We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years.

Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community.

In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.

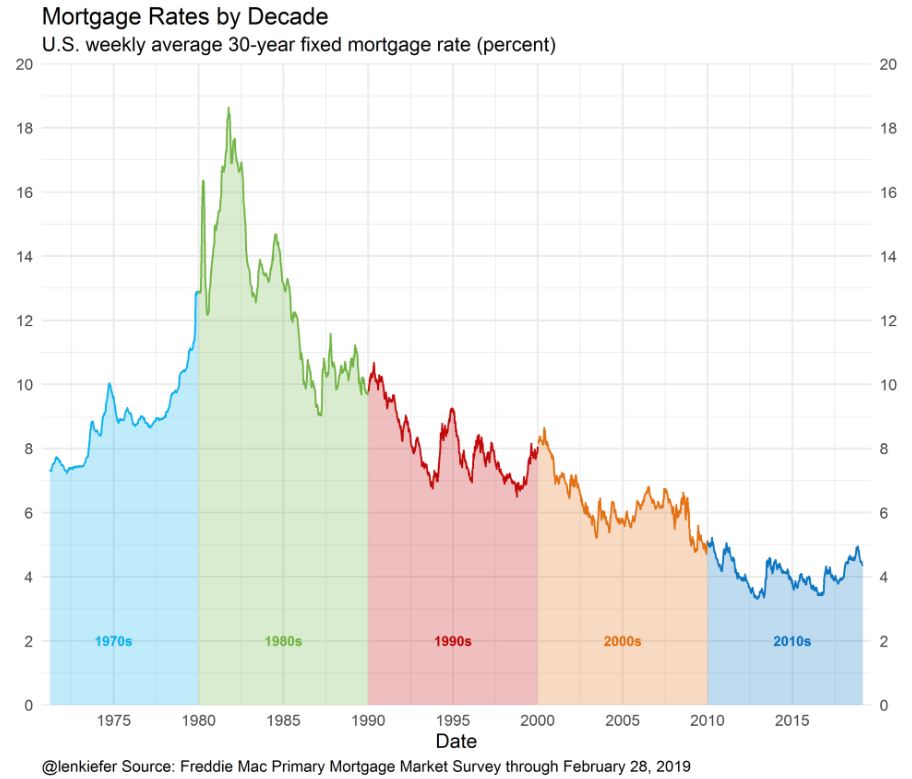

When interest rates finally go up, so will inflation (actually vice versa). And suddenly today’s prices will look cheap. It’s a vicious cycle.

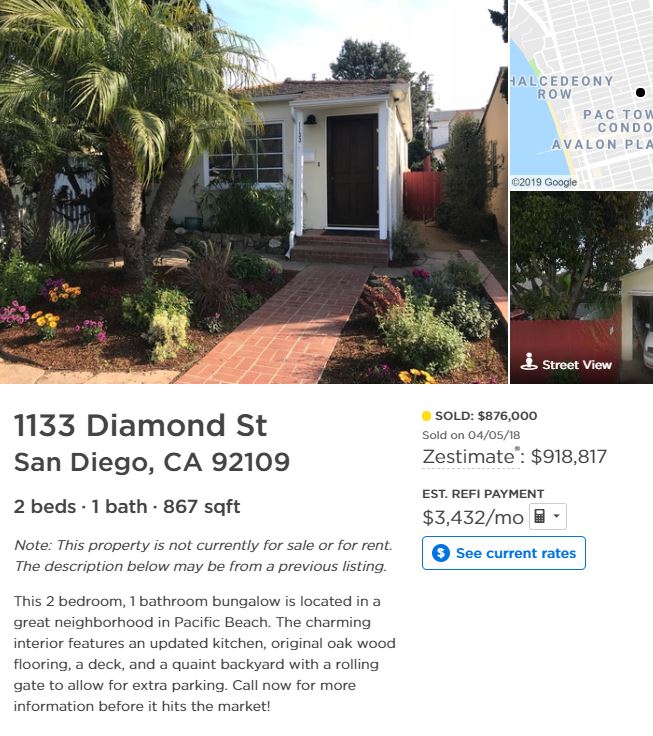

Crazy to look at the medium CA income in 1984 ($27,000) and now ($69,700) relative to the prices listed, 16×1, 15×1 for the average Joe. Affordability hasn’t improved. Do buyers now expect that level of price appreciation over the next 30 years?

Inflation is 2.4x since 1984, so inflation adjusted, the mortgage payments were 20% higher in 1984! However, the down payment is almost double, even adjusted for inflation, which may be the real problem. I wonder what monthly rent payments have done since 1984.

Brian, your salary numbers are inflation adjusted.

But the low rates have enabled cheap payments, not cheap prices, and rates cannot have a similar effect going forward, so that argues against real dollar appreciation. Supply and demand looks to be getting worse, so some real appreciation is still possible, just not at the past levels. Note – I’ve been wrong before.

Do buyers now expect that level of price appreciation over the next 30 years?

No but some appreciation please.

I wonder what monthly rent payments have done since 1984.

Gotta be 3x or 4x too.