank-of-canada-un-pauses-hikes-25-basis-points-second-central-bank-to-un-pause-on-resurging-inflation-fears/

I believe humans are terrible at predicting the future, especially when predicting things to their own benefit. Nevertheless, I predict the Fed will not pause but will raise again at the next meeting. I also predict 12% mortgage rates before we are done.