Worried we might run out of buyers? Plenty are waiting in the wings – and working with their parents to achieve!

Current renters value homeownership and want to buy a home but many are encountering affordability and financial obstacles that prevent them from buying, according to the CALIFORNIA ASSOCIATION OF REALTORS®’ (C.A.R.) “2016 Renter Survey.”

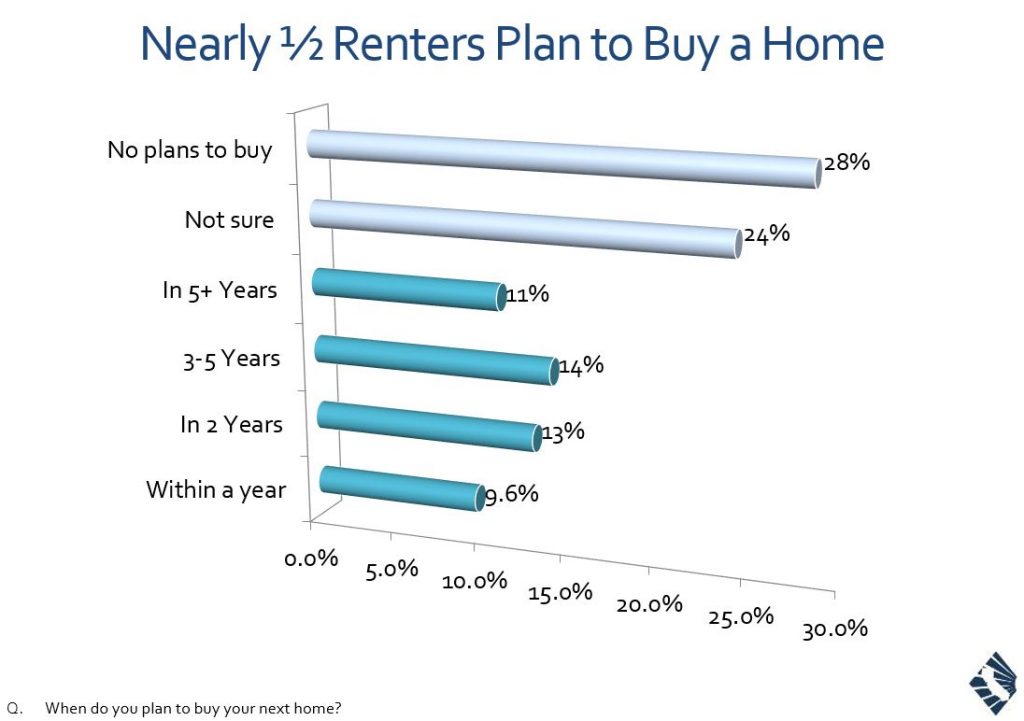

Nearly half of renters (48 percent) plan to buy a home in the future, with 10 percent saying that they plan to buy within a year. For those not planning to buy, an improvement in finances, lower housing prices, and saving enough for a downpayment would motivate them to buy now.

Of the 28 percent of renters who don’t plan to buy in the future, 50 percent said they can’t afford to buy, 20 percent will not buy because they prefer to rent, 19 percent said they can’t qualify for a mortgage, and 15 percent lack a downpayment. Job uncertainty (9 percent), economic uncertainty (12 percent), and housing market uncertainty (6 percent) were among other reasons renters cited for not buying a home.

Homeownership remains important to renters, with nearly half (45 percent) rating it 8 or higher in importance on a scale of 1-10, with 10 being extremely important. The average was 6.8. Nearly all renters (95 percent) see advantages to homeownership; freedom to do what you want with your home, building equity, and having permanence and stability were the top benefits mentioned by renters.

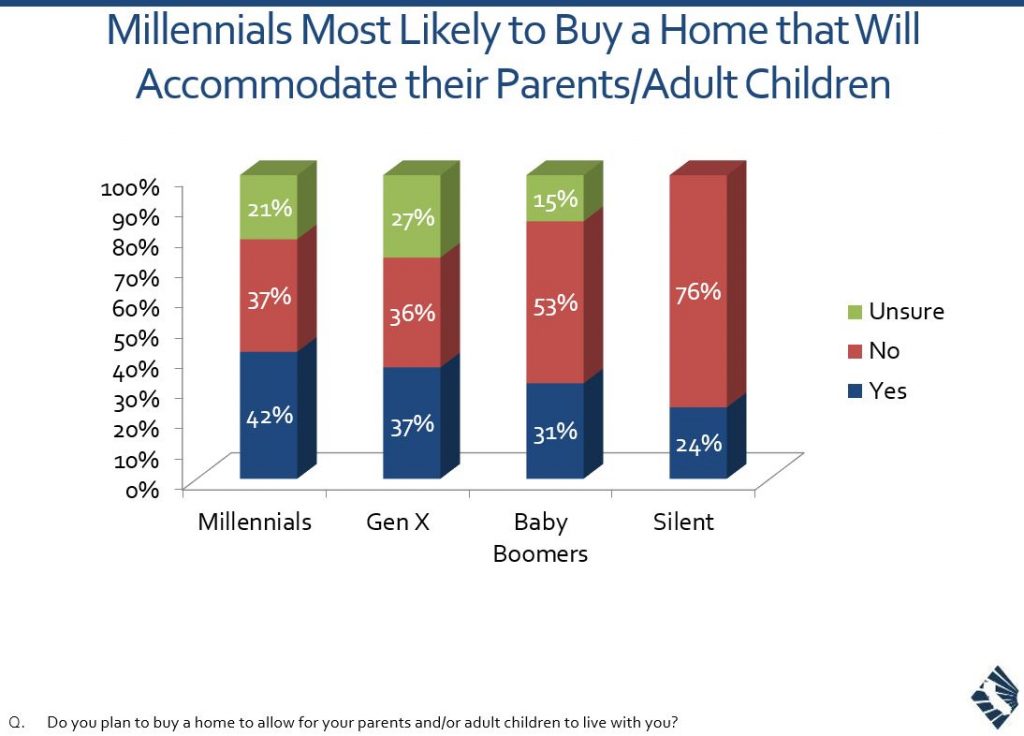

One of the surprising findings of this survey is that more than one in four millennial renters said they plan to purchase a home that will accommodate their parents, and about one in five millennials indicated they plan to pool funds with family members to buy a home.

Other key findings from C.A.R.’s “2016 Renter Survey” include:

- Forty-six percent of renters claimed they currently rent because they can’t afford to buy, and 13 percent said they have poor credit and can’t qualify for a loan. The remaining renters choose to rent because they like the flexibility, freedom and ease of renting, are concerned about the maintenance costs of owning a home, or are not interested or aren’t ready to buy.

- Nearly four in 10 renters (39 percent) indicated they plan to purchase a home in the same county where they currently reside, and 23 percent plan to buy in the same neighborhood.

- Fifteen percent of renters plan to buy a home out of their current area, with 7 percent planning to move to another state, 7 percent to another county in California, and 1 percent to another country.

- Of the renters who are planning to leave the area where they currently reside, 27 percent are moving to find lower housing prices, 24 percent are moving for a better neighborhood, 14 percent want to be closer to family, 9 percent want a shorter commute, and 7 percent are moving for a better school district.

- Two in three renters have made some kind of preparation to buy a home: 25 percent have searched for homes, 16 percent have searched online for information about the homebuying process, and 12 percent have spoken to a REALTOR®.

- Thirty-one percent of renters previously owned a primary residence, and 9 percent currently own real estate. Of those who previously owned a home, the reasons for selling included family reasons (37 percent), financial difficulties (28 percent), and work (13 percent).

http://www.car.org/newsstand/newsreleases/2016releases/2016rentersurvey/?view=Standard#

0 Comments