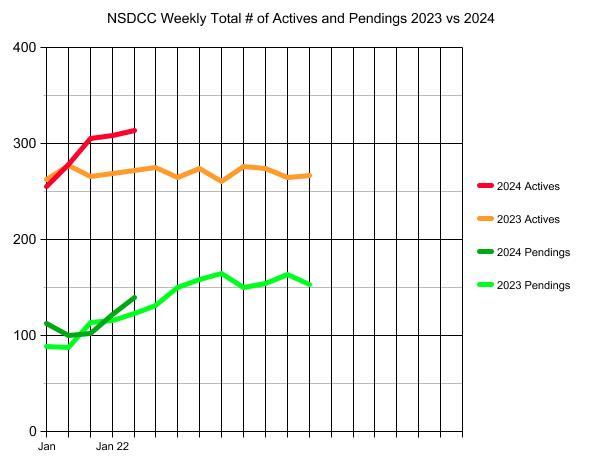

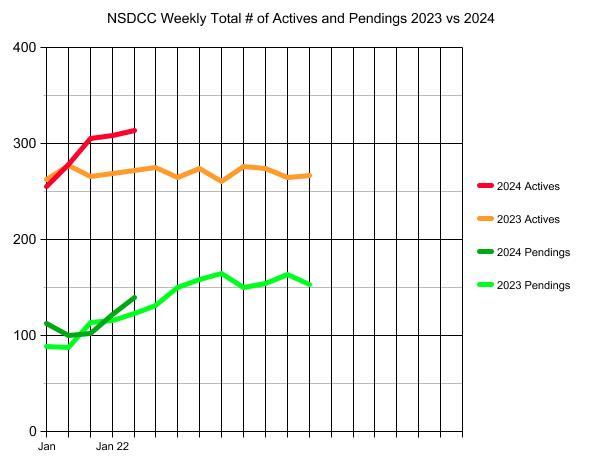

In our previous reading last Monday, the pendings count had jumped 20% – and this week it popped another 15%! Today’s actual count of 140 pendings is now ahead of last year, which had an early start to the selling season! At this point, this year looks the same!

This morning’s count of January listings between La Jolla and Carlsbad is 204, which means Joe has the contest for Padres tickets in the bag. Having slightly more inventory than last year should mean more sales!

The $0 – $1,500,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2024 |

15 |

$724/sf |

49 |

23 |

| Jan 8 |

13 |

$645/sf |

58 |

19 |

| Jan 15 |

10 |

$664/sf |

55 |

15 |

| Jan 22 |

15 |

$750/sf |

36 |

15 |

| Jan 29 |

12 |

$834/sf |

36 |

21 |

The $1,500,000 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2024 |

20 |

$866/sf |

66 |

28 |

| Jan 8 |

23 |

$890/sf |

63 |

23 |

| Jan 15 |

32 |

$876/sf |

47 |

35 |

| Jan 22 |

35 |

$823/sf |

43 |

25 |

| Jan 29 |

38 |

$833/sf |

43 |

26 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2024 |

54 |

$1,046/sf |

65 |

34 |

| Jan 8 |

59 |

$1,034/sf |

57 |

30 |

| Jan 15 |

69 |

$1,094/sf |

44 |

35 |

| Jan 22 |

60 |

$1,108/sf |

42 |

45 |

| Jan 29 |

65 |

$1,126/sf |

41 |

48 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2024 |

33 |

$1,216/sf |

92 |

15 |

| Jan 8 |

37 |

$1,248/sf |

83 |

15 |

| Jan 15 |

42 |

$1,236/sf |

77 |

18 |

| Jan 22 |

43 |

$1,283/sf |

77 |

17 |

| Jan 29 |

42 |

$1,242/sf |

75 |

20 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2024 |

139 |

$1,858/sf |

116 |

20 |

| Jan 8 |

151 |

$1,896/sf |

109 |

18 |

| Jan 15 |

157 |

$1,879/sf |

106 |

22 |

| Jan 22 |

159 |

$1,824/sf |

104 |

27 |

| Jan 29 |

162 |

$1,758/sf |

108 |

231 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 2, 2024 |

18 |

10 |

255 |

113 |

| Jan 8 |

43 |

12 |

278 |

100 |

| Jan 15 |

52 |

20 |

305 |

102 |

| Jan 22 |

50 |

29 |

308 |

122 |

| Jan 29 |

44 |

32 |

314 |

140 |

NSDCC List Price Quartiles

| Week |

1st Quartile |

Median List Price |

3rd Quartile |

| Jan 2, 2024 |

$2,549,888 |

$4,444,000 |

$8,350,000 |

| Jan 8 |

$2,572,444 |

$4,447,000 |

$8,097,500 |

| Jan 15 |

$2,499,000 |

$4,200,000 |

$7,950,000 |

| Jan 22 |

$2,429,000 |

$4,250,000 |

$7,450,000 |

| Jan 29 |

$2,399,000 |

$4,225,000 |

$7,495,000 |

Blackstone, the world’s largest commercial property owner, said real estate values are reaching a bottom as inflation has slowed and the Fed is expected to cut rates this year, an optimistic sign for the sector that’s been hurting from sour deal activity and valuation, and denting even Blackstone’s own performance on the heels of the U.S. central bank’s string of rate hikes.

This tactic is called “talking up your book.” Father Time will tell the truth in the near future. One clear winner and one clear loser will emerge; for every winner there is a loser.