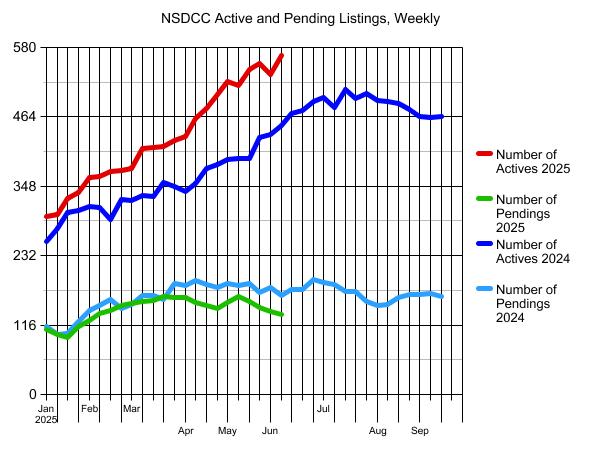

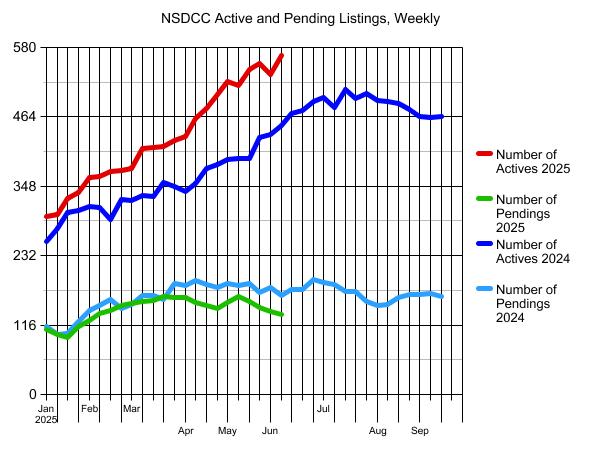

Last week I thought inventory might have peaked for the year?

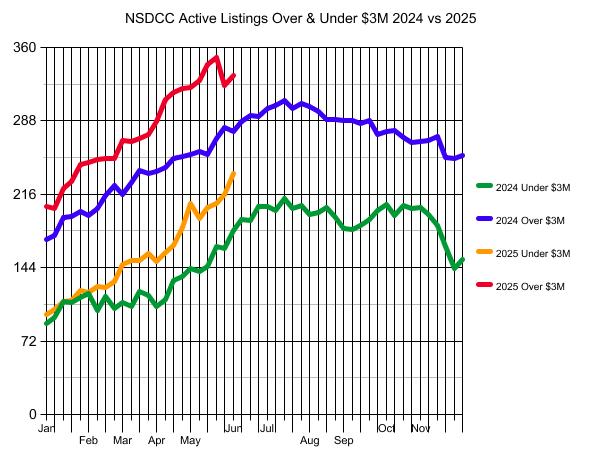

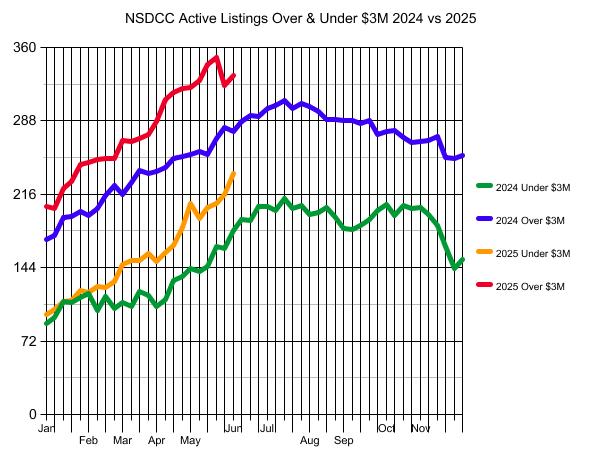

The dip from the previous week was all from high-end listings, some of which are now being refreshed and coming back on as new listings. Even though the lower-end inventory is rising steadily, at least the actives-to-pendings ratios show where the action is:

Under-$3M: 236 actives/82 pendings = 2.88

Over-$3M: 333 actives/54 pendings = 6.17

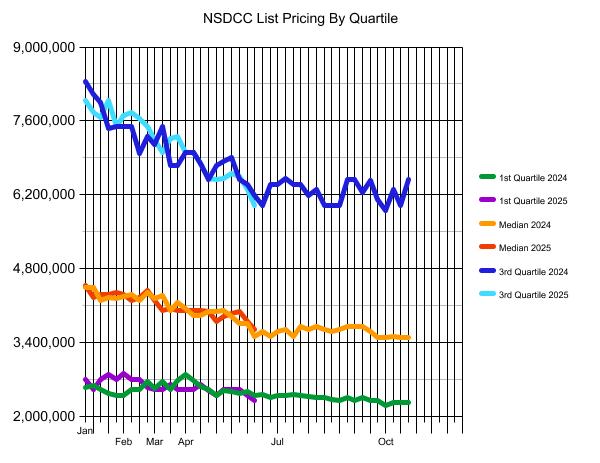

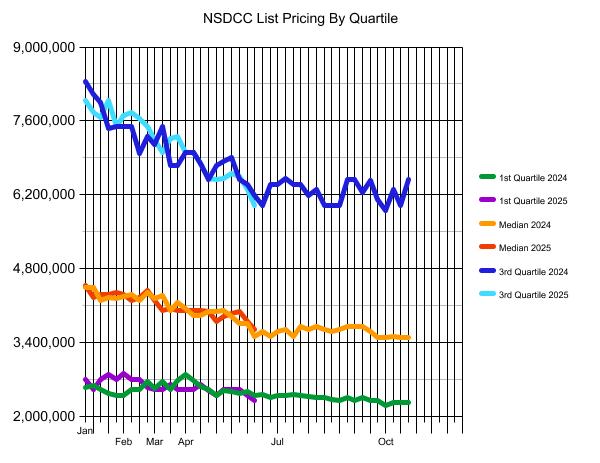

The quartiles are at their lowest points of 2025, yet it may not be enough:

Are there reasons for hope? The stock market has regained its losses from Liberation Day (which is huge), rates aren’t going up, and there are plenty of choices for home buyers who have guts. But you need to dig out the deals – they won’t be obvious.

From Bill:

The $0 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

43 |

$918/sf |

63 |

27 |

| Jan 13 |

45 |

$936/sf |

53 |

22 |

| Jan 20 |

47 |

$908/sf |

54 |

25 |

| Jan 27 |

48 |

$904/sf |

48 |

32 |

| Feb 3 |

51 |

$914/sf |

47 |

41 |

| Feb 10 |

45 |

$935/sf |

46 |

45 |

| Feb 17 |

45 |

$916/sf |

46 |

46 |

| Feb 24 |

45 |

$958/sf |

48 |

40 |

| Mar 3 |

50 |

$950/sf |

37 |

42 |

| Mar 10 |

55 |

$908/sf |

36 |

45 |

| Mar 17 |

53 |

$891/sf |

35 |

50 |

| Mar 24 |

53 |

$898/sf |

30 |

51 |

| Mar 31 |

58 |

$878/sf |

35 |

44 |

| Apr 7 |

56 |

$867/sf |

30 |

43 |

| Apr 14 |

63 |

$906/sf |

32 |

40 |

| Apr 21 |

59 |

$936/sf |

35 |

37 |

| Apr 28 |

74 |

$899/sf |

32 |

39 |

| May 5 |

83 |

$907/sf |

30 |

47 |

| May 12 |

72 |

$916/sf |

34 |

44 |

| May 19 |

70 |

$898/sf |

38 |

51 |

| May 26 |

74 |

$923/sf |

39 |

43 |

| Jun 2 |

76 |

$912/sf |

39 |

36 |

| Jun 9 |

87 |

$939/sf |

38 |

36 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

55 |

$1,029/sf |

66 |

36 |

| Jan 13 |

58 |

$990/sf |

63 |

31 |

| Jan 20 |

64 |

$1,018/sf |

57 |

26 |

| Jan 27 |

64 |

$1,025/sf |

53 |

31 |

| Feb 3 |

71 |

$1,009/sf |

50 |

31 |

| Feb 10 |

75 |

$1,005/sf |

46 |

36 |

| Feb 17 |

81 |

$1,015/sf |

44 |

39 |

| Feb 24 |

80 |

$1,012/sf |

38 |

52 |

| Mar 3 |

80 |

$1,034/sf |

33 |

49 |

| Mar 10 |

92 |

$1,029/sf |

37 |

44 |

| Mar 17 |

98 |

$1,015/sf |

39 |

44 |

| Mar 24 |

98 |

$1,008/sf |

41 |

52 |

| Mar 31 |

100 |

$997/sf |

44 |

54 |

| Apr 7 |

94 |

$940/sf |

43 |

54 |

| Apr 14 |

96 |

$962/sf |

42 |

53 |

| Apr 21 |

107 |

$1,000/sf |

43 |

53 |

| Apr 28 |

109 |

$1,010/sf |

44 |

49 |

| May 5 |

124 |

$1,036/sf |

40 |

50 |

| May 12 |

120 |

$1,041/sf |

43 |

57 |

| May 19 |

133 |

$1,034/sf |

43 |

49 |

| May 26 |

133 |

$1,055/sf |

47 |

53 |

| Jun 2 |

140 |

$1,039/sf |

48 |

51 |

| Jun 9 |

149 |

$1,042/sf |

45 |

45 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

44 |

$1,091/sf |

82 |

19 |

| Jan 13 |

46 |

$1,122/sf |

77 |

19 |

| Jan 20 |

52 |

$1,156/sf |

70 |

16 |

| Jan 27 |

49 |

$1,197/sf |

67 |

20 |

| Feb 3 |

56 |

$1,182/sf |

55 |

21 |

| Feb 10 |

58 |

$1,158/sf |

51 |

25 |

| Feb 17 |

58 |

$1,179/sf |

54 |

24 |

| Feb 24 |

56 |

$1,168/sf |

52 |

24 |

| Mar 3 |

51 |

$1,147/sf |

56 |

31 |

| Mar 10 |

56 |

$1,240/sf |

61 |

34 |

| Mar 17 |

60 |

$1,209/sf |

61 |

36 |

| Mar 24 |

60 |

$1,209/sf |

62 |

39 |

| Mar 31 |

62 |

$1,158/sf |

64 |

34 |

| Apr 7 |

68 |

$1,208/sf |

59 |

34 |

| Apr 14 |

79 |

$1,193/sf |

55 |

26 |

| Apr 21 |

85 |

$1,230/sf |

54 |

28 |

| Apr 28 |

85 |

$1,198/sf |

53 |

28 |

| May 5 |

82 |

$1,179/sf |

56 |

28 |

| May 12 |

89 |

$1,148/sf |

53 |

30 |

| May 19 |

88 |

$1,161/sf |

56 |

28 |

| May 26 |

85 |

$1,157/sf |

58 |

26 |

| Jun 2 |

81 |

$1,162/sf |

58 |

22 |

| Jun 9 |

89 |

$1,146/sf |

58 |

21 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

160 |

$1,822/sf |

105 |

27 |

| Jan 13 |

156 |

$1,868/sf |

105 |

31 |

| Jan 20 |

170 |

$1,936/sf |

95 |

29 |

| Jan 27 |

180 |

$1,877/sf |

90 |

31 |

| Feb 3 |

189 |

$1,884/sf |

85 |

31 |

| Feb 10 |

189 |

$1,864/sf |

88 |

29 |

| Feb 17 |

192 |

$1,875/sf |

90 |

32 |

| Feb 24 |

195 |

$1,869/sf |

91 |

34 |

| Mar 3 |

200 |

$1,860/sf |

87 |

34 |

| Mar 10 |

213 |

$1,811/sf |

83 |

36 |

| Mar 17 |

208 |

$1,755/sf |

85 |

30 |

| Mar 24 |

211 |

$1,800/sf |

86 |

25 |

| Mar 31 |

213 |

$1,784/sf |

90 |

32 |

| Apr 7 |

219 |

$1,777/sf |

90 |

33 |

| Apr 14 |

230 |

$1,790/sf |

87 |

35 |

| Apr 21 |

231 |

$1,792/sf |

87 |

32 |

| Apr 28 |

235 |

$1,772/sf |

88 |

28 |

| May 5 |

239 |

$1,811/sf |

82 |

30 |

| May 12 |

239 |

$1,811/sf |

85 |

33 |

| May 19 |

255 |

$1,773/sf |

85 |

29 |

| May 26 |

265 |

$1,759/sf |

87 |

24 |

| Jun 2 |

242 |

$1,745/sf |

90 |

29 |

| Jun 9 |

244 |

$1,774/sf |

90 |

33 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 6 |

27 |

11 |

298 |

108 |

| Jan 13 |

38 |

26 |

301 |

101 |

| Jan 20 |

55 |

16 |

328 |

95 |

| Jan 27 |

60 |

32 |

337 |

113 |

| Feb 3 |

72 |

28 |

363 |

123 |

| Feb 10 |

50 |

34 |

364 |

135 |

| Feb 17 |

50 |

29 |

373 |

140 |

| Feb 24 |

58 |

38 |

374 |

148 |

| Mar 3 |

60 |

31 |

378 |

152 |

| Mar 10 |

60 |

30 |

411 |

156 |

| Mar 17 |

49 |

37 |

413 |

157 |

| Mar 24 |

57 |

39 |

414 |

164 |

| Mar 31 |

47 |

27 |

425 |

162 |

| Apr 7 |

52 |

31 |

431 |

162 |

| Apr 14 |

70 |

28 |

462 |

153 |

| Apr 21 |

58 |

24 |

478 |

148 |

| Apr 28 |

71 |

30 |

501 |

143 |

| May 5 |

82 |

37 |

524 |

154 |

| May 12 |

56 |

39 |

516 |

163 |

| May 19 |

54 |

20 |

543 |

156 |

| May 26 |

58 |

29 |

554 |

146 |

| Jun 2 |

41 |

22 |

535 |

138 |

| Jun 9 |

62 |

25 |

566 |

134 |

NSDCC List Price Quartiles

| Week |

1st Quartile |

Median List Price |

3rd Quartile |

| Jan 6 |

$2,685,000 |

$4,472,500 |

$7,995,000 |

| Jan 13 |

$2,499,000 |

$4,250,000 |

$7,750,000 |

| Jan 20 |

$2,695,000 |

$4,300,000 |

$7,767,000 |

| Jan 27 |

$2,795,000 |

$4,498,000 |

$7,995,000 |

| Feb 3 |

$2,695,000 |

$4,350,000 |

$7,499,000 |

| Feb 10 |

$2,799,000 |

$4,299,000 |

$7,695,000 |

| Feb 17 |

$2,695,000 |

$4,200,000 |

$7,750,000 |

| Feb 24 |

$2,699,500 |

$4,250,000 |

$7,645,000 |

| Mar 3 |

$2,550,000 |

$4,375,000 |

$7,497,000 |

| Mar 10 |

$2,500,000 |

$4,200,000 |

$7,250,000 |

| Mar 17 |

$2,500,000 |

$4,000,000 |

$6,995,000 |

| Mar 24 |

$2,595,000 |

$4,047,500 |

$7,275,000 |

| Mar 31 |

$2,499,000 |

$4,000,000 |

$7,300,000 |

| Apr 7 |

$2,500,000 |

$4,000,000 |

$6,995,000 |

| Apr 14 |

$2,500,000 |

$3,999,000 |

$6,995,000 |

| Apr 21 |

$2,590,000 |

$3,995,000 |

$6,799,500 |

| Apr 28 |

$2,490,000 |

$3,988,000 |

$6,500,000 |

| May 5 |

$2,395,000 |

$3,795,000 |

$6,495,000 |

| May 12 |

$2,495,000 |

$3,895,000 |

$6,500,000 |

| May 19 |

$2,495,000 |

$3,950,000 |

$6,595,000 |

| May 26 |

$2,495,000 |

$3,984,500 |

$6,547,500 |

| Jun 2 |

$2,395,000 |

$3,799,000 |

$6,295,500 |

| Jun 9 |

$2,300,000 |

$3,649,000 |

$5,998,500 |

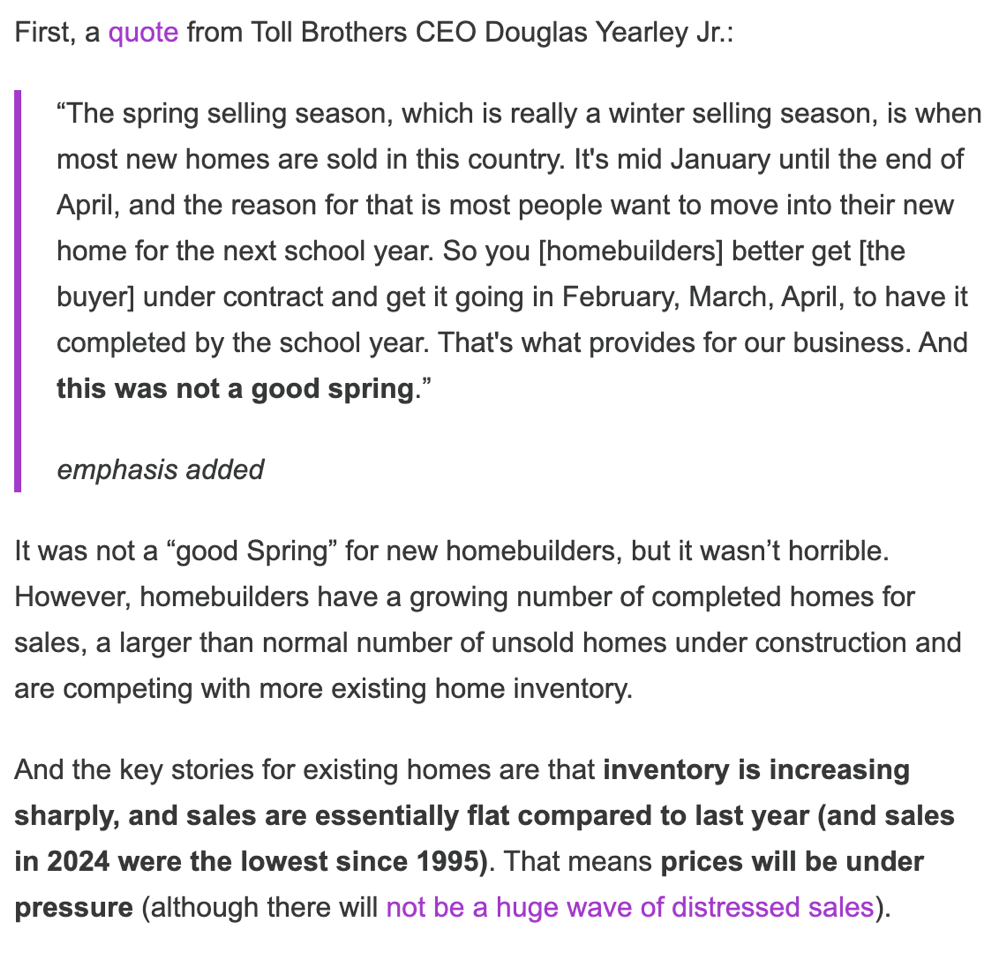

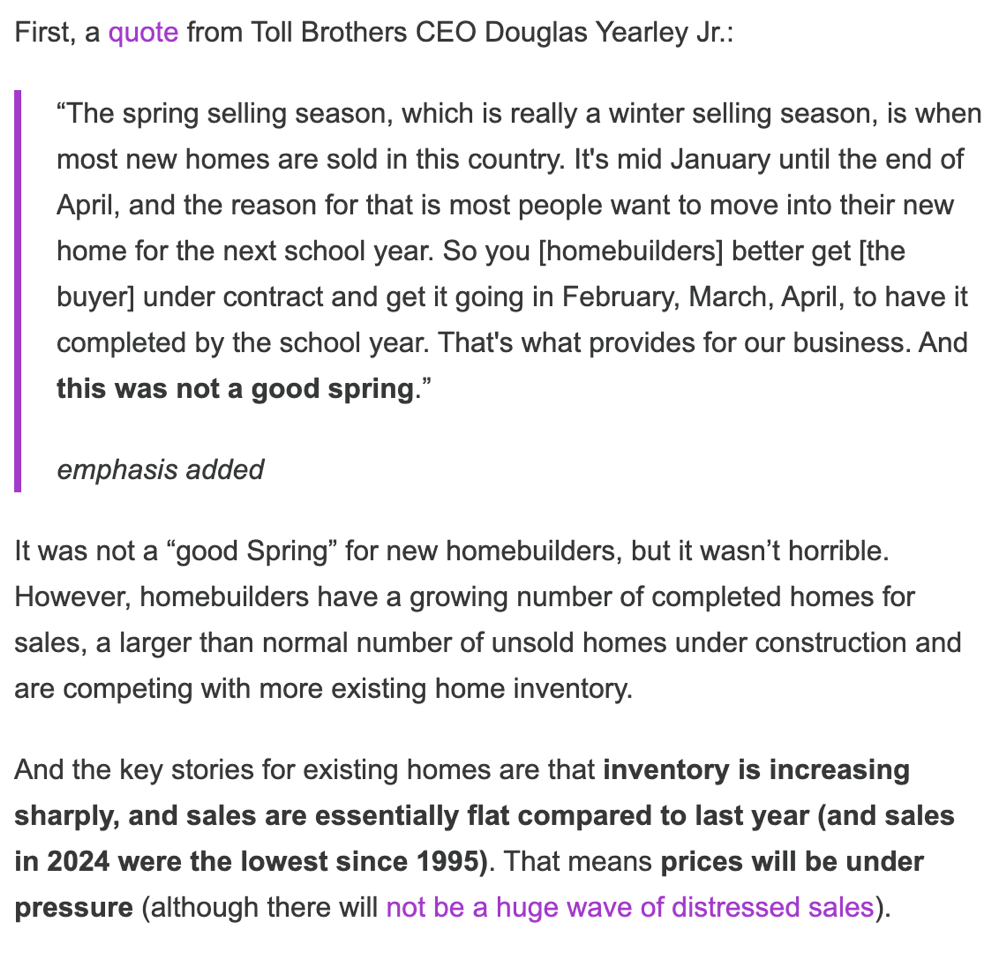

“The spring selling season, which is really a winter selling season, is when most new homes are sold in this country. It’s mid January until the end of April, and the reason for that is most people want to move into their new home for the next school year. So you [homebuilders] better get [the buyer] under contract and get it going in February, March, April, to have it completed by the school year. That’s what provides for our business. And this was not a good spring. We went into it cautiously optimistic in January. You know, the election was behind us, and there was some reason to believe that the spring was going to line up and do well, and it didn’t.”

“Our client, 25% of our buyers are all cash, and those that get a mortgage have an average LTV of 69% so they’re not maxing out. Our client at the million-dollar price point has more financial strength. They’re more invested in the market. They probably own a home that has equity in it. And so while rates are certainly important, they’re not the driver for us of demand. It’s more confidence. I said earlier in a few meetings that I track the Michigan confidence survey more than I track [mortgage] rates, because that seems to be a better indicator of current market conditions for us. And confidence is very, very low, as we know. Tariffs, we gotta get this worked out, right? We all know. We just have to. We have to figure out a way to have some deals done. We gotta get a deal done with Japan or India, or start talking nice to China and have them talk nice back to us and get to a table and show some momentum and get some positive headlines that will calm things down and get consumer confidence back into a place where buyers come off the sidelines. And I don’t know when that happens. I believe it will happen. I think the administration understands the need to make sure it does happen. It’s just been a difficult path to get down.”

“So February was the worst month [for us], interestingly, and then March and April, while not great, kind of stabilized, and they continued with that stabilization. So it got better as the quarter went on. But I’m not celebrating that yet, because it still was, overall, a soft [2025] spring season.”

– Toll Brothers CEO Douglas Yearley, Jr.