The path forward is becoming more clear. Zillow is rapidly expanding their ibuying enterprise, and because they are so well-known, they have a shot at a major disruption.

In the video below, Mike describes how homeowners who used to rely on their zestimate for a home valuation are now getting a written quote from ibuyers – for free. In Phoenix, the center of the ibuying universe, 40% of homeowners get a quote from an ibuyer before selling their home.

In effect, ibuying is the new zestimate, and more tangible because if you like the number, you could sell your house instantly.

Sure, Zillow is losing money, but their first-year volume is remarkable:

Since launching Zillow Offers in April 2018, more than 170,000 homeowners have requested an offer through the program. In the second quarter alone, there were 70,000 requests.

Zillow reported that it made $1,578 on each home it sold in the second quarter before interest expenses are calculated. After interest expenses, the company, on average, lost $2,916 per home. Barton believes that, eventually, the company will earn 400-500 basis points of return before interest expenses on homes it sells.

It’s an improvement, however, over the company’s first-quarter numbers, where it lost, on average, $3,268 per home it sold, after interest expenses.

“Over time, our unit economics should benefit more from other adjacent services, like mortgage origination, title and escrow,” Barton said in a letter to shareholders. “We expect to be able to leverage these services to support Zillow Offers and improve the consumer’s overall transaction experience, while also generating cost savings for Zillow and our customers.”

They are the only real estate company that has been willing to spend $100 million per year in advertising, and it’s what made them who they are today. It won’t matter if they charge 7% to 13% for their service, all that matters is that they advertise it – which may not be that costly.

Because many or most homeowners have saved their home on Zillow (giving up their email address), they will get regular solicitations to sell their house to Zillow.

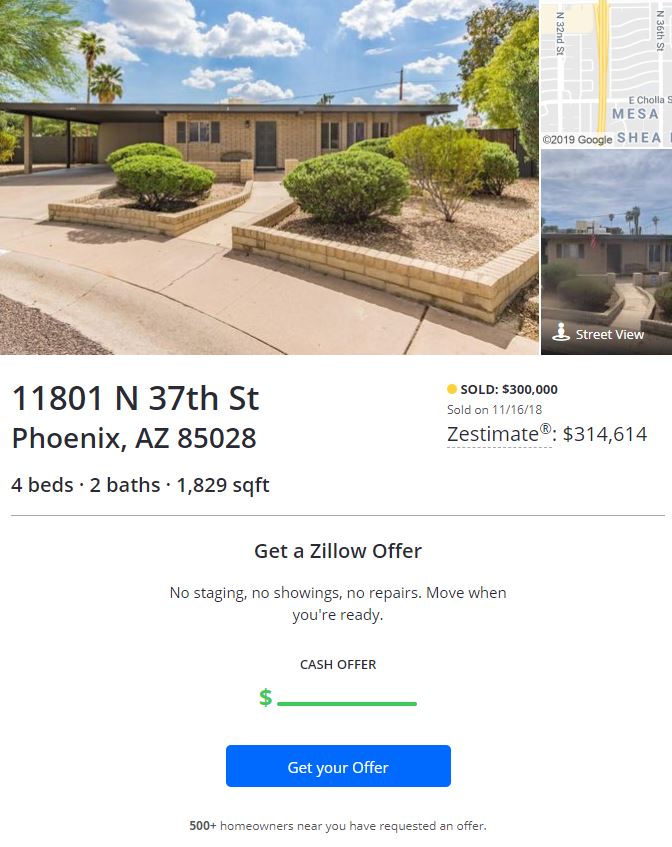

Look how easy it is – one click and you get a cash offer…….just like 500+ others near you:

If you have 18 minutes to spare, Mike’s presentation below is a full examination:

Mike mentions that he thinks the companies who position themselves at the start of the consumer journey will win. Stay tuned for a Compass announcement shortly!

All it will take is for z-team to flip a house for $100k more than they paid and the word gets around.

and the word gets around

It would in the old days, but today I’m not sure who would be spreading the word, and where. Agents would really have to be paying attention to notice, and to spread the word, but to survive it will be in our best interests to do so.

Remember when there used to be real estate blogs?? 😆

There will be real estate blogs again when real estate gets interesting again. Zguess says the Dawghaus has gone up 3% in the last 30 days and predicts it will go down 0.7% over the next year. I don’t want idiots like that anywhere near a million dollar transaction.

But what, exactly, do iBuyers bring to the table for home sellers? And, can this business model survive the housing market downturn so many are predicting?

That’s what Collateral Analytics sought to answer in a recent paper on the topic, which offered a deep dive into the strength of the iBuying concept.

First introduced in Phoenix by Opendoor in 2014, the iBuying concept offers home sellers the opportunity to sell and close on their home within days, hassle-free. The iBuyer then completes any necessary repairs and lists the home for sale.

“For motivated sellers who want a predictable sale date and need to move, perhaps a long distance from the current location, there is no question that iBuyers have provided a welcome alternative to traditional brokerage,” Collateral Analytics pointed out.

But all that convenience comes at a cost.

The paper dissected the math behind the model, estimating that sellers end up paying between 13% to 15% more when they work with an iBuyer. This covers a difference in fees that ranges from 2% to 5% greater than a traditional real estate agency, plus an allowance for repairs and another 3% to 5% to cover the iBuyer’s liquidity risks and carrying costs.

The paper also noted that the iBuying model makes these companies susceptible to a number of risks, including the need to safeguard vacant homes and the possibility that the automated valuation models they rely on will overvalue a property, resulting in a loss.

They could also face troubles if home prices decline.

“A downturn in home prices, not forecast by the iBuyer market analysts, could be devastating as they ramp up their business platforms, particularly if the cost of capital increases,” the paper stated. “At the same time, downturns are precisely when the most sellers would want this option.”

While Collateral Analytics lists several companies that are investing big in the iBuyer model – including Opendoor, OfferPad, Zillow Offers, Redfin, Realogy CataLIST, Perch and Keller Offers from Keller Williams – it also states that only the most efficient firms with enough capital and market share are likely to survive.

And of course, this all depends on how appealing the concept turns out to be, mainly, how many home sellers are willing to pay for convenience.

“For some sellers, needing to move or requiring quick extraction of equity, this is certainly worthwhile,” the paper stated, “but what percentage of the market will want this service remains to be seen.”

https://www.housingwire.com/articles/49809-with-ibuyers-sellers-pay-a-price-for-convenience

I don’t want idiots like that anywhere near a million dollar transaction.

But most homeowners are inexperienced at selling – for most it’s been 10+ years since they sold a house, and boy have things changed! With their equity now bloated beyond their wildest imagination, will they mind leaving a couple of bucks on the table in exchange for convenience?

The winner(s) will be determined by who has the best salespeople.

Steve really slams Zillow in this interview, saying they have no idea what they are getting into when flipping houses:

http://www.cnbc.com/video/2019/08/08/why-steve-eismans-new-big-short-is-a-bet-against-zillow.html

how will the ‘Ibuyer’ model affect the relocation companies?

how will the ‘Ibuyer’ model affect the relocation companies?

Their reason for existing diminishes daily.

Because there is usually competition between iBuyers, it simply doesn’t happen that there are $100k profits on homes. Quite the opposite. If you think about it, when consumers get multiple offers from iBuyers, the dumbest offer (read HIGHEST offer) wins. Just like any other bidding process, it’s a careful balance between beating everyone else for the deal and not overpaying. The biggest deltas for these companies have been losses.