It’s one thing to talk about whether Prop 5 will make a difference, because it’s very speculative – we won’t really know unless it passes.

Will it pass?

The powers that be are pushing their agenda on either side, but I doubt there are voters sitting on the edge of their chair awaiting the outcome.

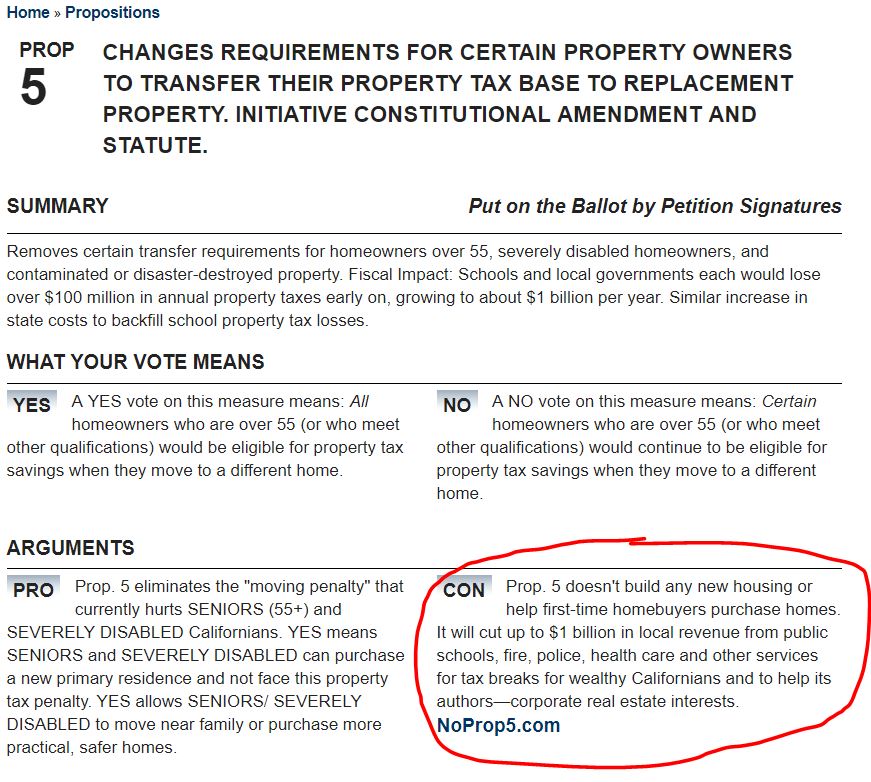

If voters just go off the voter guide for direction, this is what they will see:

The ‘con’ argument starts with two zingers and then fingers the ‘corporate real estate interests’ as the culprit. If voters go to their website, this is the first image they see, which will make an impression:

Because the C.A.R. is already gearing up for a revised initiative in 2020, this may just be a test run. But it would be helpful to have it pass, and see if there is any positive impact on the statewide market that could provide additional data for the 2020 initiative.

If it does pass, but the market doesn’t change much, then the C.A.R. will be able to say that we need the next round – which eliminates the inheritance tax break for vacation and rental properties, and clamp down on businesses that avoid higher property taxes when they buy commercial real estate.

Doesn’t this just add to what 60 and 90 did?

I am sorry, but those over 55 already have *ALL* the money in this state. Why do they need another tax break? This looks to me like another instance of boomers pulling the rug out from under their children. Thank god for the bank of mom and dad, right Jim? Otherwise, everyone under 40 would be screwed (most already are, in any event).

California’s tax policy (i.e., heavily weighted towards income vis-a-vis other forms of revenue) already contributes to the boom and bust nature of California’s state revenue – leading to massive shortfalls in downturns and excessive spending during the good years. I am not sure why anyone thinks Prop 5 is anything other than more of the same bad policies that is killing this state.

I am sorry, but those over 55 already have *ALL* the money in this state. Why do they need another tax break? This looks to me like another instance of boomers pulling the rug out from under their children.

Thanks mrdot!

If the younger folks wanted to revolt, they would find a fantastic rallying cry around the Prop 13 amendment that allows kids AND GRANDKIDS to inherit homes and get the previous ultra-low tax basis. It is a very generous benefit to the very few, and has no provision on whether the kids or grandkids need a break.

The whole concept around prop 13 was to put a cap on property-tax increases to keep grandmas from getting kicked out of their houses. But now 40 years later we see the unintended consequences – it not only encourages houses to be passed down through the generations (limiting supply), but it also give them tax incentives to do so, which are unfair too.

OK – grandma didn’t get the boot, thanks Prop 13!

But that should be the end of the benefit.

Agreed something must be done re: prop 13 too. I am not nearly smart enough to have any reasonable answer to that. One idea though: defer the excess taxes up until the property is sold. Inheriting family members can take the property at the lower tax value but if and when the property is eventually sold (and it WILL eventually sell – 10, 20, 100 years later) then there is a property tax bomb where all past the deferred taxes have to paid out from the revenue from the sale.

Overall, I cannot imagine these have much impact on the housing market or property values. I just don’t think most people make decisions like whether to sell or hold onto a house based on the tax implications; certainly not enough to tip the needle much in terms of overall housing availability (or lack thereof).