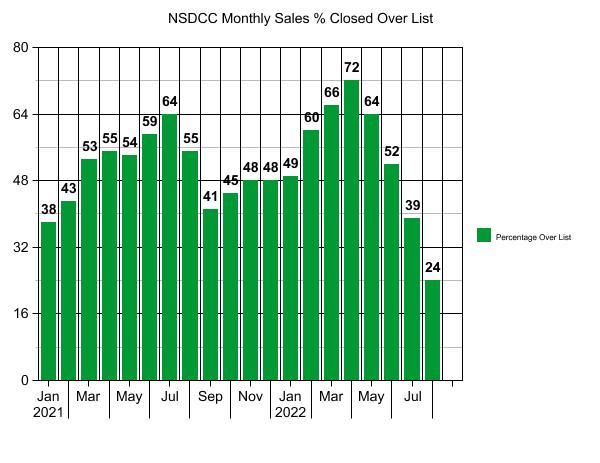

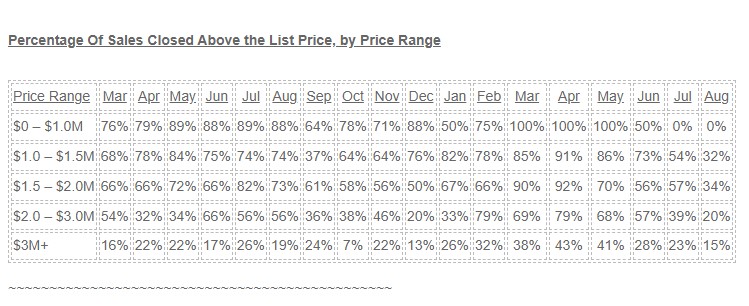

The over-bidding is winding down to more manageable levels as just 24% of August buyers were willing to pay over the list price. As usual, the $1,000,000 to $2,000,000 range was the most active, where inventory is low and the number of quality homes for sale even lower:

The number of sales in August were higher than they were in July, but still well under recent history:

NSDCC August Sales

2018: 275

2019: 263

2020: 351

2021: 268

2020: 161

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

NSDCC Average and Median Prices by Month

| Month | |||||

| Feb | |||||

| March | |||||

| April | |||||

| May | |||||

| June | |||||

| July | |||||

| Aug | |||||

| Sept | |||||

| Oct | |||||

| Nov | |||||

| Dec | |||||

| Jan | |||||

| Feb | |||||

| Mar | |||||

| Apr | |||||

| May | |||||

| Jun | |||||

| Jul | |||||

| Aug |

This is much more normal – the average and median sales prices are under their list prices!

It will be interesting to see what happens with the fixers.

If home Sales are slowing down + Interest Rates are going up. Construction groups will become more “hungry” then they’ve been in the past. Because of increased competition for limited opportunities construction costs will go down.

This might make fixers more appealing.

The price gap between the creampuffs and fixers is coming back, and that’s a good thing.

Plenty of people watching for the good buys though. I wasn’t convinced this was a deal until the agent told me that he has 13 offers, and mine at full price didn’t make the Top 5 so boo hoo, no counter for me:

https://www.compass.com/app/listing/2513-sarbonne-drive-oceanside-ca-92054/1135706202501330777

Your prognostication track record has been unblemished for getting close to 20 years Jim!

I didn’t fully believe you over the last five years but you’ve nailed it.

Still calling the blog bubble info doubles your credibility.

Keep up the good on the ground work!