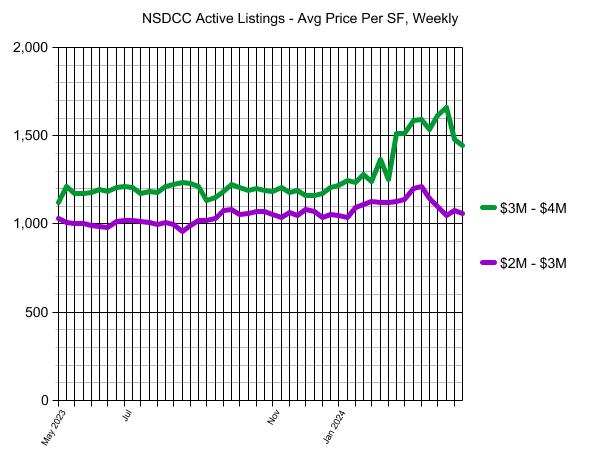

Pardon the casual presentation. I’m used to working with this same basic graph format but it’s limited to 50 datapoints – we’d really like to take these back a few years to see the long-term trends.

But in early 2023, the active listings in the $3M – $4M category were range bound between 1,170/sf and 1,342/sf, so there is some normal optimism in springtime. But not like this pop in 2024 (above). These two subsets are the meat of the market, and aren’t swayed by radical outliers that would tweak the averages.

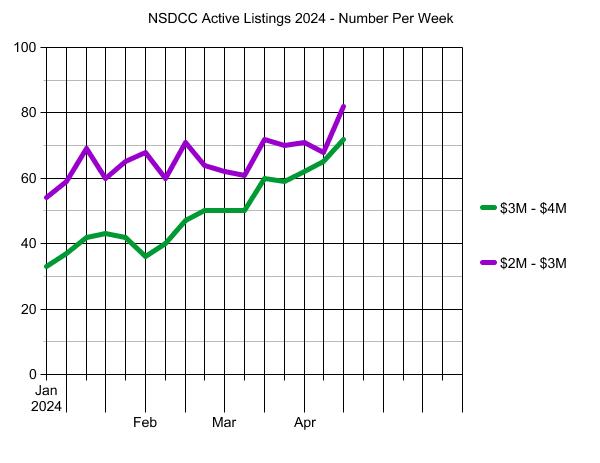

Starting right after the Super Bowl, there was a huge swing from $1,252/sf to $1,515/sf in the $3M – $4M category, and it has stayed elevated until the last couple of weeks. The reason for pricing to relax a little?

The number of unsold listings are starting to stack up now:

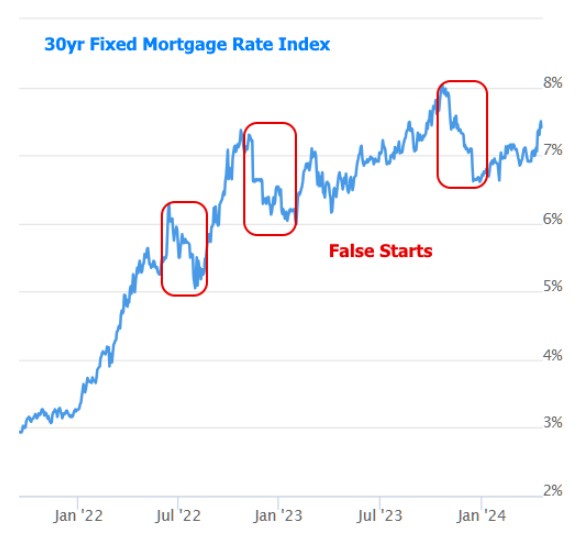

There isn’t any reason for home buyers to think mortgage rates are going to drop significantly this year. If there were one or two Fed cuts, it would only cause mortgage rates to get back into the 6s which isn’t enough to compensate for the sky-high prices that buyers are seeing today.

Then we have the changes from the commission lawsuit, which will have a clunky start over the next few months as buyers grapple with hiring a buyer-agent in writing just to tour a house. All we need is the Padres to go on a run this summer and we will have all the excuses we need for a very sluggish rest of the year.