Yesterday, Yunnie said that he sees no sign of buyer optimism fading, to which I said ‘just wait for the Case-Shiller Index (which should be the strongest of the year)’.

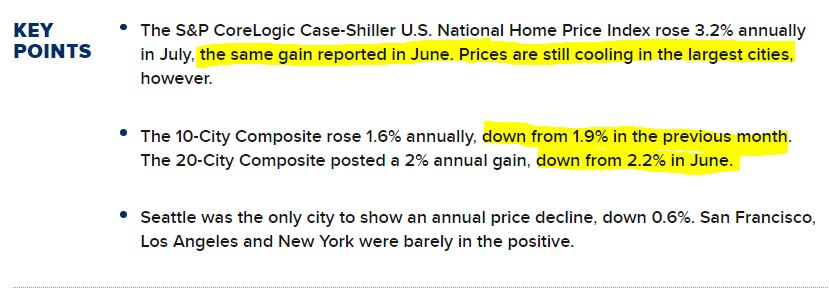

CNBC posted the click bait above, which is shocking because they are usually so negative about real estate – then published the key points below:

Mortgage rates dropped back into the threes at the end of May, yet the national index didn’t change between June and July? Every other time buyers could get a mortgage rate that started with a 3, they’ve come running. But not this time – home prices are stalled year-over-year, and existing home sales in the West declined 3.4% in August.

But never fear, our head cheerleader won’t let that get in the way:

Lawrence Yun, NAR’s chief economist said, “As expected, buyers are finding it hard to resist the current rates,” he said. “The desire to take advantage of these promising conditions is leading more buyers to the market.”

What he should say is that sellers should be sharpening their price. You’re on our side Yunnie, help us out!

San Diego Non-Seasonally-Adjusted CSI changes:

| Observation Month | |||

| January ’18 | |||

| February | |||

| March | |||

| April | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sept | |||

| Oct | |||

| Nov | |||

| Dec | |||

| January ’19 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| June | |||

| July |

The index is a three-month weighted average, so July closings should reflect the environment where mortgage rates were 3-something for the buyers. But they aren’t willing to pay 1% more than in June?

Looks like a sign of buyer optimism fading to me.

0 Comments