Long-time homeowners who can keep their taxable income lower and pay off their house don’t find California that much more expensive (based on how few are moving). Excerpted from this article:

https://finance.yahoo.com/news/why-rich-people-leaving-california-isnt-what-you-think-130327533.html

In short, California and San Francisco in particular, has always been off-kilter and difficult, but at the same time remarkable and inspiring. (Maybe what’s different now is just that there’s more money.)

There’s a camp that downplays this recent exodus, arguing for one thing, that there are no hard numbers to measure the scale or import of people leaving.

“I feel like it’s too early to know, and anybody who claims they know for sure is doing that based purely on anecdote,” says Molly Turner, a professor at UC Berkeley’s Haas School of Business focused on tech and urban policy, who co-hosts the podcast “Technopolis.” “My gut tells me it’s mostly just a couple of loud people leaving and throwing a tantrum on the way out. I don’t think it will have a significant impact on the Bay Area as the global center of the tech industry.”

OK, that’s the gut, but what does a moving guy say? “Typically in years past [moving jobs have] been about 50% outbound, 50% inbound,” says Steve Komorous, who since 1988 has co-owned King Relocation Services, a moving agency in Los Angeles, California. “In 2020, it was 59% outbound, 41% inbound.”

Is that imbalance the biggest Komorous has ever seen? “I think that’s going too far,” he says. “I’ve been in this business since 1982. There have been big, funky years. This cycle of the mad dash leaving California, that will subside. It may take another year or so. It’s just a cycle.”

Another point, many companies leaving nowadays aren’t exactly highfliers. They’re mature businesses growing through price increases, cost cutting, outsourcing or by buying smaller companies rather than through innovating. “The Bay Area still has Google, Apple, Facebook, Salesforce, Genentech, Airbnb, Twilio, etc.,” says Turner of Berkeley. “The biggest tech companies in the world are still headquartered here and expanding here.” (Plus, there’s Turner’s university and Stanford.)

Dee Dee Myers, former press secretary for former President Bill Clinton, hired in December to head Gov. Gavin Newsom’s business and economic development office, agrees the exodus is overstated, but with some caveats. “Every few years, somebody writes ‘California is over,’ ‘Silicon Valley is over,’ ‘the tech boom is over,’ — there’s always some reason,” she says. “It always ends up not being true. There are too many big pieces in place here that make this a big place to live and do business.” But she adds, “The cost of living is high. There are some challenges to being in a place where a lot of people want to live. We need to continue to try to address the challenges that come with the incredible assets we have. We can’t rest on our laurels.”

That’s for sure because that aforementioned laundry list of issues is very real. You could write a book about each one: fires, homelessness, and what people consider political correctness. (“You hear that teachers are teaching our kids that we’re evil,” a Silicon Valley executive told me.)

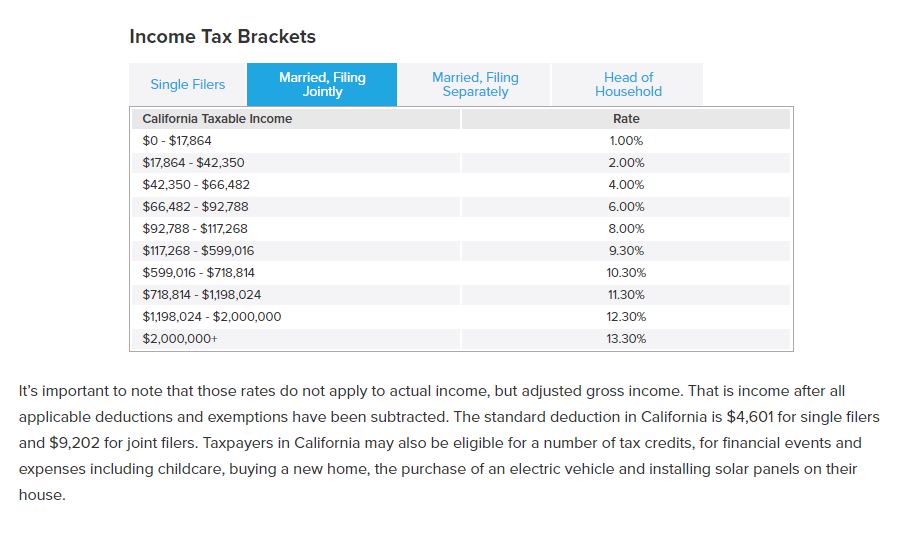

But let’s just drill down and take a quick look at taxes in California because they are eye-popping. First, California has the highest marginal tax rate in the country, 13.3% for income over $1 million. Not surprisingly then, it’s estimated that California’s top 1% of income earners already pay most of the state’s personal income tax revenue, some 46%. (These are ultra-rich people mind you.) On the other hand Proposition 13 caps property taxes: “Annual valuation increases for locally assessed property are capped at the lesser of the inflation rate or 2%, and the tax rate cannot exceed 1% of the property’s assessed value,” according to KPMG.

Then there are proposed taxes, like a corporate tax which would fund solutions for homelessness. And another so-called “Hotel California” tax, where any person who stayed in the state for more than 60 days in a year would be subject to California tax for the next decade. (Get it? “You can check out anytime you like, but you can never leave.”) And now a new bill calls for hiking the top rate to 16.8% and adding a 0.4% wealth tax (which if approved would be the nation’s first.) The wealth tax would be levied “on all net worth above $30 million,” and would apply to some 30,400 residents and raise $7.5 billion,” the bill’s authors say.

(Also remember thanks to Donald Trump’s tax reform which targeted high-tax blue states, read California and New York, state and local tax deductions are capped at $10,000.)

Myers says talk of new taxes is just that. Talk. “The governor has no intention of raising personal income rates or creating some kind of wealth tax,” she says. “[He’s] not interested in increasing corporate taxes. It’s not going to happen.”

For those Californians who want to move to avoid taxes, they better really mean it. Tax experts point to a lengthy checklist in order to prove you no longer really live in California, including which state issues your driver’s license, and where your dentist is located.

“I am concerned for California,” says Sandy Murray, a partner and private client services co-leader at the San Francisco accounting firm BPM, who’s done accounting for wealthy people in California for more than 30 years. “More people have left in the past six months than ever in my career. It’s always been a theoretical conversation for clients—should I break domicile? Now it’s become an actionable conversation. I see a snowball effect. When one guy moves and talks about it, then I get a call from three colleagues at the same company. If only a small percentage of those folks move, it’s a huge tax base that moves.”

I understand people complaining about huge taxes, but the fortunes are pretty huge too. And more millionaires, never mind billionaires, are minted in California every quarter. Even No. 438 on the Bloomberg rich list, software CEO Tom Siebel, is worth a cool $6 billion. Speaking of Siebel, he recently spoke to our subject:

“I think every responsible chief executive officer has to consider moving their company out of California,” Siebel told the Silicon Valley Business Journal recently. “My family is here and I love California so, for now, we’re here. But there’s not a dinner party that I go to where I see yet another job creator—some of them among the greatest job creators in history—leaving the state and taking their employees with them.”

What will it take to stem the exodus? “You are going to have to have a business-friendly environment with a reasonable tax structure,” Siebel said.

Speaking of high profile people possibly leaving California, a knowledgeable source told me Marc Andreessen—Silicon Valley’s alpha male venture capitalist—is making noises about moving to Miami. When I emailed Andreessen to see if that was the case, I got back: “No word on Marc leaving CA.,” from Andreessen’s spokesperson.

Andreessen has deep ties to Silicon Valley through his investments and through his wife, Laura Arrillaga, who’s from Palo Alto, (her father, John Arrillaga, retired now, was one of the largest property developers in Silicon Valley.) Still, Andreessen may want to emulate his old Netscape running mate, Jim Clark, and move to Florida as he sells some of those big gains he’s made over the years.

And then there’s the political environment which Andreessen addressed back in 2017 when he said, “Silicon Valley is extremely left-wing, extremely liberal.” You wonder if our partisan environment has been bringing out their inner more Libertarian (dare I say neocon) in the likes of Andreessen, Larry Ellison and Elon Musk. It’s also a fact that as people get older and richer they often get more conservative.

As for their destinations, “it’s abundantly clear most of these tech executives who are leaving for other cities are in for a rude awakening,” says Turner of Berkeley. “They don’t know anything about the politics in these other cities. San Francisco may not have been as poorly managed as they thought it was.”

On that note, let’s check back in with one of our first movers, Jim Clark. Turns out that after a decade in Florida, Clark moved again. “I lived in Miami for 10 years. I got remarried. Once we had kids, I didn’t want them growing up in redneck Florida,” he says. Ah that.

Clark actually tried California again briefly, buying “an ordinary” $40 million home in Atherton. How did that work out? “It’s not the same anymore,” Clark says. “It was during the height of the unicorn thing and everyone thought they walked on water and were pitching me things like I was a gullible.” So Clark ultimately settled in New York City, establishing an irrevocable trust as a tax shelter.

Would he ever go back to California? “No,” he says. “There’s climate change, plus Facebook, Apple and Google have made everything so crowded and expensive, the real estate situation is out of control. And I’m a Democrat, but the Democrats there don’t fully get it. I love New York, but I do miss the technology conversations of the Bay Area.”

Lessons? How about some oldies but goodies. To wit: “The grass is always greener on the other side of the fence.” And, “you can’t have your cake and eat it too.”

Bottom line is yes, some more tech moguls and their companies will leave California, which as it turns out will be that state’s loss but America’s gain. “The silver lining is it’s probably going to distribute tech jobs to more cities across the country,” notes Turner of Berkeley. Sure Austin will become a big time tech hub and Seattle already is, but the Bay Area will remain the center of the nation’s tech industry. Like Myers says, there’s just too much going on there for it to be over. Having said that, California does need to get its act together.

By not moving, the baby boomers could really screw this up for the kids too. It’s looks like it will get worse too – and could go on for years! Empty nesters rattling around in the family homesteads while millennials stand in line 20-30 buyers deep to purchase the few homes for sale:

Phoenix Arizona saw the largest inflow of buyers in 2020 in the USA, just ahead of Dallas, Texas. Phoenix attracts many for its sunny weather, affordable housing options and low local taxes. It’s also a big attractor of retirees and with almost 9,000 US Babyboomers retiring every single day, this is destined to be a boomtown for quite some time! By 2030 all Babyboomers will be aged 65 and older…..that’s almost 72 million, and fewer than half have retired to date!

Let’s hope the CAP canal keeps flowing to keep Phoenix alive! Otherwise, things will get really expensive!

CAP goes to Tucson, not Phoenix. And yes, CAP will continue to flow. In the event of a break in the line, Tucson has stockpiled a decade of water. I think San Diego and Los Angeles are more worth debate when it comes to water crisis.

I think San Diego and Los Angeles are more worth debate when it comes to water crisis.

We got the Bud plant though! 🙂

https://www.carlsbaddesal.com/

I used to live in Phoenix and drove by the CAP canal every day.

https://www.phoenix.gov/waterservices/resourcesconservation/yourwater

At least California gets first dibs if Colorado river water comes to a water fight:

https://www.cap-az.com/departments/planning/colorado-river-programs/water-supply-and-water-rights