Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

This is what’s happening in the United States now…

https://en.wikipedia.org/wiki/Lost_Decade_(Japan)

Read through the link and it’s amazing how many parallels there are to what we’re going through right now.

The main difference is that Japan had a fast aging population that was fiercely against ANY Inflation, they just now AFTER 10-years of no growth realize there is no growth without inflation and no way to monetize debt.

“Read through the link and it’s amazing how many parallels there are to what we’re going through right now.”

There are important differences. Japan has a very strict immigration policy, their relationship to China isn’t good, and they don’t rely on slave labor to the degree that the United States does. I don’t believe Sony or Fuji has their products assembled in quasi slave labor colonies like Apple does. Apple is a major driver in the american stock market thanks to 16 year old kids living in dorms working 60 hour weeks. If Apple products were manufactured here, prices would be prohibitive. There are other examples.

The housing market has become a global issue, which is why figuring it out is more difficult. What may seem like a top in the housing market may be a bottom by global sensibilities. Jiji thinks the housing prices in the hollywood hills are crazy high. A multimillionaire in China looking to launder his money might disagree. If so, prices go up on 1920 era bungalows in the hollywood hills.

It’s not that I think the prices are crazy high in the hollywood hills, it’s that is crazy to use the same metrics that you would use in Dallas in Hollywood or anyway in SoCal coastal.

They ARE NOT THE SAME so cannot be painted with the same brush.

Nor is 1970’s Coastal SD the same as 2015 Coastal SD, its not the same market that it was then.

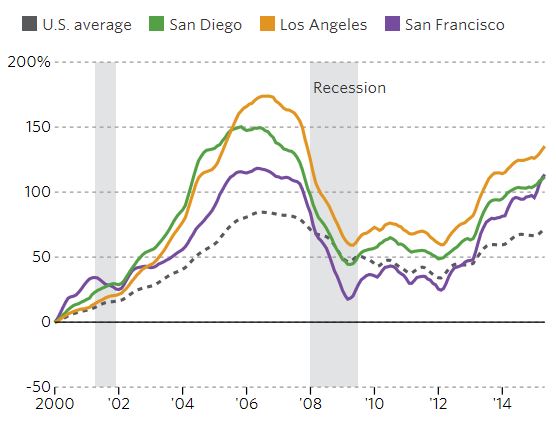

SF Case-Shiller includes Marin and San Mateo.

SF proper is WAY above the prior peak… as is prime NSDCC.

JtR, are there any areas from La Jolla to Oceanside with houses going for less than 2007 prices?

Only an occasional random sale here and there.

Jiji, in a recent past post, you said:

“There are different levels of “inefficient and irrational”, Try buying a place in Hollywood hills LOL.”

“If you took the average wage of Hollywood and try to justify the home prices it will come out looking VERY irrational on a chart.”

To me, “VERY irrational on a chart” is synonymous with “crazy high.” If by “VERY irrational on a chart,” you meant “priced correctly, according to it’s location,” my bad. 🙂

In any case, I think we are agreed that buyer demand, wherever it comes from, is related to price in important ways.

Here’s a report from the NYT pointing out relative scarcity in new homes built, related to buyer demand:

http://www.nytimes.com/aponline/2015/07/28/us/politics/ap-us-home-prices.html?_r=0

“The pace of single-family home construction has risen 9.1 percent in the past year, while purchases of new homes have jumped at more than double that pace.”

As I mentioned a few posts ago, I think it’s buying time. For selling, I’d use Victorville McMansion production increases as a leading indicator.

OK but I would not be so sure about the Victorville thing, A lot of Chinese/Asian investment going into the SoCal high desert areas.

Not saying that makes it a sure winner just a lot of investment and growth going into the SoCal inland areas these days.

I Stopped in the Victorville Costco on the way to Vegas a few times in the last few years, Seems a lot of (at least somewhat) well off people stuffing their carts to the gills.

Jiji, I agree it ain’t easy making sense of what’s going on out there. Lots and lots of pro/con variables that weren’t in play even a decade ago, and you don’t know if you’re right until years after the choice is made.

It’s fun to debate it tho, and I *always* appreciate your contributions here.