As you can see in my mortgage-rate tracker (in right column), we had another meltdown today, and the conforming rate now is over 6% (with no points).

The idea of paying higher prices AND rates really discourages the move-up/move-down markets. Combined those with having to pay federal and state capital-gains taxes and the existing homeowners aren’t going to give moving another thought. They probably weren’t giving it much thought any way! And now they might have to sell their home for less? Forgetaboutit!

While most will be (rightfully) concerned about how the buyer pool could dry up, also keep in mind that for every move-up/move-down homeowner that decides not to move, the supply side shrinks a little more too.

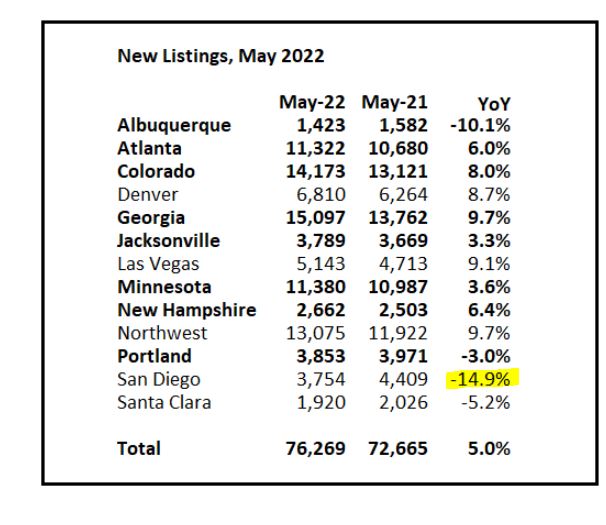

Bill added more towns to this list, and it keeps showing how San Diego is bucking the national trend:

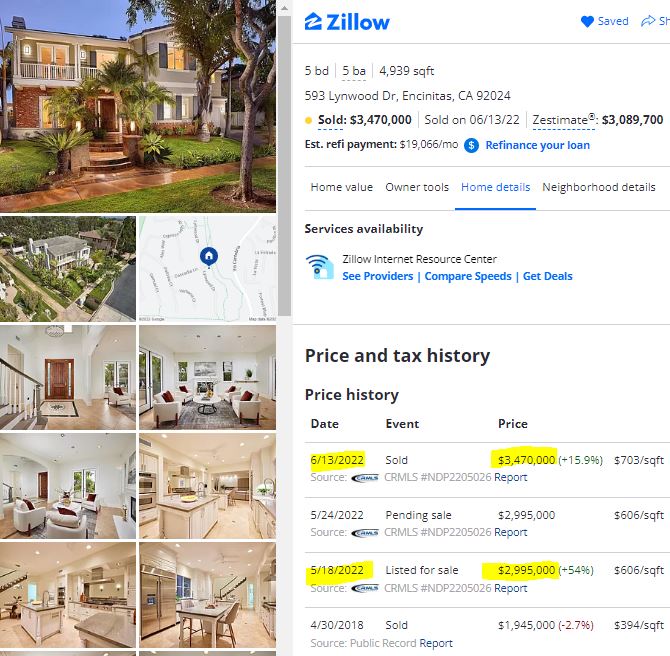

We’ve had enough buyers who NEED a house that sales will keep happening, regardless of mortgage rates. I’m sure buyers are hoping to just pay the list price, or less, to compensate.

Yet, after rates got into the 5s and several ER sales closed for less, here’s another over-list:

Mortgage Rates spiking above 6%, this is why home buyers have been paying $100k’s over list for the past 3 years. Locking in a sub-3% 30-yr mortgage in prime coastal SD county real estate was the chance of a lifetime. That opportunity has now evaporated, except for ARMs, and coastal SD county will become a fortress; owners have no incentive to sell if they’re holding a low interest mortgage in this environment. Some will cash out regardless for the typical reasons (death, divorce, etc.), but I’d expect ultra-low inventory here for years to come.

It could dry up like a peach seed!

Yes, mortgage rates really moved above 6% yesterday for the first time since 2008. Yesterday’s coverage addressed the core of the matter (definitely read that one here if you haven’t already). Today was just an addendum by comparison, but an unpleasant one in which rates moved even higher into the 6% range.

The average lender is quoting top tier 30yr fixed rates in the 6.25-6.375% range, but as we discussed yesterday, it’s cheaper than normal to buy one’s rate down. That means rates in the high 5’s are still being quoted, but those quotes imply higher upfront costs (aka “points”).

There were no new market movers in play in terms of data or events. A case could be made that this morning’s producer-level inflation data wasn’t reassuring enough to counteract last Friday’s consumer-level data, but rates were likely doomed from the start as traders increasingly got in defensive positions ahead of tomorrow’s Fed announcement.

Ultimately, the fate of the current trend will be determined by the Fed tomorrow–at least in the short term. There are several avenues through which the Fed could surprise the market, but it’s worth noting that some of those surprises could be good for rates as well. Either way, expect a substantial amount of volatility tomorrow afternoon starting at 2pm.