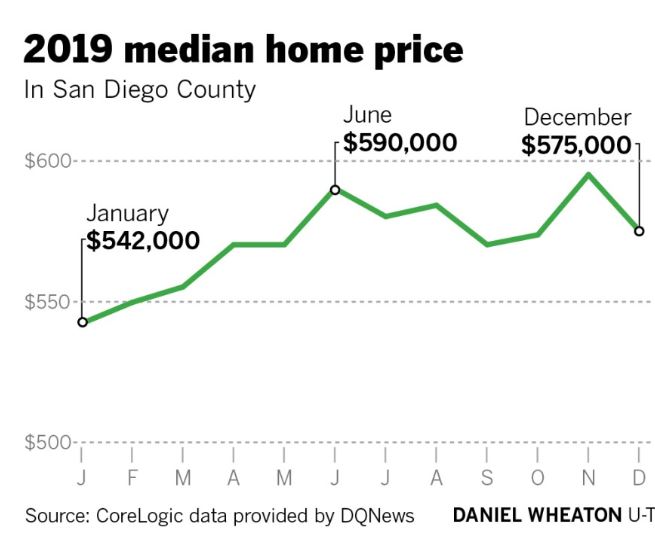

Like the San Diego Case-Shiller Index, the median sales price has been sputtering lately (above).

Homeowners didn’t have to make their mortgage payments before the coronavirus, and now they really don’t have to make them, so analysts who point to foreclosures are ill-informed. Let’s also note that the Dow was down 29%, but it has recovered nicely, and is only 9% lower than it was a year ago so down payments have been mostly restored. My guess is at the bottom.

Link to U-T articleHousing analysts are split so far if home prices will go up or down because of the coronavirus. It is especially difficult to figure out in highly desired areas like San Diego.

On one hand, inventory is still very low and that should keep prices competitive. But, a lot of people have lost jobs and it seems like fear of the virus would not be very inspiring to a potential buyer.

Q: The median home price in San Diego County was $587,000 in February. Will it be higher or lower by the end of the year (and why)?

Kelly Cunningham, San Diego Institute for Economic Research

HIGHER: Although sales are dropping dramatically, home prices will stay about the same. With few transactions and the housing market with much of the economy on pause, prices will not change much. The FHA directed mortgage servicers to put moratoriums on foreclosures and offer forbearance or reduced payments, which will also limit price reductions. Supply remaining at record lows, demand near all-time highs, low mortgage rates should bring the housing market back to where was prior to the pandemic.

Jamie Moraga, IntelliSolutions

LOWER: This depends on when we might see a light at the end of the tunnel and then how quickly Americans can recover economically. Housing prices could be slightly lower than the median reported in February and that’s if significant recovery can happen in Q3 and Q4. Because of the ongoing uncertainty, homeowners and homebuyers are likely to hang tight to see how COVID-19 shakes out unless they absolutely need to buy or sell property at this time. Because this is such a fluid and unprecedented situation, it’s difficult to really forecast or predict at this point.

Reginald Jones, Jacobs Center for Neighborhood Innovation

LOWER: Housing prices will likely adjust a bit lower by year-end, driven mostly by the middle market. Homes priced in the first- time buyer range will affect the market most. The target group in this category — middle, to upper- middle-income earners, will be most concerned about job security for homeownership investment as the economy settles. This will create a drag on the median home price.

Austin Neudecker, Weave Growth

LOWER: Until the COVID-19 crisis hit, San Diego did not have enough homes for sale, which was driving prices up. Post-pandemic, I expect the widespread unemployment / furloughing to take a toll on personal finances (reducing active buyers). I am hopeful that we see a quick recovery and, provided we are prepared and able to keep any significant recurrence next season, that we could return to the booming market of the past 10+ years in 2021.

Bob Rauch, R.A. Rauch & Associates

LOWER: This is because sales volume will decrease and hence, it will no longer be a seller’s market. The banks will work with homeowners given the impact of COVID-19 so we will not see prices falling off the cliff. Prices will trend lower because sellers are only selling if they are virtually forced to sell. Yes, there are a few who want to leave the Peoples Republic of California but they are in the minority.

Norm Miller, University of San Diego

LOWER: High-end homes, often owned with no mortgages, are getting hit from the stock market declines, which reduces the ability to buy up. Middle to lower-tier homes will be hit by unemployment and increases in foreclosures. Since there will be very little inventory on the market over the next quarter or two, the sales we will observe will include more distress than normal and not representative of the underlying market or patient sellers that will wait until next year.

James Hamilton, UC San Diego

LOWER: The world economy has just been hit by the biggest shock of the last 50 years. It’s hurting everybody, regardless of location, economic sector, or type of business. And things are going to get worse before they get better. We might be recovering by the end of the year. But the rebound won’t come soon enough or be big enough to undo the losses that I’m expecting over the next several months.

David Ely, San Diego State University

LOWER: While the low inventory will stop home prices from falling sharply, demand factors will likely dominate and cause prices to be lower by the end of the year. Major sectors of the economy have shut down. The huge jumps in state and national claims for unemployment benefits are clear indicators of just how much COVID-19 will damage the economy. Given the job losses and economic uncertainty, demand for housing will drop dramatically.

Ray Major, SANDAG

LOWER: 2020 will prove to be a down year for the housing market. Even before the crisis, housing prices were nearing their peak. The COVID-19 disruption has wiped out many people’s investment and retirement portfolios, consumer confidence is down, and many people will return to struggling businesses or find themselves out of work. Viewing properties in an era of social distancing will further complicate and dampen the sales process — all bad signs for real estate.

Chris Van Gorder, Scripps Health

LOWER: Growing unemployment, a decline in personal wealth resulting from the financial markets meltdown, and the uncertainty of the extent of the COVID-19 pandemic are headwinds to sustaining current home prices. While housing prices will likely drift lower, if the pandemic is short-lived and government stimulus initiatives are successful in muting the resulting economic impact of COVID-19, supply factors and low interest rates should lift the housing market in a relatively short period of time.

Lynn Reaser, Point Loma Nazarene University

HIGHER: Home prices are likely to be slightly higher as demand recovers faster than supply. Housing demand is now plummeting as people fear either infection from an on-site visit or the economic impact on their jobs, incomes, and savings. However, new construction is also likely to slow as caution among lenders and developers climbs. Unless the virus rebounds later in the year, jobs, business, and spending should then revive housing demand, while new construction will continue to lag.

Phil Blair, Manpower

LOWER: I think there will be long term ramifications from this pandemic. The hardest hit are small businesses and low wage earners, but the huge drop in the stock market has rattled the higher-income sector, too. We will see a corralling of spending and a cash-is-king attitude. Neither of which bode well for laying out down payments and taking on huge debt from a big expenditure like buying a house. I just spoke with a business owner who has stopped paying herself a salary to conserve cash in the company. Because of no salary she has sworn off Amazon until she feels comfortable starting up her salary again. Truly suffering for the good of the company.

Alan Gin, University of San Diego

LOWER: Economic activity has ground to a halt and a lot of people have been laid off. Even with aid from the government, many small businesses will likely not be able to survive. So unemployment will probably remain high through the end of the year. That will hurt the housing market, as some will lose homes to foreclosure and demand will decrease. Even though interest rates will remain low, a lot of potential buyers will hold back because there will be too much uncertainty.

Gary London, London Moeder Advisors

LOWER: The activity counts and listings in home sales have already plunged. Soon we will see distressed listings, further eroding value. The consequences of the shut down are that economic activity is likely to be slow to re-emerge. Uncertainty about the future will abound, and this will feed declines in value. I do not expect the level of downward movement that we experienced in 2008, but price drops are likely to be significant. The shallow supply pool of new housing may slightly offset the decline.

Jim the Realtor, Compass

LOWER: I’ll guess lower because if there is fear/desperation in the environment, then those homeowners of more-modest means and less equity would be more likely to panic and dump on price (rich people might list their home, but their ego will prevent them from dumping). I’m sticking with 60% fewer NSDCC sales in 2Q20, and -5% in price for the year.

I agree with that Compass guy. 🙂

There’s also a sea change in people’s priorities. What people may be wanting now is mismatched with the housing stock available. JtR and this Dawg have very similar houses. Single story rambling California Ranch style on modest lots where sidewalks are the exception. They don’t make them anymore. Zero lot lines 3200sf on 4000sf lots are the norm now. So. With a new appreciation for “residential distancing” senior living and condos aren’t going to be as popular. Likewise at the high end, those rich types are questioning the value of being tied to an expensive urban asset. To use a decade plus old analogy the slinky will relax. The low end will not be pushed as hard and the high end will not be pulled as tight. Because of the distribution the median will decline but the vast middle part of the slinky will be largely unmoved. Unmoved both in price and numbers sold.

Yes, love the slinky comparison!

We’ve discussed often how the median sales price is a terrible way to measure ‘prices’ when talking about hundreds of micro-markets.