The big concern for long-time homeowners today is having to pay capital-gains tax on the net profit that’s ABOVE the exempted $500,000 for married couples. While the 2-out-of-5-year rule that was passed in 1997 is due for some adjusting, there haven’t been any indications that the politicians will re-visit the issue.

What can homeowners do to minimize the tax owed?

- Document Your Expenses. All home improvements (not repairs) and closing costs are added to your home’s cost basis (purchase price), which help to minimize the taxable gain.

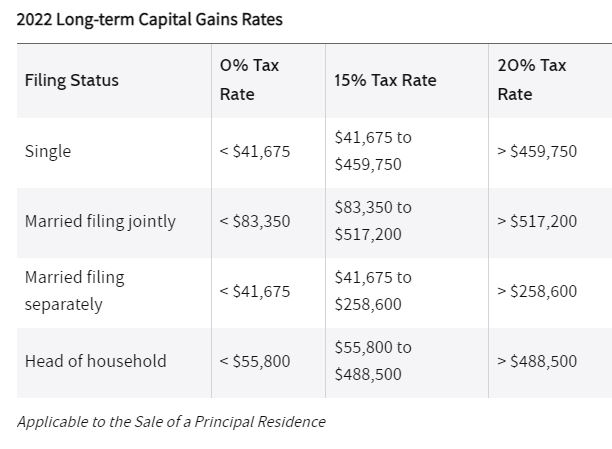

- Carry the Financing. Have a big equity position and don’t need all the money? Take payments from the buyer over time, instead of receiving all the cash at closing. Require a big down payment so you would receive a nice chunk up front, and then collect on a 5% mortgage over the next 5-10 years. You only pay tax on the money received, so structure it so you drop down into the 15% tax bracket for the first year:

- Rent it out for a year and do a 1031 Exchange. After renting your home out for a year, you could trade it for another rental property and postpone the capital-gains tax indefinitely. You have to rent out the new home too for at least a year before occupying as your residence, so it is a 2+ year project – but hey, no tax! If you don’t need to live there, another alternative is to buy a property in an ‘opportunity zone’. Investors begin to enjoy a step up in basis after 5 years. After 10 years, the gains become tax-free!

- Offset with capital losses from elsewhere. Business and stock losses can be included in the same tax return to offset the capital gains.

- Move every time your net gain rises up to $500,000. You may have to take a hit this time, but to avoid having to pay capital-gains tax again in the future, move more often. 🙂

- Dying correctly. The burden of being the remaining spouse after a full life together can be devastating, but at least he/she will have the cost basis increased to the home’s value on the day of death – with no capital-gains tax owed. Make sure to have your family trust named as owner of the home.

- Wait until your home’s value goes down. This isn’t likely to happen, so focus on 1-6 above!

Virtually every long-time homeowner has seen their equity rise enough in the last 12 months to cover their tax exposure, and didn’t that feel like free money? Instead of fretting over having to pay the government, just enjoy the ample amount left over – you made more than they did! Or utilize the tips above.

Check with your tax preparer for more details.

If I rent out my home for a year and do a 1031 exchange into another rental property and I do this within two years of occupying my house can I also get the $500k tax exclusion for my wife and I kind of like double dipping?

No, you have to own the second house for five years, then sell and get the $500,000 tax free. Time goes by quickly though!

“Dying Correctly” means to have your affairs in order with a trust that is up-to-date and is named as owner of the home(s).

Dear Liz: We’re retired and living in California. We are planning on selling our home, which is paid for, and moving to Tennessee in a couple of years. I think we qualify for a “one time” capital gains exemption. Our home is worth over $1 million and we only paid $98,000 in 1978. We plan on buying a home in Tennessee for around $800,000. Will we have to pay capital gains?

Answer: Before 1997, a homeowner could defer paying taxes on home sale gains as long as they rolled the proceeds into the purchase of another home of equal or greater value. In addition, there was a one-time exclusion for homeowners over age 55, who could exclude up to $125,000 in home sale gains.

Those rules were replaced in 1997 with the current law. Now homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, as long as they’ve owned and lived in the house for at least two of the previous five years. As a married couple, you can exclude up to $500,000 of gain — but that still leaves you with more than $400,000 of potential capital gains.

The capital gains calculation doesn’t factor in whether you have a mortgage or the value of your replacement home. However, you can use the value of home improvements you’ve made over the years to reduce your taxable gain — assuming you kept those receipts.

The IRS defines home improvements as expenses that add to the value of your home, prolong its useful life, or adapt it to new uses. Examples would include additions (bedrooms, bathrooms, decks, garages, etc.), heating or air conditioning systems, plumbing upgrades, kitchen remodels and landscaping, among other costs. Improvements don’t include maintenance required to keep your home in good condition, such as painting, fixing leaks or repairing broken hardware, or improvements that are later taken out. If you put wall-to-wall carpeting and then removed it to install hardwood floors, only the cost of the hardwood floors would count.

Many of the costs you incur to sell the home, such as real estate agent commissions and notary fees, also can be used to reduce the capital gain. You can find more details in IRS Publication 523, Selling Your Home.

A big home sale gain can affect other areas of your finances, such as your Medicare premiums, and may require you to pay quarterly estimated taxes. Consider talking to a tax pro before the sale so you know what to expect.

There are lawsuits underway that will probably result in buyers having to pay their agent for services, instead of those commissions being paid by the sellers.

Here is today’s hilarious comment – from a watchdog agency:

“If sellers no longer paid buyer agent commissions, buyers would benefit from lower sale prices.”

“Furthermore, it is highly likely that buyers could finance buyer agent commissions in their mortgages. The mortgage lending and Realtor industries have the political clout to remove any related regulatory barriers, and they would likely face no political opposition in doing so.”

CFA’s report recommended that buyers ask for rebates. While “a few agents advertise their willingness to do so, other agents will do so if asked, and the more home buyers request rebates the more willing the entire industry will be to provide them,” the report said.

Jim, I just check with my tax attorney and he said yes I can do a 1031 and do the $500,000 exclusion.

I’m wondering if the new ADU laws can be argued to be a stepped up basis. You bought a SFR and now find yourself with a potentially dual-unit property.

Jim, I just check with my tax attorney and he said yes I can do a 1031 and do the $500,000 exclusion.

Tob, Can you add more detail? Is the $500,000 exclusion on the first house, or second house?

Too bad you can’t sell 1/2 of your house like stock positions. I like #7. Hey if the market goes down far enough you won’t pay any capital gains tax. Lol

Great article Jim!

oooof!!! Grandma is going to get hit hard this year.

8. Reduce income in the year you want to sell your house and pay no capital gains tax whatsoever.

Thanks Liz K!

Doesn’t the net profit from the sale of your primary residence get added into your 1040 before the taxes are calculated? I don’t know, and scouring the internet and 1040s doesn’t provide a clear conclusion.

Are you an accountant by chance?

It is smart to pack any losses into the same tax return to offset the gain!

I’m a biologist, Jim.

No idea how to file tax returns, but love reading about real estate.