With the strategy of not-foreclosing working so well for the banks, you can probably say that REO and short-sale listings are winding down. How did we do?

While it is likely that REO and short-sale listings will continue for years, the media keeps touting how the distressed-property numbers are in decline. Lenders should be pursuing defaulters and liquidating their portfolios while the market is hot, but don’t be surprised if you see them do what most regular sellers are doing – waiting for prices go higher.

While it is likely that REO and short-sale listings will continue for years, the media keeps touting how the distressed-property numbers are in decline. Lenders should be pursuing defaulters and liquidating their portfolios while the market is hot, but don’t be surprised if you see them do what most regular sellers are doing – waiting for prices go higher.

Here are the grand totals of NSDCC detached-home sales since 2008, when the MLS first started marking the REO and short sales separately:

| Town or Area | REOs# | $/sf | Shorts# | $/sf | Non-REOSS# | $/sf | Non % of Total |

| Carlsbad | |||||||

| Encinitas/Cdf | |||||||

| RSF | |||||||

| La Jolla | |||||||

| Carmel Vly | |||||||

| Del Mar/SB | |||||||

| Totals |

We really didn’t get hit like the subprime-loan areas did, and NSDCC could withstand further foreclosure activity – in fact, homebuyers would welcome it!

Comparing the average $/sf of REO vs. short-sales helps to debunk the myth that short sales are better for the lenders than foreclosures.

But aren’t there additional expenses for the banks with REOs that are avoided with short sales?

Another myth that may have had some merit back in the day, but not now.

Lenders pay these on both REOs and short sales:

-Back property taxes

-All seller-side closing costs

-Commissions

-Repairs if needed

-Vig to get occupant to vacate (larger on short sales)

There may be the additional expenses incurred during the REO holding time, but in most cases around NSDCC they are getting all REOs to market within 60 days.

I would gladly trade those holding costs for selecting my own realtor and determining my own list price. Plus the price should be rising with time in an improving market.

If it weren’t for being politically correct, lenders should cancel all short sales, and go straight to foreclosing on all defaulters now. They’d pick up the appreciation on those that did get foreclosed, but mostly it would call the bluff of those defaulters who are strategically defaulting just to work the system.

If you could make your payments, would you strategically default on your primary residence in an improving market? Rents are sky high, and unless you’re leaving town there isn’t much benefit.

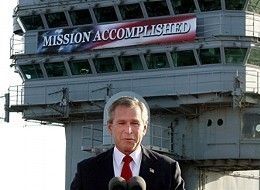

But, but, Mr. Mortgage PROMISED me they couldnt hold back the pipeline forever. He PROMISED me there would be a TSUUUUUUUUUUUUNAAAAAAAAAAAAAAMIIIIIII!!!!!!!