Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

http://www.housingwire.com/articles/38761-this-is-the-big-unknown-for-housing-in-2017

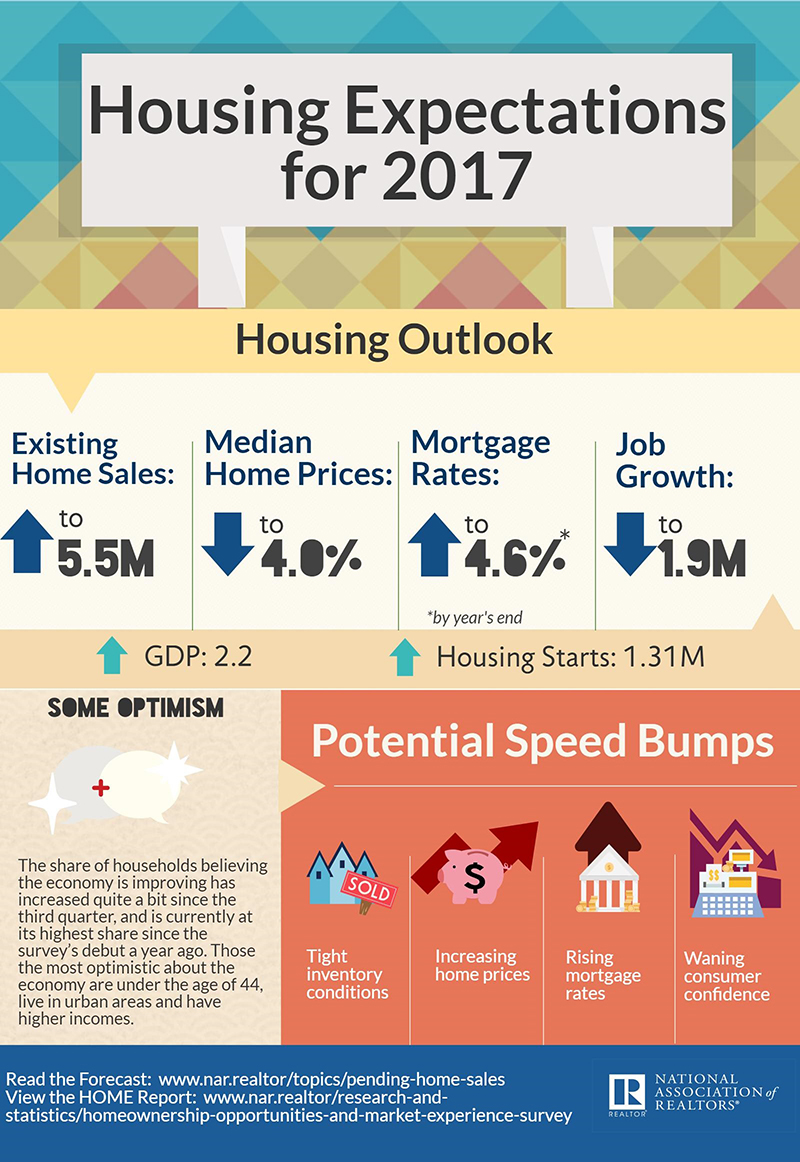

This increase in interest rates remains a concern for economist who say that the incentive to buy a home decreased slightly. While it may not be enough to ward off first-time homebuyer, the rising rates combined with the rising home prices could discourage homeowners from upgrading to a larger or better home, therefore leaving little inventory for first-time buyers to move into.

If Trump is able to get business tax rates down to 15% instead of roughly 30% it might offset interest rates going up on buying houses.

What I’m watching is how the new conservative control is going to effect foreclosures. Clearing out the deadbeats would open up a world of opportunities for buyers.

Hopefully the years of bashing savers with uber low rates will soon be over!

I wonder if Trump’s plan to increase the standard deduction to $30,000 for married, filing jointly ($15,000 for singles) will cause some buyers to reconsider a home purchase to reduce taxes, since the higher standard deduction may make the mortgage interest deduction a moot point.