Rob Dawg predicted it that any and all appreciation will happen in the first half of the year – and if we’re just talking about the general trends in local San Diego pricing, that’s how it has been lately.

As the red circles show in the graph above, the non-seasonally-adjusted SD Case-Shiller Index has a history of cooling off in the second half of the year.

Will the same seasonal event happen again in 2018?

Most likely – our June and July index numbers were the same this year, so it’s likely to stay flat, or even soften a bit like last year. But were talking fractions, not big chunks.

The number of sales are another thing, however. Few sellers NEED to sell, so while buyers might offer less, it takes two to tango.

The CNBC article that tried to paint a negative slant on the New York market included this quote:

“Offers 20 percent and 25 percent below asking prices began to flow in, a phenomenon last seen in 2009,” wrote Warburg Realty founder and CEO Frederick W. Peters”.

“While few sellers struck deals at those radically reduced offer prices, they signal a major shift in our marketplace, one which has been building for at least 18 months,” Peters said.

Sellers aren’t going for it.

They might knock off a few points, but unless they are unusually desperate, they are going to sit on their presumed equity and wait until next year if they have to. Sales would have to grind to a halt for sellers to think about dumping on price.

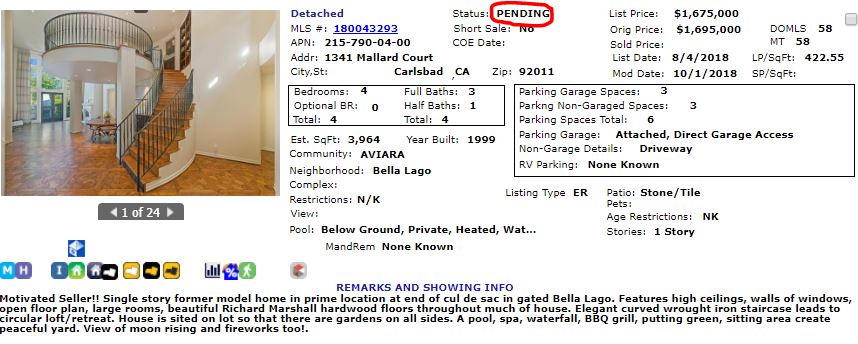

There will be just enough action to keep the sellers optimistic too. Here are a set of homes that were marked pending today that could make you think everything is fine:

Another agent has this one, but you saw it here last time around:

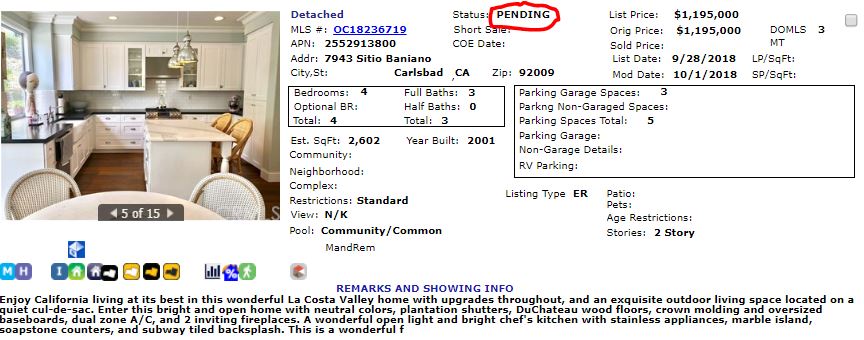

This is in La Costa Valley, which has been starting to show it age when you’re talking about 20-year old Carlsbad tract houses now over a million. But this had the updated and appealing look, and the first buyer took it:

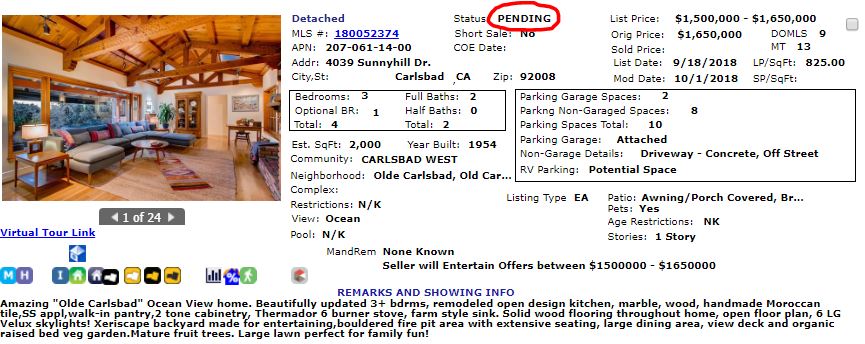

My friends in Olde Carlsbad went pending too:

I know they aren’t closed yet, and at least one of those will probably fall out. My point? The market isn’t dead, or even sleeping – it’s just finding its way.

I believe there is an astonishing amount of old money socked away, and not remarked upon, or even noted by the Forbes 400. I also know there is a TON of stock investments around the bottom of the market when Obama took office.

Money that is “on paper.” People who bought Boeing, or especially Apple back then, are enjoying their dividend premiums and just cruisin’ Lake Fun. They can buy a house when they fricking well feel like it, and they do. But they also like their dividends, along with concern for other issues, and won’t just close out shares on a whim. America ain’t sucking air.

Premium stuff will move along well enough. Crap will sit in the sun, stinking up CNBC articles. And Trump keeps Trumpin’. He just keeps Trumpin’. Alooooooong!

> Rob Dawg predicted it that any and all appreciation will happen in the first half of the year – and if we’re just talking about the general trends in local San Diego pricing, that’s how it has been lately.

Being right for what? 14 years in a row isn’t any sort of reputation. Ask JtR about the coffee bet I lost in 2007 by 2 weeks of data or so.

There is still too much money chasing too few desirable properties. The high end will continue to run and the very low end will continue to see more qualified buyers “settling.” Watch the DOM for $899k-$1.499k. A big stall will be the sign.