It looks like the tax reform bill will be signed by Congress, and sent to Trump for signature. The California Association of Realtors, led by our president, has been claiming all along that this tax bill will be bad.

On Friday, I sent this email to the C.A.R. rep Sean Bellach:

I object to this constant barrage of negativity – can the C.A.R. please use some common sense and take actions that support realtors doing more business? Let’s celebrate publicly that we got almost all that we wanted, and home values won’t be going down now!!!!

https://www.bubbleinfo.com/2017

Yesterday, Sean responded:

Dear Jim,

Thank you for contacting us regarding C.A.R.’s Call-for-Action on the tax reform bill, H.R. 1. We understand and have looked at the issues you have raised; however, nearly every independent analysis of the tax bill confirms C.A.R.’s fears that the cost of tax reform will be placed on homeowners in high-cost states, specifically California, New York and New Jersey.

C.A.R. is not opposed to tax reform, but it cannot support a bill that pays for tax reform by increasing taxes on California’s homeowners. H.R. 1 provides not one new benefit for homeownership or to support housing, but instead eliminates and weakens long standing benefits of the industry.

These are the reasons for C.A.R.’s opposition to H.R. 1 and why we are asking our members to contact their members of Congress to oppose the bill.

Sincerely,

Sean

To which I responded:

Thanks Sean.

Can you provide the studies or data please? It would help substantiate the claim.

Regarding the values dropping as a result of the middle-class paying higher taxes…..can you provide those studies too?

Thanks a million!

Jim Klinge, broker

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

While we wait for his data and studies that show the middle-class will be paying more taxes as a result of the tax reform and/or the costs will be placed on homeowners in high-cost states, specifically California, New York and New Jersey, here is how it is being reported today:

From the wapo:

But here’s the truth: 8 in 10 Americans will pay lower taxes next year, according to the nonpartisan Tax Policy Center’s analysis of the final bill. Only 5 percent of people will pay more next year. Mostly, those are folks who earn six figures and own expensive houses in places with high local taxes, such as New York and California.

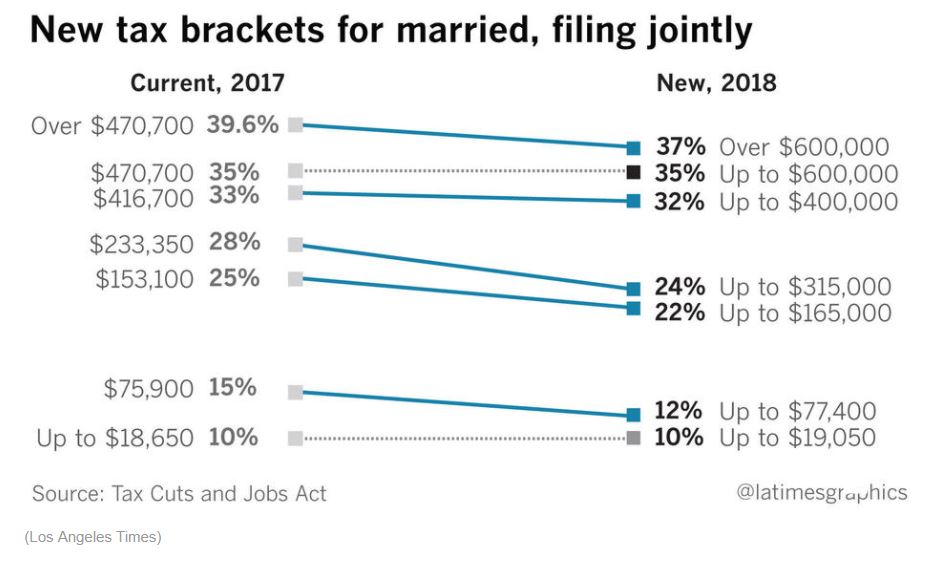

From the latimes.com:

From the wsj.com

Middle-income households will get $61 billion in tax cuts in 2019 under the Republican tax plan poised for passage this week, according to an analysis released late Monday by Congress’s Joint Committee on Taxation.

That amounts to 23% of the tax cuts that go directly to individuals. By 2027, however, these households would get a net tax increase, because tax cuts are set to expire under the proposed law.

The calculations are based on JCT estimates of cuts going to households that earn $20,000 to $100,000 a year in wages, dividends and benefits. Those households account for about half of all U.S. tax filers, with nearly a quarter making more and a quarter making less.

The Trump administration has emphasized the benefits of the tax plan for middle-income households.

America’s most-affluent households, those earning $500,000 or more a year, which account for 1% of filers, would also get $61 billion in cuts in the first year, according to the JCT analysis. They would get a cut of $12 billion by 2027.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It doesn’t look like the middle-class will be negatively impacted in California. If only the affluent are affected because of the cap on state, local, and property taxes or the mortgage cap being lowered to $750,000, they can probably handle it and still want to buy a house in which to raise a family.

I just want the C.A.R. guys to stop saying prices are going to go down!

Here’s where they are saying today that there will be a short-term drop in property values of 6.3%, but they just state it as fact – I want to see how they came to these conclusions:

From the CAR general release today:

As for the Mortgage Interest Deduction (MID), it splits the difference between the House and Senate versions at a $750,000 cap, which will apply to loans incurred on January 1, 2018 or later. The conference bill grandfathers in loans incurred before December 15, 2017. And after 2025, the MID is back up to $1,000,000 regardless of when the loan was incurred.

There is a two-week period for taxpayers who enter into a written binding contract to purchase property before December 15, 2017 to close before January 1, 2018. As long as these contracts were closed before April 1, 2018, they are grandfathered in. But strangely, this exception appears only to apply to principal residences and not second homes. Otherwise, the MID will still be available for second homes. (It is unclear what the available deduction will be for a homeowner who purchases a second home and closes after December 15 but before January 1).

Additionally, the conference bill suspends the deduction for interest on home equity indebtedness. Thus, for taxable years beginning after December 31, 2017, a taxpayer may not claim a deduction for interest on home equity indebtedness. The suspension ends for taxable years beginning after December 31, 2025.

There was a concern that the tax bill would lengthen the holding period for the exclusion on the capital gain from the sale of a principal residence. However, this provision was simply scrapped altogether form the conference bill. Sellers who live in their property as a principal residence for two of the last five years will continue to disregard taxes on up to $250,000 and married couples up to $500,000 of gain from the sale of such property.

Couldn’t he instead say that homeownership incentives were largely held intact? And please provide some concrete evidence about home values going down or being at risk:

December 20, 2017

Dear Jim,

The U.S. House of Representatives and Senate just passed the congressional “tax reform” bill. The President will sign the bill within days and the measure will go into effect on January 1. We are disappointed that Congress has passed tax reform legislation that puts home values at risk and dramatically undercuts the incentive to own a home.

While we weren’t successful in defeating the bill outright, California REALTORS® communicated with their Members of Congress over 44,000 times in the last several weeks by responding to C.A.R. and NAR Calls for Action. Those communications helped improve the final bill. And for that, we are all grateful.

Unfortunately, the final bill still eliminated homeownership incentives and is disproportionately harmful to California. For these reasons, C.A.R. continued to oppose the bill to the very end.

Thank you to everyone who helped in this effort. In the coming weeks, C.A.R. will provide members with additional information on how the new law will impact them.

As we move forward and learn the full impact of this legislation, we hope we can work with Congress to make the necessary changes that will keep housing as the foundation of this great nation’s economy.

Homeownership has been and will always be the foundation of opportunity for Americans across our great nation, and C.A.R. will not stop advocating for it.

Sincerely,

Steve White

President

CALIFORNIA ASSOCIATION OF REALTORS®

Less negative:

NAR President Elizabeth Mendenhall on Wednesday praised members for their rapid response, but warned that more work would need to be done in the new year as the impact of the tax revisions came into focus.

“The results are mixed,” said Mendenhall in a prepared statement. “We saved the exclusion for capital gains on the sale of a home and preserved the like-kind exchange for real property. Many agents and brokers who earn income as independent contractors or from pass-through businesses will also see a significant deduction on that business income. Despite these successes, we still have some hard work ahead of us. Significant legislative initiatives often require fixes to address unintended consequences, and this bill is no exception.”

The labels don’t help the accuracy of the debate. The “middle class” for the purposes of tax punditry is not the same as north county san diego “middle class”. I have yet to see the numbers run for the 2 income household with 2 kids making $200,000 buying a $900,000 house in Carlsbad. With the cap on SALT, I suspect they are the 5% that will be paying more. My guess is the over 500k people are fine, the under 150k people are fine, the 150-500k people in high tax states will carry the load.

If there is a two week window, in which you can still get the Million deduction there CAR should in capitals say to there agents RUSH…while it might still be somewhat unclear until the dust settles, it is clear that interest rates are starting to move up as predicted they will all next year….I think the real effect is not mortgage deduction loss…which is 250,000 at 4% which might be gone by the end year or early Jan that is 10,000 interest and say you are at 35% then you lose 3500 bucks, the big kicker is the loss of property tax deductions, especially if your home is over 900K or there abouts. If 1.5 mil in SD 1.25 that is $18,750 of which only $10,000 is deductible which is $8,750 non deductible at 35% $3,062…we are looking at a new buyer at 1.5 with 1 mil mortgage losing about $6,562 out of pocket with the new law change.

Prediction: Realtors, like yourself will research and market lower property tax areas…for example Encinitas tax rate is 1.0596, RSF is 1.117, and SD hillcreast is 1.16…so it a new selling point besides avoiding mello roos fees might be that the area has a lower property tax basis per year. Look for more marketing on that selling point

The CAR has it wrong. The cap on SALT made the MID even more valuable. Deduct your interest and property taxes and fight Sacramento to lower income taxes that are no longer deductible.

“C.A.R. is not opposed to tax reform, but it cannot support a bill that pays for tax reform by increasing taxes on California’s homeowners.”

I have several questions.

First: Why? Why is it not in the interests of C.A.R. to see CA homeowners paying more Federal taxes?

Second: Why? Why focus on homeowners? Aren’t 20-30% of your clients first time buyers? And what percentage is commercial interests? They clearly benefit from this same bill.

Third: Since you pretend to be concerned for the consequences of taxation on homeownership why are you not shouting to the rafters about all the other taxes that keep the CA middle class to poor to afford a home?

What are people’s thoughts on the tax calculator at:

http://taxplancalculator.com/

?

To me this suggests most married, “middle class” folks in NCC will end up seeing a tax cut. I have played around with the calculator a bit plugging in different numbers, deductions, etc. and the main thing that seems to make a difference (whether there is a cut or an increase) is whether or not a person is married.

Todd, good calculator. Wonder if accurate?

1. [Renters] Joint filers making $200k, 2 kids, don’t itemize. Tax bill of $26,819. Saves $7516.00 over current system.

2. [Owners] Same family, but itemize. 10k in prop tax and 20k in other deductions (ie, mortgage interest). Tax bill is $25,397. Saves $2043 over current system.

Tax benefit of owning a home is better or worse than before?

“Third: Since you pretend to be concerned for the consequences of taxation on homeownership why are you not shouting to the rafters about all the other taxes that keep the CA middle class to poor to afford a home?”

That’s the 1K pound California Gorilla in a Tie Die T-shirt in the room.

Granted, it’s hard for them to be heard if they speak out against, say, the one billion dollar “homeless tax” that won the vote in Los Angeles––the one that had no plan for implementation, and is currently under fiscal investigation––them being who they are.

Cautioning the voters that a tax increase with no viable plan attached will raise rents, raise the cost of property ownership, and being alive, and slowly dying, by the Santa Ana River, etc. doesn’t seem to faze Cali voters, but fiscal conservatives can apply the time-tested dem strategy of running money to political shell organizations, giving them half a chance to be heard, without triggering people to start running all over the 405 at rush hour.

“Concerned Citizens for Totally Affordable Housing,” or some such name to get their message across without being immediately peppered with pejoratives by our teeming mass of “Voter’s Who Need to Improve.”

I know that’s all just fantasy. The reality is… this is New California! Poder para la gente del río Santa Ana!

https://www.youtube.com/watch?v=DMnM_cQu6Fo

Tax benefit of owning a home is better or worse than before?

The whole tax-reform thing is minor compared to the bigger benefits of homeownership – in particular, the value of having (fairly) fixed housing costs for the foreseeable future, and maybe forever.

Great calculator.

They offset the SALT taxes by removing the phase out of the Child tax credit and additionally doubling it. This is actually more fair, and actually more of a left leaning tax law change.

The tax calculator is not correct. It does not take AMT into account.

People will adjust, but do have a conformation that the interest deduction is under contract by 15th or is it 31st and when will it have to close.

Brian – my understanding is that AMT in the revised bill affects a much smaller number of people and is specific to only a few unique circumstances (I may be wrong!). See e.g., https://www.cbsnews.com/news/gop-tax-bill-curbs-impact-of-hated-amt/

Assuming this is correct, though, then if anything I the calculator would underestimate a person’s savings under the new tax code.

the new and old tax brackets dollar values have overlap so some incomes go to a higher bracket rate eg at 401,000 income mfj

old you’d be at 33% new you are at 35% so it goes up

business insider says – An anesthesiologist who’s single and childless and making around $270,000 a year will actually end up paying 10% more once this bill goes into effect. why ?

in part because single brackets were 33%

191-416700 and this number is now at 35% 200001-500000.

I ran the numbers using the calculator – and it consistently said if you are single in california earning larger incomes, you are going to get hosed, about 10k

for mfj, the tax break seems to increase the more you earn excluding any amt effects.

if my understanding is correct, I gain advantage of a tax deduction by bringing forward next years charity contributions to this year – because next year I’ll be taking the standard deduction and so won’t be able to deduct these moneys.

I am uncertain but I think the changes are not good for home ownership because in the old scheme I could start with a huge slug of CA state tax and then add the VLF and property taxes – and compare that with the standard deduction. Now I have to compare a much smaller allowable number with a much bigger standard number – so people who have had their homes for years I’m guessing would be more likely not to itemize and just take the standard deduction. … and people just starting or who have only been in their homes a few years are likely to keenly feel the limitations. If you can’t finance it you can’t have or keep it. I suspect there are going to be a lot of people struggling to make payments who were barely managing before – the price tags are not small for homes in N county san diego. That said, I never fail to be amazed at how much money seems to be available to buy property in N county, no matter the price.

I suspect there are going to be a lot of people struggling to make payments who were barely managing before – the price tags are not small for homes in N county san diego. That said, I never fail to be amazed at how much money seems to be available to buy property in N county, no matter the price.

Thanks for the insight Trisha!

The anesthesiologist will find a way to buy a house – the extra $10k in taxes won’t stop him or her. I’m sure the bill will be picked apart, and there will be cases that seem unfair.

It will be the reporting of the tax reform that matters now.

I don’t think C.A.R. is going to change their negativity, so news reports will broadcast that the tax reform will be bad for housing, and start a self-fulfilling prophecy.

Appreciate all the analysis over the last days and the comments. From the calculators, seems the bill helps almost everyone, even in high tax states. I think the biggest change is the standard deduction going way up, changes the math for a lot (tho not really in SD) people to favor renting. Standard deduction is now $2k/mo married, takes away most of financial benefit of paying a mortgage payment for the vast majority of homes not in expensive areas.

interesting article in the UT “san diego luxury housing could boost under tax plan”…I agree, the article states most pay cash, some use a mortgage but the reduction in the corporate tax rate means upper income people will have extra money to spend on the pass thru. Also interesting the was the uptick in sales this year, homes over 4 million as of Dec 15, are 127 sales vs 93 during the entire year of 2016. Homes 2-4 million had the biggest increase 712 thru 12/15 vs 471 during the entire year of 2016..I agree with it.