Bill provides a ton of relevant data and it helps show how the real estate trends reflect the human condition – the same things are happening everywhere:

I’ve been thinking that there will be 15% to 20% more inventory this year, but so far the flow has been subdued between La Jolla and Carlsbad:

NSDCC January Listings:

2024: 242

2025: 251

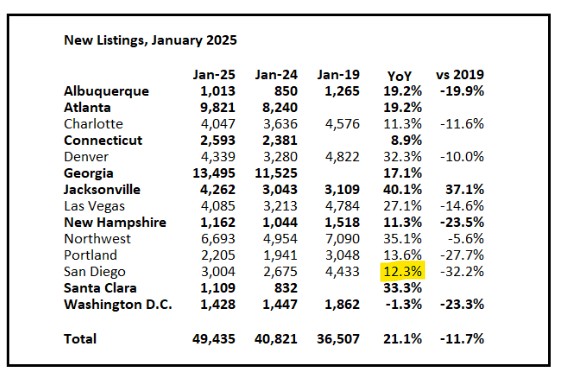

But Bill has the San Diego YoY inventory change at +12.3%.

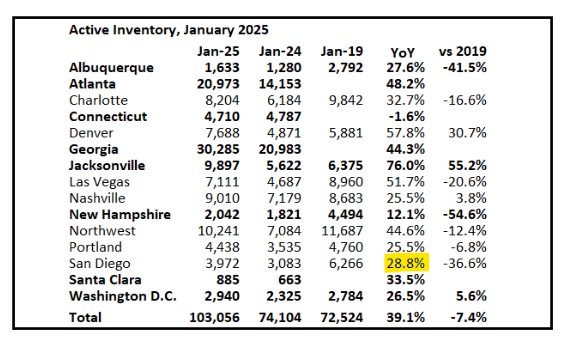

The Active Inventory shows the real trend because it reflects if homes are selling or not.

The higher-end is where it’s more stagnant, and with today’s NSDCC median list price being $4,399,000, the Active Inventory will be stacking up quickly.

Bill already has the current SD Active Inventory at +28.8% YoY!

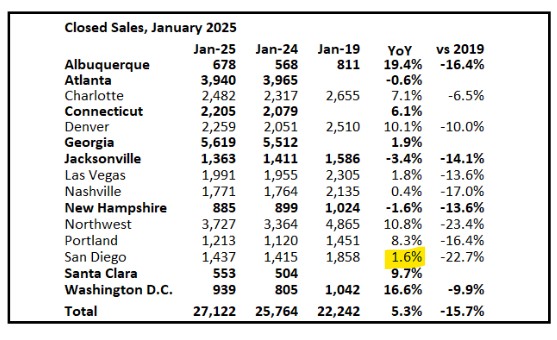

Is the demand picking up the slack? Will more homes for sale mean more sales, like our head cheerleader Lawrence Yun suggests? Hmmm no, at least not yet:

https://open.substack.com/pub/calculatedrisk/p/2nd-look-at-local-housing-markets-586

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

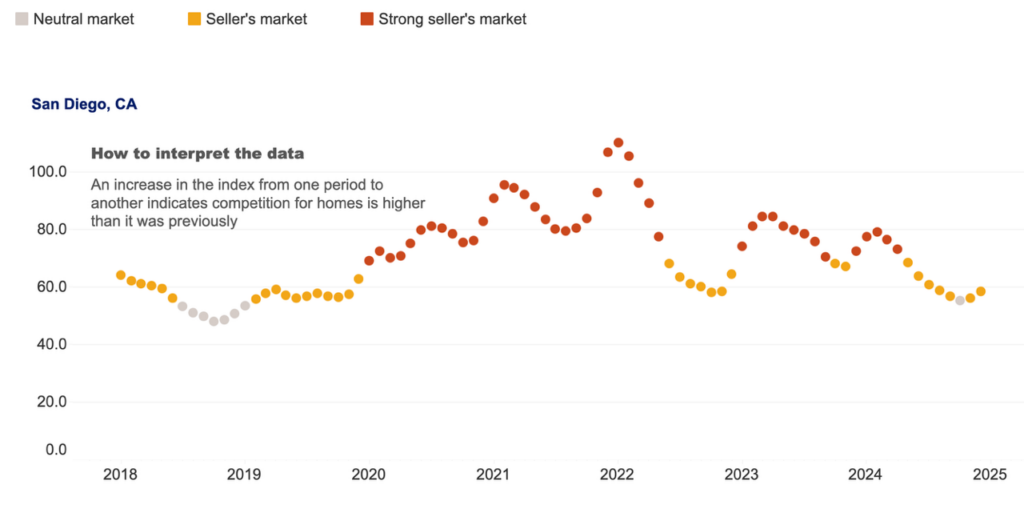

Zillow shows that the fever this year isn’t quite what it has been.

It’s a simplistic graph, but it shows we’re just barely above a neutral market:

Just when mortgage rates have improved slightly and we’re getting into the prime season, it seems like every new listing is $2,000,000+ and very few are really prime properties – which will be the main reason we could get off to a sluggish start. Buyers want the good stuff!

0 Comments