Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

New buyers are having a hard time. About 25% fewer young buyers are qualifying for mortgages than were historically. I’m not talking about the crazy subprime days.

I personally deal with a lot of renters who are largely in this group, mostly late 20s – early 40s, and I’m finding many who would like to leave and buy a house just cannot. They seem very qualified (making enough money to pay the mortgage) but mortgage lending is tight.

Also, there are many out there with credit damaged from the financial crisis who would like to buy a home.

Higher end buyers are not having problems (except finding houses to buy).

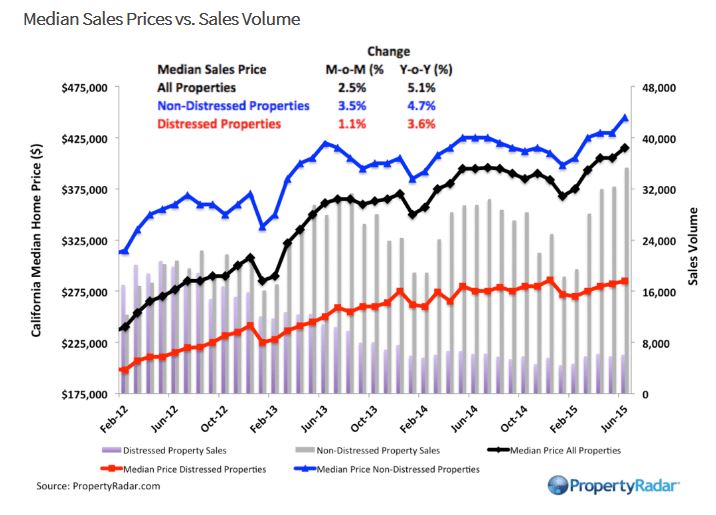

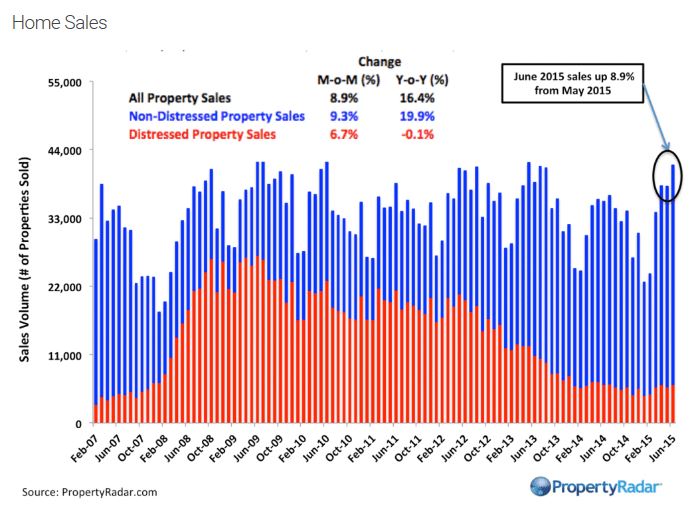

Sales are higher than 2014, but that’s not much of a benchmark.

About 25% fewer young buyers are qualifying for mortgages….

Provide link please.

Sales are higher than 2014, but that’s not much of a benchmark.

Not much of a benchmark? According to the same report linked in article, cash sales are dropping and now down to 20% (from 25% three months ago). Sales are higher, so financed sales are higher too.

I would say that is the perfect benchmark to show that financing is available to all, using the same guidelines in place since the 1980s.

To you and others who keep insisting that credit is tight – what do you want? No-qual loans?

Prices are too low! Folks need to price their OPTs HIGHER! 🙂

At this point I would be more interested in the sellers than buyers. Age and such in particular.

I really wish I could find the report that showed the 25% lower qualifications for younger borrowers (I’m pretty sure it was from the Joint Center for Housing Studies, but their stuff is in PDFs and hard to search. ).

But supporting the same idea, I’m sure you and your readers follow “Calculated Risk”…

http://www.calculatedriskblog.com/2014/10/is-mortgage-credit-too-tight.html

The main point is that mortgage underwriting is historically tight for lower income borrowers (which includes most first time buyers). Not compared to the sub-prime bubble no-qual times, but historically.

There’s no need to jump to no-qual mortgages to make things better. Everything doesn’t have to be black or white. But the banks are being ridiculously conservative now. I’m not sure exactly why. I don’t think it’s because they’re seriously worried about default.

Anyway, the numbers are the numbers. Things aren’t easy for first time buyers. Things never are. But most of the time they haven’t been this hard.

The main point is that mortgage underwriting is historically tight for lower income borrowers (which includes most first time buyers).

You’ve been hanging out in the same ivory tower as Janet Yellen.

Underwriting isn’t any different than it has ever been. The hassles and demands are from incompetent loan processors who make excessive requests for documentation to CYA. If these qualified first-timers or others who get shaken down would go to a decent loan rep, they wouldn’t have a problem getting a loan. They will give an FHA loan to just about anybody.

Obviously you aren’t on the street dealing with buyers daily like some of us. I’ve had no problems with buyers getting loans, or appraisals, and I deal with people from $300,000 to $3,000,000 – including when I represent sellers and I am at the mercy of whatever buyer happened to surface.

One more thing.

All of the stats are skewed by one simple fact. The market is competitive, and big money wins every time – which means low-down-payment buyers lose the bidding wars constantly. Over time, the stats “seem to indicate that first-timers are staying away, or having a tough time getting a loan” or headlines like “when will millennials buy a house” because the stupid reporters never consider that these folks ARE trying to buy and get beat out.

I worked 2 jobs, my current wife was also working at the time. We saved up every penny for a couple of years and put down 120k to buy our house.

Maybe young people are doing this today but I’m not seeing it. I do see a lot of complaining about how things aren’t fair. Which I 100% agree with. Things aren’t fair. Young people are getting screwed while old people live for free in houses that they’re not paying the mortgage on.

Unfortunately if you want a house you have to figure out a way to play a game that’s rigged against you.

I’m reminded of this quote as to anything in life–including real estate (whether seller or buyer)

“Life is unfair. But sometimes it’s unfair in your favor.”

It’s good for me to read this again after being a prospective seller in May to June. Sellers in my neighborhood–who never really lived in their home since March, 2010 (except for a few weekends)–decided to sell because they wanted acreage. Essentially, the house was new construction.

Their list price was way below market, and their buyers had made an offer to me one day before that house went on the market. “My” buyers withdrew their offer to me, and… well, moved into that house just this week.

What did I learn? Sometimes real estate is timing and you have to be lucky when you list your home. I learned some other stuff too, but don’t want to start a discussion how unprofessional some buyers’ agents can be… 🙂