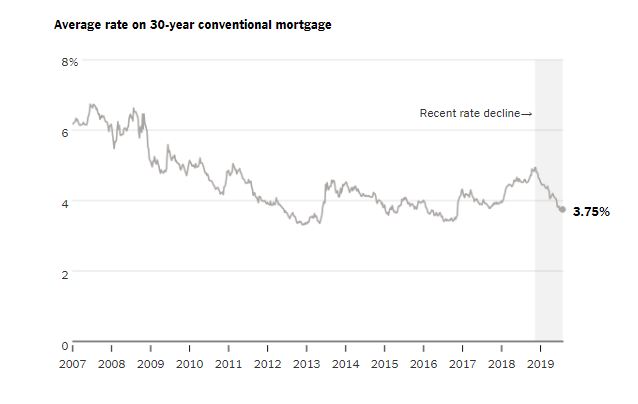

So we got the expected 1/4% from the Fed, and mortgage rates didn’t move – it was priced in.

What’s worse is talk of another Fed cut is needed just to keep mortgage rates where they are today.

From MND:

That means, all other things being equal, if the Fed were to say “we’re done cutting for now and will keep rates at these levels for the next 6 months,” you’d see an immediate and rather large move higher in rates. In other words, we’re already counting on another 1-2 Fed rate cuts simply to sustain the low rates that are already here. If those cuts don’t come, rates will move back up.

It sounds precarious, doesn’t it?

Eventually, people will start wondering, “Are home prices going to come down?”

Homes priced under a million should be fine for now; it’s the higher-end that could struggle.

But the detached homes in San Diego County that have sold over $1,000,000 have been in a fairly tight range of $525/sf to $575/sf for years now.

If sellers can just live with the same money as the last guy got, we should muddle along….for now.

Don’t discount competition. As the volume of refis declines you might see thinner margins as lenders fight for quality borrowers to keep their pools top tier. You see a little of this in jumbo lending already.

Apologies. The link didn’t paste:

https://ycharts.com/indicators/us_mortgage_originations_refinancing

That’s quite a pop in recent volume – more people who won’t move once they get a mid-3 rate:

US Mortgage Originations, Refinancing is at a current level of 146.00B, up from 97.00B last quarter and up from 118.00B one year ago. This is a change of 50.52% from last quarter and 23.73% from one year ago.