A reader on Twitter wondered how rising rates will affect the 2022 frenzy.

Here’s what is expected today:

Under Chair Jerome Powell, the Federal Reserve is poised this week to execute a sharp turn toward tighter interest-rate policies with inflation accelerating and unemployment falling faster than expected.

The Fed today will likely announce that it will reduce its monthly bond purchases at twice the rate that Powell had outlined just six weeks ago. Those bond purchases are intended to lower longer-term rates, so winding them down more quickly — likely by early spring — will lessen some of the economic aid the Fed supplied after the pandemic erupted last year.

Fed officials are also expected to forecast that they will raise their benchmark short-term rate, which has been pegged near zero since March 2020, two or three times next year. Rate hikes would, in turn, increase a wide range of borrowing costs, including for mortgages, credit cards and some business loans. Just three months ago, the Fed had penciled in barely one rate increase in 2022.

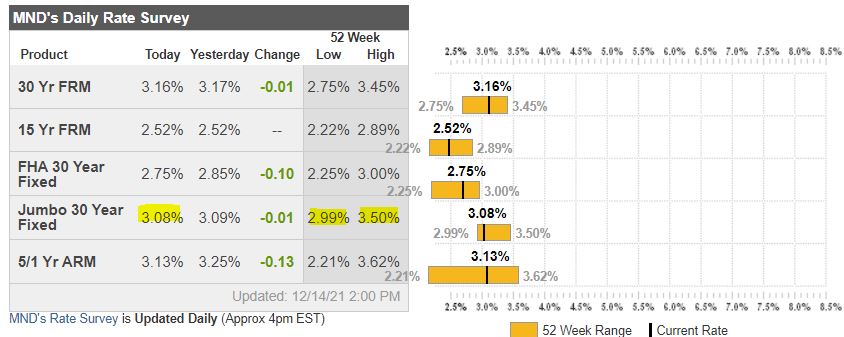

Let’s note where the mortgage rates are today:

Some of the Fed hike might already be priced in, but these rates are still very attractive. I think that any rate starting with a 3 will be attractive to buyers.

But let’s consider the history. Any time rates threaten to go up, or actually do start to rise, it causes buyers to hurry up and find a house – just to be able to lock in a lower rate. It means that we could be heading for the Ultra-Peak Frenzy, where rising rates actually create MORE frenzy!

Buyers who think sellers should lower their price to compensate for higher rates will be in for a long wait. Sellers won’t believe it, and unless they are desperate (which very few are), they will blame the market/rates/agent before considering a lower price. Many will try over and over again, and it might take them 2-3 selling seasons before they succumb.

Would rising rates cause more sellers to hurry up? Doubtful, but I hope so! It would be great just to get back to normal inventory (which is about double where it has been during the last half of 2021).

Just released by the Fed – no rate change yet:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but continue to be affected by COVID-19. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment. In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency mortgage‑backed securities by at least $20 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

Implementation Note issued December 15, 2021

If only inflation were within their wheelhouse. [/snark]

anyone buying in SD county at current market prices is not concerned with 0.5 – 1.0% increase in rates.

Mortgage Rates Only Modestly Higher After Fed Announcement

Dec 15 2021, 4:25PM

Mortgage rates were fairly flat heading into today’s important Fed announcement. Despite arguably receiving bad news, they didn’t move too much higher by the end of the day.

What was the bad news?

In short, the Fed is doubling the pace of “tapering.” That means it will be reducing the amount of bonds it has been buying twice as quickly. Those bond purchases are generally associated with lower rates although the financial market tends to move well in advance of this type of policy change because the Fed tends to telegraph it quite well. Indeed, if there’s one reason that rates didn’t freak out today, that would be it. The writing has been on the wall for more than 2 weeks now.

The movement in rates was small enough that the average borrower will still be seeing the same rate quotes as yesterday in terms of the “note rate.” The only difference would be slightly higher upfront costs. The average lender remains in 3.125-3.25% territory for top tier conventional 30yr fixed scenarios.

After implementing the tapering plan 6 short weeks ago, the Fed quickly found itself in a position to accelerate the pace of reductions. This was probably going to take the form of 100% increase, but there was some small chance it would be smaller. The Fed opted for the 100% increase and bonds reacted logically considering the widespread expectations.

In other words, despite the seemingly traumatic news, there was only a modest mount of weakness to endure because it was fairly well priced in.

Mortgage rates have been ridiculously low for a long time. Of course, you can’t get interest income on the other side of the equation either (bank accounts, CD’s, etc.).

When I bought my first house in 1984, the interest rate on the loan was 13.5%. However, I got pretty good at refinancing as rates gradually came down.