Part of this story is how the buyer-agent compensation played a role in the outcome. It is a sore subject that I detest – the agents should not be a party to the transaction, but because of the botched lawsuit by NAR, the commission rate not only varies, but the buyers who pay their own agent and don’t ask for any seller participation can end up being the net winner even with a lower offer. It’s not right.

We ask buyers to submit their highest-and-best offer, and this was a case where the best offer wasn’t the highest offer, in the minds of our sellers.

Rather than whine on about the commission unfairness, let’s focus on what made a lower offer the best – and attempt to identify the cost of convenience.

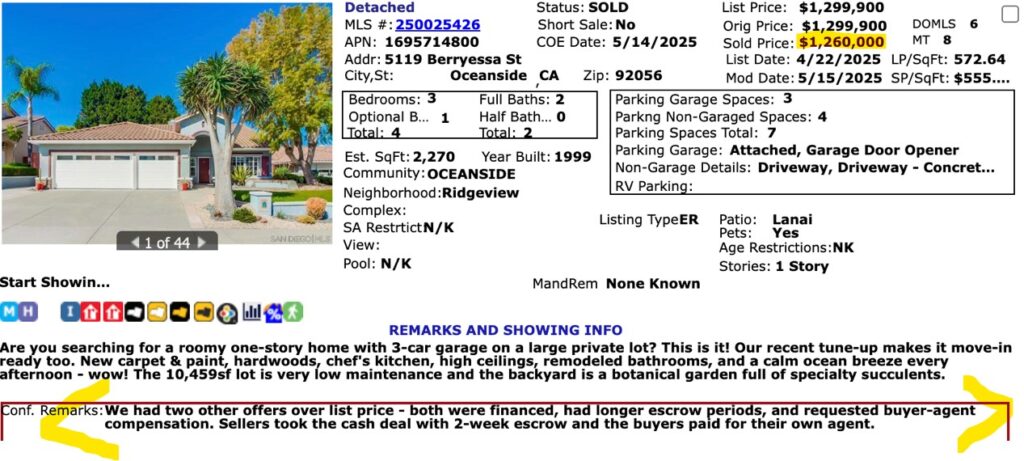

Three offers were submitted after the first open-house weekend, and we respectfully requested that all buyers submit their highest-and-best offer.

Two non-winning offers minus buyer-agent commission paid by seller:

- $1,274,000 with 40% down payment and 1% deposit.

- $1,287,925 with 55% down payment and 3% deposit.

Both requested a 30-day escrow.

The winning offer, with NO buyer-agent commission paid by seller:

- $1,260,000 cash and 3% deposit.

They requested a 14-day escrow.

The money differences between the winner and non-winners:

- $14,000

- $27,925

The Question? How much money is a 14-day escrow worth?

My sellers were the original owners of the home for sale, it was free and clear, and in their mind, the home “had been very good to them”. They purchased a home in Washington state that they financed, and moved in successfully. They intended to pay off the the mortgage on their new home with the net proceeds from the sale here, and have a nice chunk leftover.

The difference between a 14-day and 30-day escrow was around $4,000 in interest paid on their new loan

Subtract $4,000 from the non-winners and here are the net differences:

- $10,000

- $23,925

If the sellers wanted the most money, they could have taken Offer #2 and made an extra $23,925. But they didn’t take that deal, nor the +$10,000 deal either.

Why not?

We sent out the highest-and-best requests on April 29th, which was four weeks after Liberation Day. It had been a wild four weeks by then! Our sellers (who had lived in this home since 1998) had left behind a vacant house and moved into a highly mortgaged house out of state. The discomfort was already riding high, and then the tariffs were the last jolt.

We had discussed how happy buyers were during the frenzy and how we would receive several offers over list and every escrow closed without a problem. But now, every deal is uncertain while sellers wait for nervous buyers to perform.

These were the other two ingredients from the financed non-winners:

Buyer #1 didn’t go up on price in their highest-and-best round, and didn’t shorten their escrow period even though I told them how important it was to the sellers to close quickly. Their only term in their highest-and-best response was to change their deposit from 1% to 2% when we asked for 3%. You got to be kidding – it’s a three-offer competition, and that’s your best shot to win it?

Buyer #2 included in their offer that they wanted the patio room removed prior to the close of escrow, due to an unusual popping sound. Click here for video.

I made sure that all three buyers knew about the unusual popping sound before submitting their highest-and-best, which was critical. There was no way I was going to spring that on them later, and give them a great reason to cancel.

If you were the sellers, what would you do?

My sellers were happy to leave 1% to 1.5% on the table to get it over – quick!

Here’s an example of the wacky things that can happen during the escrow period these days. The house was fumigated, which means SDG&E gets involved to make sure the appliances are turned off during the tenting. The fume tent comes off, and the SDG&E guy goes back to inspect the appliances. He can’t figure out how to turn on the dryer left in the garage, so he orange-tags it and insists on it being fixed before he signs off. We closed escrow anyway, and he’s going back tomorrow to verify that our guy fixed it. But he could have held up the closing over a dryer that might not be working???

Get the deal closed!

A tour of the home:

0 Comments