We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years.

Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community.

In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.

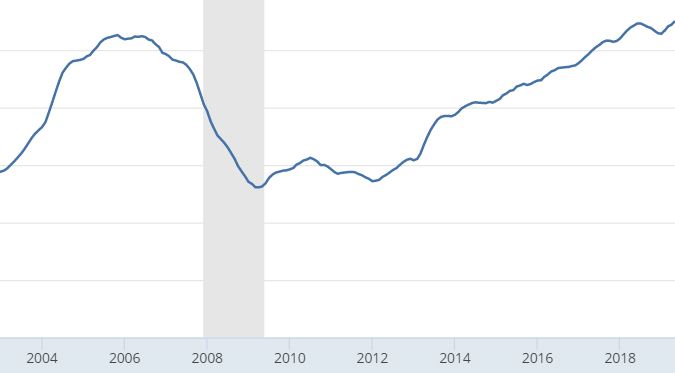

the graph is not translating to my mobile device. I only see half of the chart in vertical orientation. Even when I rotate to sideways orientation I still don’t see the whole chart.

It’s Fred’s fault.

According to Ralph McLaughlin, CoreLogic deputy chief economist and executive of Research and Insights, there is the potential for prices to reignite, especially if low mortgage rates remain the trend. The average 30-year fixed rate slid to 3.55 percent, down from 4.51 percent this time in 2018, Freddie Mac recently reported.

“While falling mortgage rates have thus far only led to an increase in refinancing, rather than purchase activity, there will undoubtedly be a large boon to the marginal homebuyer,” McLaughlin says. “Thus, we should expect the lengthy slowdown in home price growth to flatten or even tick upwards by the end of the year, assuming the U.S. economy avoids any present-day threats of a recession.”

According to Lawrence Yun, chief economist at the National Association of REALTORS®, there is a high likelihood for prices to strengthen. In July, the existing-home median price was $280,800, an increase of 4.3 percent year-over-year.

“Though showing mild deceleration in price growth, it is worth noting that this index is a bit of a lagging indicator, with the latest data reflecting what happened in April, May and June,” says Yun. “The figure is likely to show reacceleration in home price gains in the upcoming months, as the market has been shifting towards higher demand due to lower mortgage rates and reduced supply as home builders constructed fewer homes this year compared to the last year.”