Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

Of course there is an alternative the reverse mortgage to provide more resources. With that cleaning out the house becomes someone elses problem.

See bottom right…

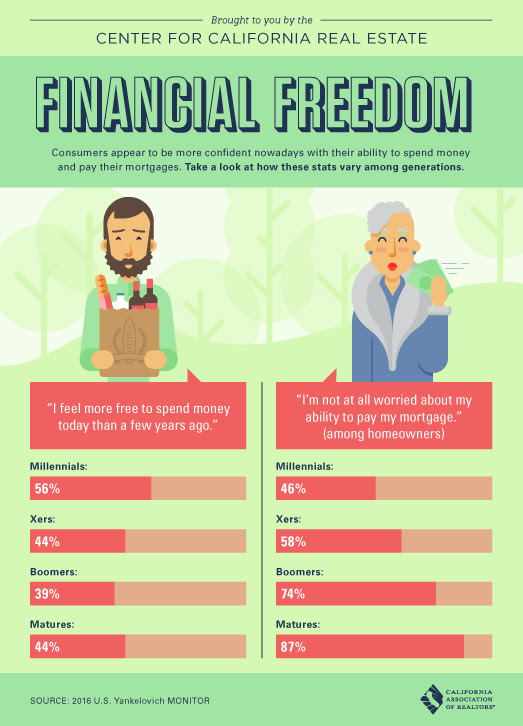

Older folks are more likely to have paid off their mortgage as well.

Prop 58 in California will have a lessened impact as time goes on. The exclusion is limited to $1MM, so there will be property tax increases for some of the kids that inherit or are gifted parental homes. That might influence a few decisions. Also, two houses in my neighborhood were just listed for $1.7MM. At what point do people take the money and run?

At what point do people take the money and run?

You like to remind us of how comfortable the older folks are, but those aren’t the market makers. As the market starts to flatten out, the people that matter are those who are willing to sell for what the market will bear, which admittedly are down to a very small subset.

The low inventory gets a lot of attention, but it is worse than that – how many of those really need to sell? It is probably less than half of the current active inventory.

How many of the ‘sellers’ of current active listings would take 10% less than their list price, if that was all they could get? I’d say 25% or less.

While it would seem to be a good time to take the money and run, egos will get in the way.

One of the houses is remodeled, has a pool, and has a pool/guest house. The other has a huge downsloping lot and a pool. One is an original owner, not sure about the other. Will be interesting to see if they get close to their asking prices.

We are down to five original owners with six long term second owners on my thirteen home cul de sac and none shows any interest in selling. The original owners next door are remodeling and retrofitting. They are nearing 70 and plan to stay until the end. Very few people here have sold to downsize into a retirement home or move closer to the grandkids. Most sales have been job relocations, and with more residents now employed in local high tech jobs, a job change means a few blocks, not 2,000 miles. So no one is selling.