Rich didn’t sound any alarms in his most-recent post, and he is among the most neutral observers – he’s not in a real-estate-related profession. He said:

So, there’s nothing extraordinary or panic-worthy here… the market is a good amount weaker than it was in recent times, but that’s coming from a very hot market, so things are still very much in the realm of normalcy at this time.

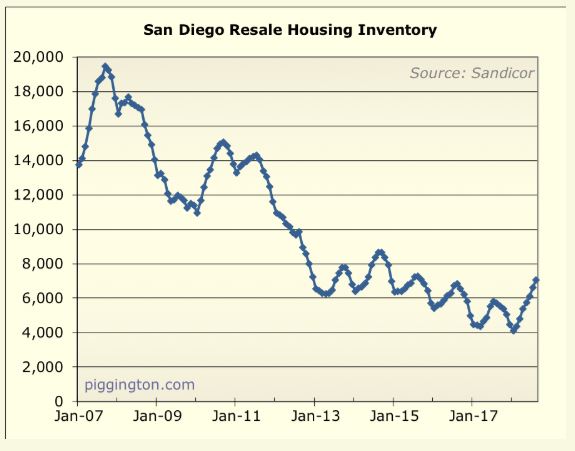

You can see why. The inventory remains relatively low, and it wouldn’t take much for it to plunge again. Rich made the point that with both rates and prices higher, we may have reached the tipping point, but if one or both were to relax a bit, the current inventory would thin out.

You can see in the graph above that the inventory peaked in the middle of the year previously, when in 2018 it’s kept growing. We may just have more sellers waiting longer into the year before cancelling their listing for the holidays.

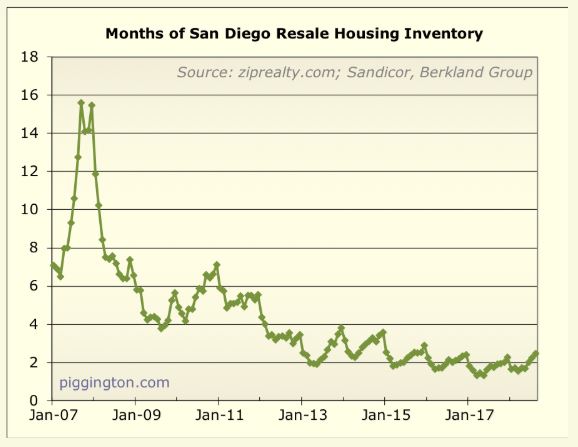

This graph doesn’t trigger any alarms either:

More factors that will create more Stagnant City, instead of a downturn:

- The county population has grown by roughly 300,000 people already this decade, and is expected to grow by another 600,000 people by 2050. Home building is so anemic that we will be short 150,000 homes by then!

- The move-up market is comatose. Prices have gone up so fast that it is miracle work trying to make sense of moving up – you really have to have a good reason, and loads of money. My rule-of-thumb is still in effect – you need to spend 50% more than the price of your old home to have it work (if you sell your a million, you can’t stay in the same area and spend $1.1 million – there isn’t enough additional benefit – maybe an extra bedroom?). There is too big of a delta between the purchase prices for someone who bought at $800,000 and can sell now for $1,000,000 who then needs to spend $1,500,000 to get enough benefit.

- Virtually nobody knows different market conditions than what we’ve had this decade. Anybody who got into this in the last nine years has only known a seller’s market, and the rest of us are too old to remember!

- Buyers don’t lowball, instead, they just walk away – which doesn’t give overly-optimistic sellers any feedback on price. They just keep waiting for that magical nuclear family with 2.2 kids to show up tomorrow.

- The trend for agents to be on salary or lower commissions means they aren’t going to work too hard – and won’t employ the expertise to create solutions.

- There are just enough sales to keep everybody optimistic!

The total number of NSDCC listings are steady, in spite of more ‘re-freshing’ than ever:

| Year | |

| 2013 | |

| 2014 | |

| 2015 | |

| 2016 | |

| 2017 | |

| 2018 |

As long as fewer people want to sell, expect more of the same.

This metric (inventory) needs a reset. Ten years ago there wasn’t anywhere near the extent of pocket lists reducing or internet disemination shortening the listing to offer cycle.

Side note. Staying at “the Del” Sat-Sun was a fun and rare treat. Leaving the sliding door open and waking to the sound of the surf then going down to the buffet should be on anyone’s bucket list. Now I have to figure out how to stay at the Awanee in Yosemite and attend the Christmas Dinner for the same $60.

Stagnant city will lead to collapse 2.0. Its called an inflection point.

It’s different this time.

Where are U gona downsize to? Flooding ower cost south east? No water future for west but drought, more costs and taxes and homeless costs and wacko governments. Whats a mother to do?

Man, Rob Dawg has the life! I’m going to start copying him!

Yep! Guess I’m going to the Del! I’m not sure where that is, but I’ll assume it’s Del Mar. Then I guess it’s Xmas at Yosemite. That’s gotta cost more than $60 to do the whole thing. Probably a lot more…

Maybe I’ll just go to Gelson’s, and get a fruit plate.

btw, why use the word “stagnant”? Why can’t they just call it “satisfied”?

A: Should we build more cheap housing? And skyscrapers? In San Diego?

B: Eh! I don’t think so, stranger.

A: But why?!

B: San Diego is… satisfied.

A: I see. Well, I guess I’ll be on my way, then.

B: Where you going next?

A: Salton Sea.

B: Interesting. Wishin’ you luck, stranger.

The comments on “move up” were spot on. There’s no benefit in going from a $1.1m house to a $1.6m house. Let’s do some of that math stuff.

You are likely paying a mortgage of $700k aka $3300/mo. And taxes of $850/mo. You net $250k on selling and take on a $1.35m mortgage aka $6500/mo. And $1700/mo. Taxes. None of which under SALT caps is additionally deductible.

@daytrip – “The del” is local speak for the “Hotel del Coronado” located on Coronado island. https://hoteldel.com/

This metric (inventory) needs a reset. Ten years ago there wasn’t anywhere near the extent of pocket lists reducing or internet dissemination shortening the listing to offer cycle.

Agree – it ain’t what it used to be.

But all of the pocket sales do get MLS-inputted eventually, so they are in the sales counts. Agents can’t wait to display their unethics.

We could also say that all of the commotion and deceit has ramped up the frustration, leading to a shortening of the listing-to-offer cycle. Frustrated buyers get to the point where they just want to get it over with.

Housing is driven by household formation and speculation. Household formation requires favorable demographics and rising income. Speculation requires the belief that you can sell the asset at a higher price down the road.

Look at a chart of household formation and real income rates, and ask yourself “will I be able to sell this house in 10, 20, 30, years at a real profit if these trends continue…”

Now factor in debt levels at the local, state, level, the national debt, student loan debt, and the trend of every business trying to offshore or automate whatever human job they can.

Stagnation City for the next two decades.

I’m hoping Trump, the King of Bankruptcy, finds a way to discharge some of our debts before he’s done. (?)

Demographics have been a negative BUT there are far more tailwinds than headwinds. HH formation is rising again. Birthrates are inching up. Housing supply growth is far far behind population growth. Number of persons per household long term continues to decline despite the Great Recession pause. If you have a nice house and your municipality doesn’t destroy value with bad zoning and such you can expect houses to far outpace inflation. The only caution is related to destructive municipalities. 10, 20 plus year from now there are going to be lottery lcation winners and equally totally undesireable location losers. Location location location has been the only constant in real estate.

You know what would go a long way towards lowering debt? Making the Chinese pay their mail bills. Right now, the Chinese can mail a box from China, and they’re charged around $1.50. If I mail that same box back, it would be around $80.00

America eats the difference.

These rates were established decades ago, when the Chinese still had shelter pup on their dinner menu’s. China is doing better now, and doesn’t need our handout. It should have been changed in the nineties, and nobody has done anything about it to this day. If the Chinese paid the same rate we paid, our mail carriers would be arriving in Tesla’s, dressed as Playboy Bunnies. As they should, except for the Tesla’s.

Okay, I’ve said enough. I’m tweeting Trump about this, right NOW!!

“The only caution is related to destructive municipalities. 10, 20 plus year from now there are going to be lottery lcation winners and equally totally undesireable location losers. Location location location has been the only constant in real estate.”

Just read that Gov Brown okayed a MASSIVE grant to assorted municipalities to buy property’s that aren’t up to much, in area’s that are kind of “neutral zones,” meaning the rich haven’t got there yet, and the police are too diligent for the poor to relax there, and convert them into commercial hipster enclaves.

The article included a photo of a decent sized commercial property they want to tear down, and redevelop into a commercial hipster haven. The property happened to be one block from a rental property we have. Gentrification lotto winner here. Nice to meet you.

Meantime, family and friends have been saying, “why don’t you sell that property? You’ve had it a while.” And I reply, “because you’re stupid.”

Conclusion: Before buying or selling, do your due diligence. Gov Brown is handing out taxpayer bucks all over the state, like a mental patient. I’m not saying that to be mean. He’s batsh*t crazy. The man sleeps hanging upside down.

And, for those with the means, consider distressed properties in Inglewood. Follow your tax money.

“I’m hoping Trump, the King of Bankruptcy, finds a way to discharge some of our debts before he’s done.”

I think he will. Obama and Bush have left him so many things to stop. All he has to do is stop them.

Gosh, remember all that yelling and screaming the day after the election? Where I live, some kids ran out onto the 101 freeway, running around in circles screaming about Trump. They were posting to my neighborhood Facebook group while they were doing it. I posted, “get off the freeway before you get hit by a bus, you morons,” and I got kicked out of the group. I’m banished to this day. My own neighborhood! Granted, it’s loaded with middle-aged unmarried cat ladies, beta dudes, and actors, but still. Where’s the humanity?

And now, Gen Z kids are finally taking a shine to our President!

I say, it’s about time:

https://youtu.be/3DMSHqqOIPA

Well said about the move up population, and a personal anecdote to go along with it.

I love the neighborhood I live in, a lot of friends and a lot of kids for my kids to play with. We do help each other out when needed, and the kids go to a top rated elementary school.

For one, moving out of this neighborhood is out of the question as we would leave behind a lot. My three bed-two bath house at 1400 sq ft is crowded with three kids, but where would I move? In the neighborhood there are scant few houses that would really solve the issue, and I’d be looking at doubling my mortgage. I’d make a hefty profit on selling my house, but I’d then need to buy an expensive house anyways.

Option B is to realize kids in the house are in reality not around forever on and to stick it out. The elderly neighbors from the 70’s did the same thing and seem to be much better for it. They certainly managed in the same situation, and a paid off house would be nice when I’m thinking of retiring.

What are your thoughts on Prop 5? That should free up some inventory?

And 2 decades of stagnation…..? Half the boomers will be dead by 2 decades…..should free up some more inventory.

I think Prop 5 is too-little, too-late and likely to be a nothing-burger.

But yes, I’ve been hoping for a boomer liquidation sale for years now!