While the benefits of buyer-agents may be obvious, will anyone stop their demise? Probably not.

Will it become easier or harder to buy a home?

The answer is unclear amid widespread confusion over what’s happening to real-estate agent commissions. On April 5, a federal court determined that the Justice Department can reopen its investigation into the policies of the National Association of Realtors, indicating that the association’s March settlement in a separate case may not be the final word on this issue. Yet in their effort to deliver lower costs for home buyers, federal officials and courts may inadvertently undermine consumer protections without addressing the root causes of high home prices.

The settlement is a positive development: It could lower real-estate agents’ commissions, benefiting home buyers. It also increases transparency and negotiating power for home buyers who use agents for representation. The settlement will also increase professionalism among agents, who will now sign an agreement detailing their services before showing a buyer a home. These policies should put downward pressure on commission prices, which currently average 5.3% and are split between buyer’s and seller’s agents.

Despite these wins, federal officials seem to want a more aggressive solution. In a February court filing, the Justice Department noted that U.S. commissions are “two to three times more than” those in “other developed countries,” a point the media frequently repeats. That gives the impression that federal officials want to cut commissions at least in half as quickly as possible, and the department appears to be pursuing this goal. Yet dramatically slashing commissions can be achieved only by reducing the use of buyer’s agents—a move that would be unwise for a few reasons.

Consider the pitfalls that home buyers face in countries where buyer’s agents aren’t commonly used. In Australia, where I grew up, home buyers typically work directly with listing agents, who have a fiduciary duty only to the sellers. In some Australian territories and states, if a buyer looks at a home on a flood plain or in a region prone to bush fires, the seller’s agent isn’t necessarily obligated to tell him about the risks.

The U.S. model provides lower overall costs and better representation for buyers and sellers alike. Americans chose this model for good reasons. Before the 1990s, few people in the U.S. used a buyer’s agent. Yet home buyers began to demand representation, especially low-income and first-time buyers who needed help navigating the process. Consumer-rights advocates championed this development. As buyer’s agents became more popular, eight states even banned the old model of a single agent representing both parties. Americans effectively gained two agents for the price of one, and that price has fallen from over 6% to closer to 5% today.

Discouraging the use of buyer’s agents would reverse this progress. Although it would likely lower home buyers’ costs, it would do so at the price of sacrificing their interests. Without a buyer’s agent, no one would be legally required to help buyers understand their risks and options. There would also be nothing to stop seller’s agents from increasing their commissions to match what previously went to buyer’s agents.

There are better ways to help home buyers save money, policies on which state lawmakers should take the lead. Most U.S. states have transfer taxes, which can add thousands of dollars to the cost of a home purchase. Lawmakers should either cut these taxes, leading to lower costs and more home sales, or reduce property taxes after windfall gains post-pandemic. State and federal lawmakers could also ease burdensome licensing, zoning and environmental regulations, all of which add nearly $94,000 to the cost of a new single-family home and lead developers to build fewer homes. The best way to decrease housing’s cost is to increase its supply.

The alternative is to erode the hard-fought victory that American home buyers have achieved. While the U.S. system is far from perfect, it serves home buyers better than any other arrangement, and it’s moving in an even better direction after the recent settlement. As federal officials and courts weigh whether to push further, they should remember that some cures are worse than the disease.

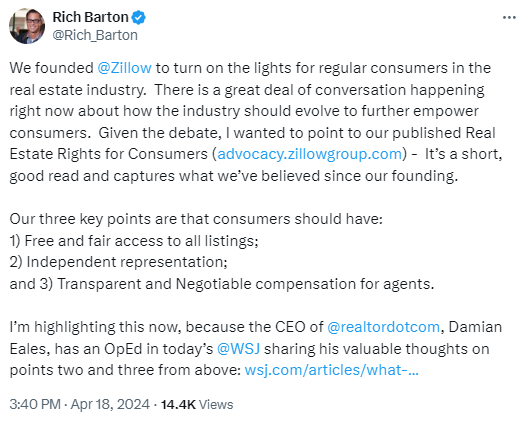

Mr. Eales is CEO of Move Inc., which operates Realtor.com. Move Inc. is owned by News Corp, which also owns The Wall Street Journal.

Link to Article

I personally am disgusted to see real estate agents and loan brokers driving around in $200k G wagons, and $120k S Classes (sorry Jim).

At least mine was a used car for half that…..

Price and commissions become an issue when there is an absence of value. Thus, if a buyer does not perceive a value from the buyer’s agent services, high commissions will become an issue. Ask yourself what value does my buyer’s agent provide? Is it worth what I will pay? You can make an equal argument for yes and no.

What about the listing agent who does not negotiate the highest price for their seller? Are they entitled to 2.5%-3% if they simply list the home in the MLS and fill in boxes and write “as is” on the Purchase Agreement?

Until supply returns to the market, the buyer’s agent will have rough sailing. I think that a seller would willingly to give someone 2-3% if they bring a buyer for their home (2007-2013). Hardly anyone under the current age of 45 has experienced a market like this in Southern California.

Ask JTW what is was like?

Not a happy future for most buyer agents. Although good ones provide a valuable, if not necessary service to home buyers (especially first time home buyers) during the largest and most regulated transaction of their lifetime, the drive to lower transaction costs seems to rest entirely on their shoulders. Never mind loan junk fees, government recording taxes, the cost of lenders title insurance, and a host of other misc required transaction fees (appraisal fees, credit app fees, various inspection/underwriting fees). No, we need to focus on buyer agent fees to address the high cost of buying a home. That’ll do it…

JtR:

what are you telling first time buyers that call you to represent them?

There is a big disconnect.

Buyers don’t think they need an agent until they find a house to buy.

Then when they find the right house, they just grab an agent. Any agent. Maybe even the listing agent.

How to navigate that one is undetermined so far, but I’m working on it!

Buyers will literally have to sign an employment contract and hire an agent just to see a house. Even at open house.

There will probably be resistance to that idea. Is the realtor going to insist, and just send them away if they refuse to sign?