Zillow has been vilified for many reasons, but the one thing they have going for them is the viewer data for each area. If their 2022 projections are based on the number of clicks on listings, then their forecast should be a reasonable reflection of the actual demand – a macro look that no one else has.

The Big Question: if they are so confident about the 2022 appreciation, why did they quit home flipping?

Their first move of suspending the program until next year while digesting their inventory was understandable. But why quit altogether? I think it was due to having billions invested in a high-overhead venture that was new to them – and the rich guys hit the panic button, instead of calling me.

I’m sticking with my 2022 NSDCC Pricing Guess of +15%, and agree with Zillow that most areas could see +20%. But this frenzy is going to come to a screeching halt with no notice (they always do), and it will be when you least expect it.

P.S. ALL of their forecasted value increases here are higher than last month:

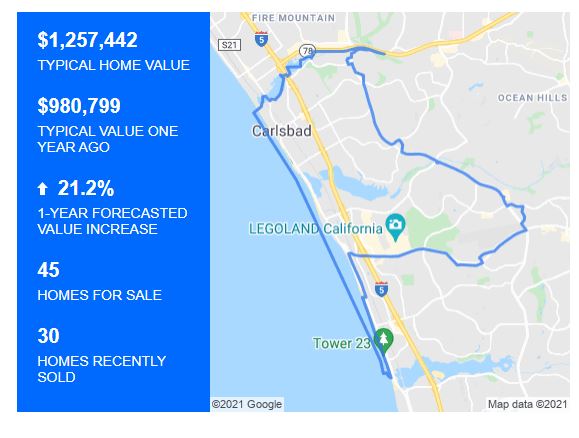

NW Carlsbad, 92008:

SE Carlsbad, 92009:

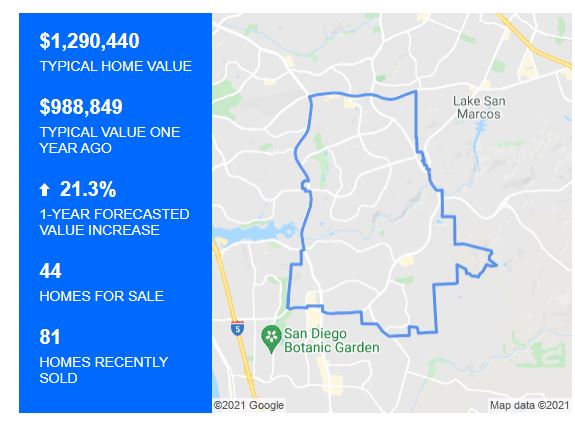

NE Carlsbad, 92010:

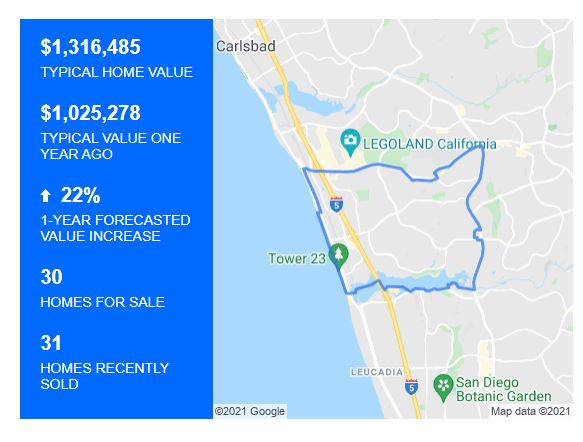

SW Carlsbad, 92011:

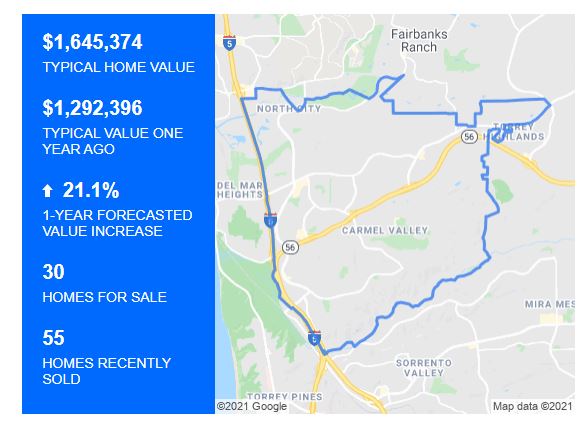

Carmel Valley, 92130:

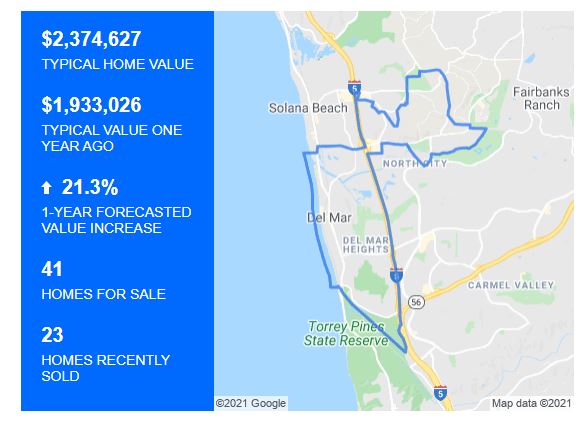

Del Mar, 92014:

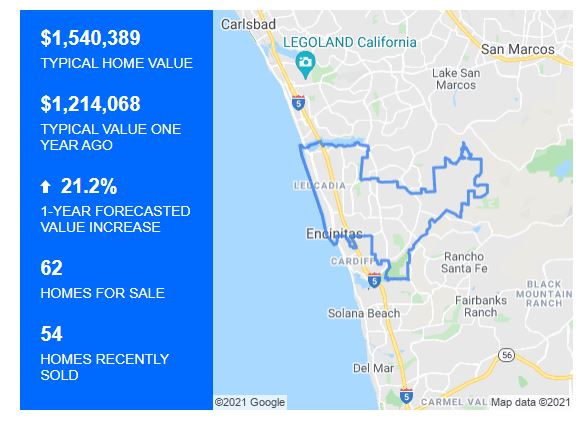

Encinitas, 92024:

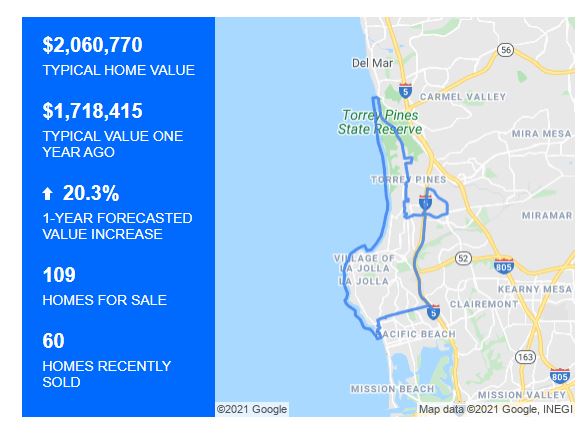

La Jolla, 92037:

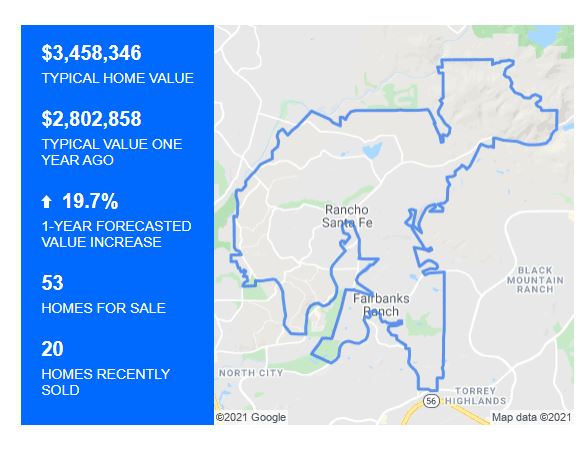

Rancho Santa Fe, 92067:

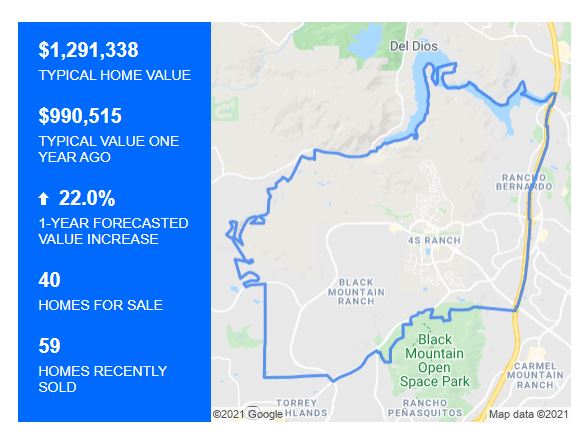

Santaluz/Crosby/4S, 92127:

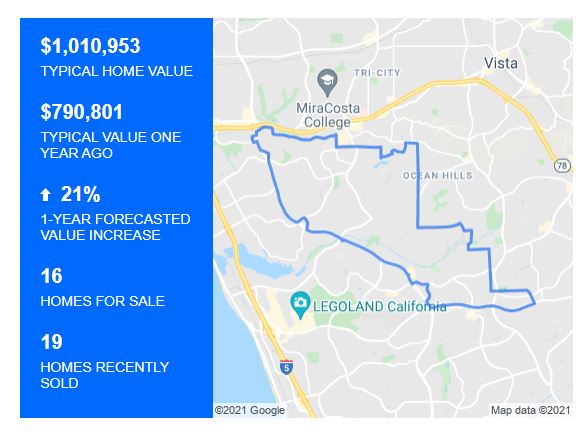

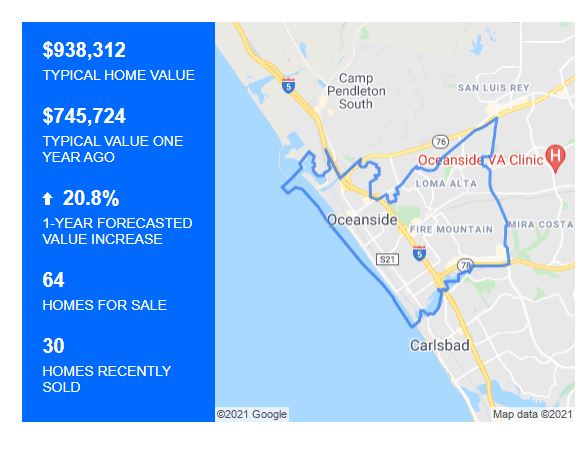

Coastal Oceanside, 92054:

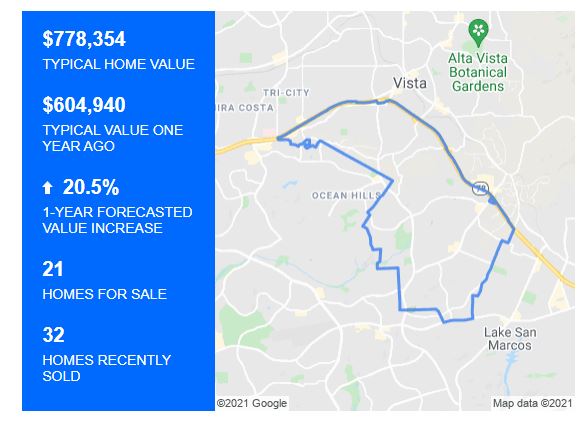

S. Vista, 92081:

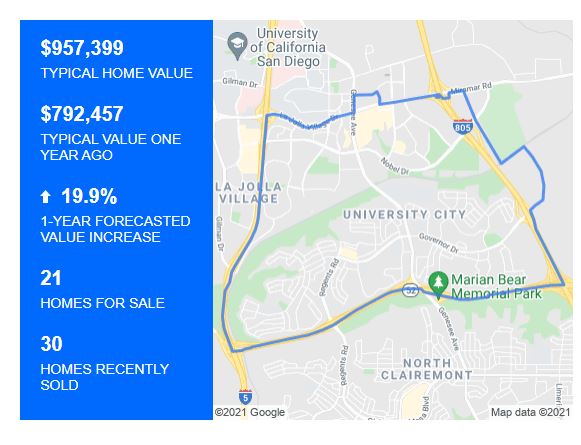

University City, 92122:

The additional last four areas show how overwhelming the demand is for all of north county.

The National Association of Realtors® (NAR), holding its annual conference in San Diego, heard from chief economist Lawrence Yun about the prospects for residential real estate in 2022. Yun told NAR members that the market, which performed exceptionally well during the height of the pandemic, continues to be promising.

“All markets are seeing strong conditions and home sales are the best they have been in 15 years, Yun said. “The housing sector’s success will continue, but I don’t expect next year’s performance to exceed this year’s.” As of the September existing home sales report, those sales were on-track to end that year at 6.29 million transactions. Yun expects 2022 to fall 1.7 percent below the final 2021 totals.

Yun says one unknown for the coming year is how remote work opportunities will play out. “We are only in the first innings of work-from-home options,” he said. “People have not fully digested the work-from-home-flexibility model yet in determining home size and locational choice.” He advised the industry to keep this factor in mind.

Yun said even though there may be a decline in sales in 2022, he still forecasts home sales will outdo pre-pandemic levels. His prediction, he noted, is based on an anticipation of more inventory in the coming months. That supply will be generated, in part, from new housing construction – already underway – as well as from the conclusion of the mortgage forbearance program, which in turn will cause a number of homeowners to sell.

“With more housing inventory to hit the market, the intense multiple offers will start to ease,” Yun said. “Home prices will continue to rise but at a slower pace.” He did not provide a projection for prices.

Looking at the economy as a whole, Yun said that the job market, which naturally struggled during the pandemic, has turned a corner and continues to make incremental progress. Since the nation emerged from lockdown, 18 million jobs have been created and the 4.6 percent Yet some areas in the nation are thriving and are already fully recovered. He pointed to Idaho and Utah which both report having more jobs now than the beginning of the pandemic.

Yun projected that mortgage rates, which are currently at 3.0 percent, will see an increase of 3.7 percent in the coming months, a rise he attributes to persistent high inflation. Home prices rose by 12 percent on average in 2020 and 2021 while inflation rose 3 percent.

“Rising rents will continue to place upward pressures on inflation,” he said. “Nevertheless, real estate is a great hedge against inflation.”

How did Cardiff do? I imagine 21%, just curious about the values.