We hear the term, ‘tight inventory’. What does it mean?

Fewer homes for sale?

Fewer of the lower-priced homes for sale?

Homes selling faster?

The best buys are flying off the market in the first day or two?

NSDCC detached-home statistics for Jan 1st – Aug 15th:

| Year | ||||||

| 2016 | ||||||

| 2017 | ||||||

| 2018 | ||||||

| 2019 | ||||||

| 2020 | ||||||

| 20vs19 |

The average and median Days-On-Market metrics are within the normal range, so generally-speaking, homes aren’t selling faster than before.

We’ve had fewer homes for sale (-12% YoY), but sales are only down 8% which isn’t bad. The drop in sales between 2017 and 2018 was slightly more at 9% so we’ve endured this previously.

The overall volume is only down 0.4% YoY ($3,000,850,233 vs $2,988,471,818) – so those on commission (realtors, lenders, escrow, and title) shouldn’t be too concerned with ‘tight inventory’.

Who should be concerned?

Buyers on the lower-end of every market.

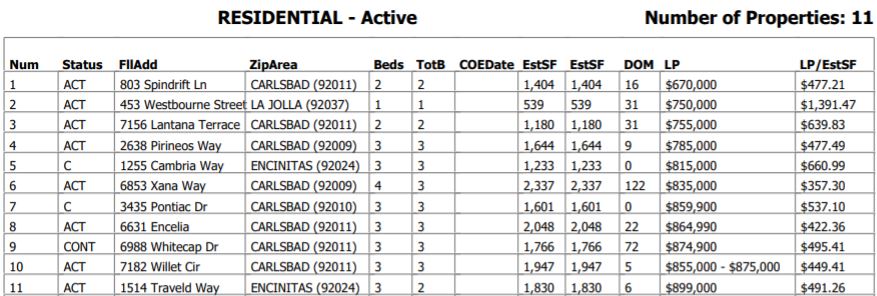

We have eleven NSDCC houses for sale priced under $900,000 (in an area of 300,000 people):

Two of those aren’t on the market yet (coming soon!), and a third has a contingent buyer.

Tight inventory = buyers are getting squeezed up on price.