They calculated that baby boomers provided 4.41 million of the 7.74 million homes for sale in 2019 (57%). Now that younger homeowners are locked into their forever home, it’s likely that the percentage of estate sales will rise dramatically – but only because there will be so few sales from other categories.

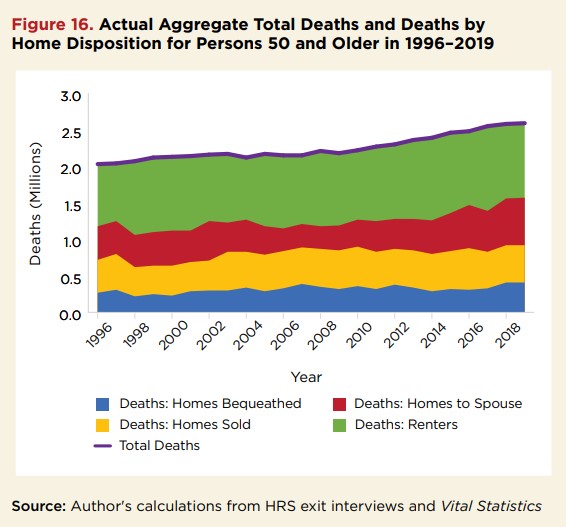

Complicating the flow is the amount of surviving spouses that stay in the home. The red band in the graph above looks like it’s around 1/3 of the total number of deaths of homeowners, which means we really need to wait until BOTH boomers die before seeing those homes get into the supply of homes for sale.

This is going to take decades to sort out!

~~~~~~~~~~~~~~~~~~~~~~~~~~

The baby boomers will be riding into the sunset in the next few decades, leaving behind a surplus of houses.

But a study by the Mortgage Bankers Association predicted the impact of the “Silver Tsunami” will be more glacial and easily absorbed by the market.

Edward Seiler, the institute’s executive director and the MBA’s assistant vice president for housing economics, said the study shows a detailed picture of America’s aging population and its effect on the housing market.

“The impact from baby boomers exiting their homes is not insignificant but will happen over a few decades without significantly disrupting the housing market,” Seiler said.

Findings from the report included:

- “Prior to the COVID-19 pandemic, boomer homeowners numbered 32 million and represented almost 41% of all homeowners.”

- “The baby boomers eventually will die. Their housing will become available for others or other uses.”

- “Some estimates suggest that one-quarter of current owner-occupied homes will come on the market by 2040, as older Americans transition out of owner-occupied housing and eventually die.”

- “Projected deaths rise steadily as the baby boomers age and eventually die, then plateau around 2045. By 2060, the tail end of the baby boom will be 95 or older.”

- “Overall, housing supply and demand shifts from changing demographics are slow moving and highly predictable, which suggests that there will not be measurable effects on house price growth from population aging and mortality.”

- “Over the next decade … most of the adjustment to aging and mortality will be through a reduction in the growth of new housing and some softness in the rental market.”

Something to consider…

It’s not always deaths that push boomers out. Sometimes its illness or the need for full time care.

When this happens often a “nice” relative moves into the house to “take care” of it.

In these situations the nice relative is just trying to take over the house + it’s better to sell and pocket the $$$.